- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Hi Skate, wouldn't it be safer to trade on a daily basis and leave no capital exposure overnight because of the uncertainty? We never know what the night will bring nowadays (although we do get a sense of what is to come, but never any guarantees that our judgement/ assessment is right)

@eskys, every word you have posted is valid & you won't get an argument from me "but finding a trading method" that actually works that you can consistently stick to is not as simple as it sounds.

Trading Consistently

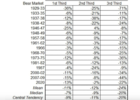

Being Methodical & Consistent will put you on the road to success but the real issue that faces us all is "determining" whether your methodology or any other trading methodology will be profitable. Having no exposure overnight is beneficial to some but it's not me as a trend trader. Even trading a good system it is hard for me to tell when a trend starts & when it finishes. Grabbing the meaty part of the move over & over works for me.

It's a pity but it's a fact of trading.

Everything about system development is always a tradeoff & there are no absolute ‘right answers’ to achieve a perfect system. What works once might not work again, so you always have to stay on top of your game.

Day trading

If you are considering Day Trading then be "Very, Very, Careful" as there are sharks in them waters!

Skate.