Dump it Here

- Thread starter Skate

- Start date

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Even though stop loss starts at 40%, all my trades were stopped out at 10% once the index moved down (ribbon turns from green to red).

@Sid23 thank you for stepping up to the mark & posting a comparison backtest for Nick's TurnKey Strategy.

I'm now even more confused

Sid confirmed that his "WTT TurnKey Strategy" initial stop loss starts at 40% & reverts to 10% when the index filter moves down. That was my understanding as well. So when the ribbon is "Green" the stop loss should be 40% below the highest weekly close. This means the Index filter has to be above its 10 Week moving average to be "on".

WTT's initial Stop Loss is set at 40%, not 20%

Just to be clear, when the WTT Strategy is "on" the initial stop loss is set at 40% below the highest weekly close.

This raises some questions

1. With the Index Filter being "ON" why is Nick's WTT Strategy in his tweet set at 20% & not 40%? (The Standard Setting)

2. What was the motivation to change the initial Stop from the standard setting of 40% back to 20%?

3. What was the motivation for making the tweet?

those who push an agenda

Why is Nick's (exit) initial Stop Loss at set at 20% in his Twitter post?

So there is no confusion, Nick's chart for (LKE) trading the WTT Strategy has a buy & sell signal during the period when the index ribbon is green. Meaning when the Index Filter ribbon is green the system is "on". When the ribbon is green the initial Stop Loss should be set at 40%, not 20%. (I've added the green verticle lines to the chart so there is no confusion that the Index filter is "ON")

In my opinion

Nick should have posted a chart for (LKE) using the standard initial Stop Loss setting for the WTT Strategy which BTW is set at 40% when the Index Filter is on. So why did Nick tweet using a lower initial Stop Loss of 20%?

Summary

Looking at both of the charts above, using the standard settings of the WTT Strategy the exit is not as good using the 40% setting. Was that the agenda (motivation) to revert the initial Stop Loss back to 20%?

# I'm sure there is a simple explanation for why the index filter was changed from 40% to 20%.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Hi Skate,

The stop loss is from the highest high (not close), exits if Friday's close is below. Hopefully this now makes sense.

View attachment 143697

Regards,

Stewart

The parameter from the "Think or Swim" forum referenced the close

@Sid23 thank you for clarifying the fact that the exit is from the high of the bar (not the close of the bar).

I wish to make some additional comments

1. Nick's exit signal bar was on 8/4/2022 - the exit bar was on 11/4/2022

2. Your signal bar was on 22/4/2022 - your exit bar was on 25/4/2022

3. Nick's exit price was $2.08 whereas your exit was 2 weeks later at $2.04

You were lucky

With your signal bar being two weeks later it was sheer luck that the price didn't fall away. At face value, the difference between the two exit prices is not that far apart (in value). Two extra weeks in this market could have been catastrophic, to say the least. As I said "you were lucky" this time.

Okay, now I'm standing firm

After recoding the strategy using the (High) rather than the (Close) to exit a position I still maintain Nick has used a "20%" initial stop loss to get the results shown in the chart of (LKE) that he tweeted.

Something to think about

If I am wrong about this (Nick using 20% instead of the original 40% iSL) how do you explain the difference between his & your signal trading the same WTT Strategy?

Nope

I have to say, your explanation has not swayed me one iota, not one tiny little bit at all. I stand by every post I've made on this subject matter. (Nick's Twitter post)

My question is still unanswered

"Why did Nick change the strategies iSL from 40% to 20% when the index filter was definitely on?"

Summary

This tiny matter of Nick fiddling with the iSL to make a tweet wouldn't hold the interest of others that it does for me.

Thanks for your input, Stewart.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

It's nice to see @Sean K reading this thread

Maybe it was the mention of Nick Radge that sparked his interest as he had his own issues when it comes to unaudited information of promotional material published by "The Chartist". Then again, the subject matter might hold his interest, who knows.

For the effort

Explaining something that I found at odds with Nick's tweet hasn't held the interest I was hoping for. Usually, at the first sniff of an ill word about Nick, some of his fans will dig in & defend him to the hills. I was not expecting a robust discussion but rather someone to enlighten me on why Nick would change the iSL & post a tweet about it. I was even expecting @MovingAverage to drop in & add his perspective on the matter I've raised. (it's not too late BTW)

Don't get me wrong

I'm not trashing Nick - rather I'm trying to understand why Nick change the original standard-setting for his WTT Strategy iSL from 40% to 20% when his own chart confirmed the index filter was definitely on?"

Skate.

Maybe it was the mention of Nick Radge that sparked his interest as he had his own issues when it comes to unaudited information of promotional material published by "The Chartist". Then again, the subject matter might hold his interest, who knows.

For the effort

Explaining something that I found at odds with Nick's tweet hasn't held the interest I was hoping for. Usually, at the first sniff of an ill word about Nick, some of his fans will dig in & defend him to the hills. I was not expecting a robust discussion but rather someone to enlighten me on why Nick would change the iSL & post a tweet about it. I was even expecting @MovingAverage to drop in & add his perspective on the matter I've raised. (it's not too late BTW)

Don't get me wrong

I'm not trashing Nick - rather I'm trying to understand why Nick change the original standard-setting for his WTT Strategy iSL from 40% to 20% when his own chart confirmed the index filter was definitely on?"

Skate.

Thanks for the clarification@Willzy thank you for taking interest in my last series of articles concerning Nick's WTT TurnKey Strategy. The point of these posts was to understand & explain to others why "The Chartist" Twitter chart for (LKE) didn't look quite right to me. The exit displayed by Nick in his Twitter feed didn't display the normal tendency of a system that incorporates a wide 40% initial Stop Loss.

Backtesting

Comparing a backtest from many moons ago isn't productive. It's even less productive & misleading when it comes to optimizing the parameters & settings. In my opinion, you can include too much historical data resulting in a series of false & misleading results. I've made multiple posts explaining the reasons why I prefer a shorter backtest period to a larger time frame. One of the major reasons is that the results are more reflective of changed trading conditions.

I haven't the time to do a search

@qldfrog articulated why he also preferred a shorter backtest period where he explained the reasons succinctly & much better than I ever managed to. In saying this there are those who have prosecuted the alternative view with vigor. I'm not stirring this conversation up again.

In saying this

I started trading on the 1st of July 2015, over that time I've traded like a mad man & traded more strategies than I care to remember. Coding my version of Nick's WTT Strategy is a recent endeavour but if the WTT was available back in 2015 I would have most likely traded it with all the others. Now I'm curious to see if it would have performed back then to now. For me to revisit a backtest any further back than 2015 is not on the cards,

View attachment 143680

Skate.

@Skate, I can't see how the trail stop would be measured from the close price, it is showing consistency from the high rather than the close on all bars.

I changed parameter of initial stop from 40% to 10% from the high and the trail stop seems pretty close to what Nick shows on Twitter. Nick has mentioned that he runs a tricked up version of WTT so I would expect the Turnkey with default parameters to have different signals to Nick's.

In regards to my signal being lucky that it didn't drop lower after 2 weeks, I don't see it that way. The index was still up so not as much market pressure, it did it's job.

Regards,

Stewart

I changed parameter of initial stop from 40% to 10% from the high and the trail stop seems pretty close to what Nick shows on Twitter. Nick has mentioned that he runs a tricked up version of WTT so I would expect the Turnkey with default parameters to have different signals to Nick's.

In regards to my signal being lucky that it didn't drop lower after 2 weeks, I don't see it that way. The index was still up so not as much market pressure, it did it's job.

Regards,

Stewart

Last edited:

Nick change the original standard-setting for his WTT Strategy iSL from 40% to 20% when his own chart confirmed the index filter was definitely on?"

This is interesting, first read it from a post by Aussie Firebug...

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

This is interesting, first read it from a post by Aussie Firebug...

@Sir Burr thank you for the hyperlink. I’m unsure of your intentions in doing so, but I did find a few paragraphs interesting.

Misleading or deceptive

The law prohibits conduct that is misleading or deceptive, or likely to mislead or deceive, in relation to financial products or services. It doesn’t matter whether or not you intend to mislead people – it’s about the overall impression your post creates when it’s viewed.Skate.

Hopefully, someone will post

There are those (forum members) who would trade Nick's WTT Turnkey Strategy. I'm hoping that a backtest will be posted for a direct comparison.

Skate.

Unfortunately the NDA prevents us from posting or sharing/discussing signals generated from his turnkey code or the code itself. I have about 50 versions of WTT though and i've studied it for years as well.

Nick actually mentions that he runs WTT with "Radge tweaks" as opposed to running a vanilla turnkey. This is evident when you compare his EOY score cards with his turnkey backtests that is published on his site. His version of the WTT clearly beats the turnkey version.

So NDA aside, i will say that your assessment of "LKE" is accurate. On paper the vanilla strategy would NOT have sold LKE so early. The BUY seems accurate enough though.

I'm curious too now, so it would be interesting to get to the bottom of it.

Uuuurrrggghhh .... down the rabbit hole we go (tonight).

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Nick actually mentions that he runs WTT with "Radge tweaks" as opposed to running a vanilla turnkey. His version of the WTT clearly beats the turnkey version. So NDA aside, i will say that your assessment of "LKE" is accurate. On paper the vanilla strategy would NOT have sold LKE so early. The BUY seems accurate enough though.

I'm curious too now, so it would be interesting to get to the bottom of it.

@DaveDaGr8 thanks for dropping in to post your assessment of Nick's WTT. I don't have 50 versions of the strategy but I do have a few. There are those (like me) who try to code a strategy so that the signals align as a benchmark.

Benchmark Nick's WTT Strategy

Back in August 2020 was the first time I tried to concentrate on aligning the signals from Nick's Twitter feed. For those just starting out, coding a 20-period breakout strategy is as simple as it gets.

WTT comparison charts can be found here

Dump it Here

Thank you Skate for all your great work. Plenty to analyse and think about.

www.aussiestockforums.com

www.aussiestockforums.com

Nick's Twitter Feed

I posted a series of charts from "The Chartist" Twitter feed at the time & inserted my version below uploaded for comparison. The signals are close. A strategy as basic as the "Weekend Trend Trader" would be a handy strategy to have. Simplicity sometimes works.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Nick actually mentions that he runs WTT with "Radge tweaks" as opposed to running a vanilla turnkey

The WTT Strategy with a twist

Breakout systems have been around forever & they work well as a trend-following strategy no matter the periodicity. I'm sure with a few modifications to Nick's "vanilla turnkey" strategy improvements can be found, slanting the odds of increased profitability.

The WTT overview

As a recap, the "Weekend Trend Trader" (WTT) is a simple 20-period breakout trend following strategy. The idea behind this strategy is solid but in "my version" of the WTT Strategy, the results are a bit lackluster & unimpressive. But in saying this the results are okay to some degree.

With all sound strategies

Improvements are difficult to find but with perseverance, it's not impossible to find some. I've found such improvements by adding a "Strength indicator" & an "Ulcer Index Indicator" as part of the buy condition. A "stale stop" predictor also helps in getting the exit sharper.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Unfortunately the NDA prevents us from posting or sharing/discussing signals generated from his turnkey code or the code itself

Duly noted

First off, I should say, there have been a word & expressions recently posted by others that I'm going to use in this post.

(a) @DaveDaGr8 "vanilla" &

(b) @Newt's "Lipstick on a pig".

Both are not to be construed in any particular way

They are just expressions, & I'm not using them in any derogative way. I want to make that very clear so others don't get upset.

Compare & Contrast

I'm guessing there would be some interest in comparing & contrasting my work to Nick's "vanilla version" of his turnkey WTT Strategy. All I'm saying, "vanilla" can be improved on, with a bit of "Lipstick on the pig".

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

I feel like I've been trading forever

There are those who have traded much longer than I who could reminisce about the times trading has bitten them on the "bum" without warning. Since 2015, there have been two such periods that caught me by surprise. The last quarter of 2018 & the first quarter of 2020. Both times I was "pissed" giving back open profits.

What I'm trying to say

When I post charts concerning the WTT Strategy, they will be cherry-picked to make a point. Adding "Lipstick" IMHO can improve something that is considered "vanilla".

Skate.

There are those who have traded much longer than I who could reminisce about the times trading has bitten them on the "bum" without warning. Since 2015, there have been two such periods that caught me by surprise. The last quarter of 2018 & the first quarter of 2020. Both times I was "pissed" giving back open profits.

What I'm trying to say

When I post charts concerning the WTT Strategy, they will be cherry-picked to make a point. Adding "Lipstick" IMHO can improve something that is considered "vanilla".

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

I'll let you be the judge

As I said, the last quarter of 2018 was not kind to me & it was the first real shock when actually live trading. It was a big wake-up call. To be fair I wasn't trading the WTT Strategy, but one of my own.

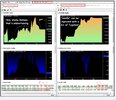

Results of Nick's Vanilla WTT Strategy

I'm sure if the backtest results of my version of Nick's "Vanilla" WTT are off-kilter, I'm sure someone will take me to task.

Backtest period 1/1/218 to 30/12/2018

This backtest period is short admittedly being the 2018 Calendar year. I've cherry-picked this period to demonstrate the last quarter of 2018 was a "bitch".

Visual improvements

Well, blow me down. That's not the results I was expecting from "vanilla"

Skate.

As I said, the last quarter of 2018 was not kind to me & it was the first real shock when actually live trading. It was a big wake-up call. To be fair I wasn't trading the WTT Strategy, but one of my own.

Results of Nick's Vanilla WTT Strategy

I'm sure if the backtest results of my version of Nick's "Vanilla" WTT are off-kilter, I'm sure someone will take me to task.

Backtest period 1/1/218 to 30/12/2018

This backtest period is short admittedly being the 2018 Calendar year. I've cherry-picked this period to demonstrate the last quarter of 2018 was a "bitch".

Visual improvements

Well, blow me down. That's not the results I was expecting from "vanilla"

Skate.

Last edited:

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

I'll let you be the judge again

As I said, in the first quarter of 2020 the COVID-19 Flash Crash wasn't kind to me, as I experienced a second major loss. It was a shock. I was extremely disappointed at the time as I believed some strategies fail me. Keeping in mind, that I had done extensive work on all my strategies after the 2018 episode to protect me from such events happening again. Believing those strategies had failed resulted in parking them.

#But I now accept as @peter2 said "sometimes $hit happens"

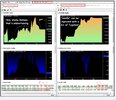

Results of Nick's Vanilla WTT Strategy

I'm sure if the backtest results of my version of Nick's "Vanilla" WTT are off-kilter, I'm sure someone will take me to task.

Okay, I accept this

Bugger the "Non-Disclosure Agreement" (NDA), but there must be someone who would be kind enough to verify my results of Nick's "vanilla" WTT Strategy. I'm positive the "vanilla" version couldn't be that disappointing, so I'm hoping someone will put this matter to bed by indicating (a) or (b)

(a) The "vanilla" backtest results are "way off" or

(b) The "vanilla" backtest looks about right

Backtest period 1/1/2020 to 30/6/2020

This backtest period is shorter than before being only the first half of the 2020 Calendar year. I've cherry-picked this period to demonstrate why I haven't fond memories of this period. In fact, this period hurt like a "bitch" financially & hurt others "medically".

Visual improvements

That's not the results I was expecting from my version of Nick's "vanilla" WTT Strategy. I hope someone corrects me by indicating (a) or (b)

(a) The "vanilla" backtest results are "way off" or

(b) The "vanilla" backtest looks about right

Skate.

As I said, in the first quarter of 2020 the COVID-19 Flash Crash wasn't kind to me, as I experienced a second major loss. It was a shock. I was extremely disappointed at the time as I believed some strategies fail me. Keeping in mind, that I had done extensive work on all my strategies after the 2018 episode to protect me from such events happening again. Believing those strategies had failed resulted in parking them.

#But I now accept as @peter2 said "sometimes $hit happens"

Results of Nick's Vanilla WTT Strategy

I'm sure if the backtest results of my version of Nick's "Vanilla" WTT are off-kilter, I'm sure someone will take me to task.

Unfortunately the NDA prevents us from posting or sharing/discussing signals

Okay, I accept this

Bugger the "Non-Disclosure Agreement" (NDA), but there must be someone who would be kind enough to verify my results of Nick's "vanilla" WTT Strategy. I'm positive the "vanilla" version couldn't be that disappointing, so I'm hoping someone will put this matter to bed by indicating (a) or (b)

(a) The "vanilla" backtest results are "way off" or

(b) The "vanilla" backtest looks about right

Backtest period 1/1/2020 to 30/6/2020

This backtest period is shorter than before being only the first half of the 2020 Calendar year. I've cherry-picked this period to demonstrate why I haven't fond memories of this period. In fact, this period hurt like a "bitch" financially & hurt others "medically".

Visual improvements

That's not the results I was expecting from my version of Nick's "vanilla" WTT Strategy. I hope someone corrects me by indicating (a) or (b)

(a) The "vanilla" backtest results are "way off" or

(b) The "vanilla" backtest looks about right

Skate.

@Skate, I can't see how the trail stop would be measured from the close price, it is showing consistency from the high rather than the close on all bars.

I changed parameter of initial stop from 40% to 10% from the high and the trail stop seems pretty close to what Nick shows on Twitter. Nick has mentioned that he runs a tricked up version of WTT so I would expect the Turnkey with default parameters to have different signals to Nick's.

In regards to my signal being lucky that it didn't drop lower after 2 weeks, I don't see it that way. The index was still up so not as much market pressure, it did it's job.

View attachment 143731

Regards,

Stewart

Theoretically it should stop out at 29%

The High was 2.65 and the close was 1.86. = 70.18%.

So IF it was his iSL that triggered the sell then it was set below 29.8%.

His original strategy suggests that this is the only Stop

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

So IF it was his iSL that triggered the sell then it was set below 29.8%.

@DaveDaGr8, that's the point I was trying to make.

I now accept

That you & @Sid23 confirmed that "Nick actually runs his own version of the WTT strategy with "Radge tweaks" as opposed to running a vanilla turnkey system". Finally, this clears the matter up.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

I was looking for a new project

Heck, I am mighty impressed with the backtest results so. The pig & I are seeing Dollars.

This strategy could have legs

It might just need a few minor adjustments to get the "Lipstick" in the correct position.

I should check with @Newt where to put the lipstick

Then again, I don't think the position would make much of a difference.

Skate.

- Joined

- 25 July 2016

- Posts

- 336

- Reactions

- 680

Skate,I'll let you be the judge again

As I said, in the first quarter of 2020 the COVID-19 Flash Crash wasn't kind to me, as I experienced a second major loss. It was a shock. I was extremely disappointed at the time as I believed some strategies fail me. Keeping in mind, that I had done extensive work on all my strategies after the 2018 episode to protect me from such events happening again. Believing those strategies had failed resulted in parking them.

#But I now accept as @peter2 said "sometimes $hit happens"

Results of Nick's Vanilla WTT Strategy

I'm sure if the backtest results of my version of Nick's "Vanilla" WTT are off-kilter, I'm sure someone will take me to task.

Okay, I accept this

Bugger the "Non-Disclosure Agreement" (NDA), but there must be someone who would be kind enough to verify my results of Nick's "vanilla" WTT Strategy. I'm positive the "vanilla" version couldn't be that disappointing, so I'm hoping someone will put this matter to bed by indicating (a) or (b)

(a) The "vanilla" backtest results are "way off" or

(b) The "vanilla" backtest looks about right

Backtest period 1/1/2020 to 30/6/2020

This backtest period is shorter than before being only the first half of the 2020 Calendar year. I've cherry-picked this period to demonstrate why I haven't fond memories of this period. In fact, this period hurt like a "bitch" financially & hurt others "medically".

View attachment 143789

Visual improvements

That's not the results I was expecting from my version of Nick's "vanilla" WTT Strategy. I hope someone corrects me by indicating (a) or (b)

(a) The "vanilla" backtest results are "way off" or

(b) The "vanilla" backtest looks about right

View attachment 143790

Skate.

How did you get your lipstick version to turn off so quickly? I am not that presumptuous to expect an exact answer with settings etc. Is at an market filter or extreme tightening stops etc? is all I would like to know.

Similar threads

- Poll

- Replies

- 258

- Views

- 23K