- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Everyone finds their own style of trading, or investing. I personally choose to Trade and invest. My investments are time driven, meaning minor blips don't really effect quality long term investments

It's the perfect time for an investment update

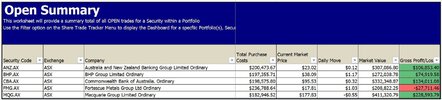

Investing is all about the time in the market. By investing in good quality companies that pay dividends you'll not only enjoy those dividends but the capital gains along the way.

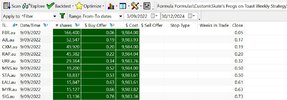

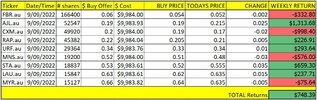

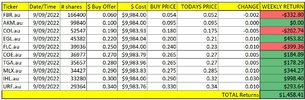

The capital gains over the last 2 1/2 years

The dividends accumulated along the way & the spin-off from BHP are not included in the results below. Other than capital gains, I regard any other income from these investments to be the icing on the cake. In the five holdings below, an investment of a million dollars should generate approx 80k to 100k annually give or take a few dollars.

FMG is a recent addition (it's early days)

It doesn't take blind Freddy to work out that red is not my favourite colour but in the early stages of an investment cycle it's irrelevant. Investing in quality companies has always been proven to be a successful strategy. Market timing in the short term can affect your portfolio in the early stages of building such a portfolio but nothing to worry about until it gets out of control.

There is an old saying, "give it time"

With Investing, short-term price fluctuations are meaningless throughout the investment cycle as "father time" is the edge. Wealth creation takes time so "give it time" to do its thing.

Skate.