- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

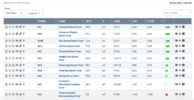

This is how I trade

(CDD), was a position taken in August. In this case, a profit target stop took me out of the position. The PANDA Strategy got in on a confirmed trend & exited just at the right time.

Another Chart

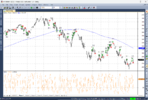

(EGL) is another included in the Excel log of trades. Both trades were taken out by a "Take Profit Stop" which is always a healthy way to exit a position.

Summary

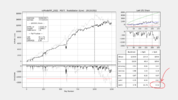

Trading this way is simply jumping on a confirmed trend & hope or wish or pray for the best. When you place a bet all you can do from here on is wait to execute a sell signal, which can come in many forms. I should also point out that if you look closely at the signals they are executed precisely. Other than those two moves you wouldn't want to be in this position at any other time. Trading this way, "doing this over & over" is boring but profitable.

Skate.

(CDD), was a position taken in August. In this case, a profit target stop took me out of the position. The PANDA Strategy got in on a confirmed trend & exited just at the right time.

Another Chart

(EGL) is another included in the Excel log of trades. Both trades were taken out by a "Take Profit Stop" which is always a healthy way to exit a position.

Summary

Trading this way is simply jumping on a confirmed trend & hope or wish or pray for the best. When you place a bet all you can do from here on is wait to execute a sell signal, which can come in many forms. I should also point out that if you look closely at the signals they are executed precisely. Other than those two moves you wouldn't want to be in this position at any other time. Trading this way, "doing this over & over" is boring but profitable.

Skate.