- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

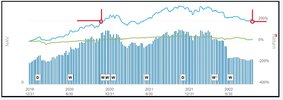

@Cam019 Imagine if he had let himself be influenced by the people on this forum to stop trading, or tweak his system or whatever, at pretty much the lows.

@InsvestoBoy made a great comment in "cam019-asx100-monthly-superannuation-portfolio" today about not being influenced by others. There were comments made at the time when his trading system was well underwater, raising the question, "when do you stop trading your system"?

When do you stop trading your system?

When @Cam019 was asked this question, he was steadfast in his reply:

"I can only speak for myself, but my answer to "When do you just Stop!" is; I don't."

Cam went on to say:

"Now would be the worst time to stop executing trades in this system, however it is probably the most likely time for someone to do so."

This allows me to make a few general comments

1. When you have a trading system that really suits you it is very easy to follow the system’s signals.

2. A trading system that fits you allows you to focus on trading it with conviction & doing it well.

3. The hold time in Cam's case "monthly periodicity" I'm sure it feels natural to him in a unique way.

4. If you believe your strategy has an edge, you will trade with confidence.

Summary

Kudos to Cam for sticking with the strategy & achieving good trading results since August this year.

Skate.