- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Sorry, a bit of time i do not have today to do a proper answerLuck

I'm also at odds with @peter2 when it comes to mentioning the word "luck" with "trading" as his way of trading revolves around skill.

I believe we all need a degree of luck

All systematic traders need to be aware of the significance of "timing & luck" when they start trading. As an example, system traders who started last year in January 2020 got hammered with the COVID-19 flash crash. In hindsight, they were just unlucky to start when they did. After any major drop, traders are normally fearful to get back in. Restarting to trade again also relies on a degree of luck to kick them off on the right foot.

Starting the new "The Platinum Strategy" in November was sheer bad luck

Another failure will make it even harder to start trading the strategy next time around - "if there is a next time for many".

Abandoning a strategy too quickly

When strategies are not performing as expected or they don’t follow the backtest results we tend to start fiddling & modifying a perfectly good strategy disguised as a trading strategy improvement. The development stage of a system is when these measures are crafted & certainly not during the paper trading phase. @cynic has made a stack of posts in this thread where he mentions that trading doesn't always follow the backtests results. I'd suggest you do a search for his posts as they are worthy of a re-read.

Phew....

View attachment 134273

Skate.

This is a very surprising statement...you're in fact suggesting that long term tests somehow mask the true performance of a system, which can only truly be seen through short term term testing? If you plan to trade your system for an length of time you can't seriously suggest that just a few hundred simulated trades is good enough? You need to understand the steady state dynamic of your system over the longer term. I like my coin flip analogies so you are in effect suggesting that to flip a coin once and land heads (that is in effect your short term analysis) is all the evidence you need to assume that any future coin flip will be 100% guaranteed to turn up a heads. I think you are confusing short term back test (a handful of trades) with relevance to current market dynamics--to conflate the two is a major mistake. This is why WF testing is so important.I'm a believer in shorter-term backtests to evaluate the metrics as IMHO its usefulness diminishes the longer the backtest period.

Skate.

This is a very surprising statement...you're in fact suggesting that long term tests somehow mask the true performance of a system, which can only truly be seen through short term term testing? If you plan to trade your system for an length of time you can't seriously suggest that just a few hundred simulated trades is good enough? You need to understand the steady state dynamic of your system over the longer term. I like my coin flip analogies so you are in effect suggesting that to flip a coin once and land heads (that is in effect your short term analysis) is all the evidence you need to assume that any future coin flip will be 100% guaranteed to turn up a heads. I think you are confusing short term back test (a handful of trades) with relevance to current market dynamics--to conflate the two is a major mistake. This is why WF testing is so important.

Your sim result run out to a few hundred trades--anyone with half a brain wouldn't go live with a system after only simulating a few hundred trades. But, hey...it's your money so trade away.

The backtest period is important

We have canvased the ideal of what length a backtest should be used to have meaningful results. Others have posted their views which is completely opposite to mine.

you're in fact suggesting that long term tests somehow mask the true performance of a system, which can only truly be seen through short term testing? If you plan to trade your system for an length of time you can't seriously suggest that just a few hundred simulated trades is good enough?

I'm pretty bloody minded about sticking to the rules of my systems and have been pretty good over the years, if my systems say buy I buy and if my systems say sell I sell...nothing more and nothing less matters.

I know I should have done nothing and run my system at close today, but I just couldn't ignore the profit given the crappy state of the market. Shame on me, so feel free to strip me of my system trader title and call me a discretionary trader

I pretty much overrode all my systems today and closed out all my positions. I’ve found it mentally too tough to continue trading in this market despite what my backtesting tells me.

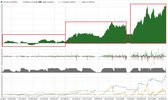

Started trading the system in early 2015. It basically did nothing for the first 2.5 years, but really found it's momentum around mid 2017 and has really got some good traction since then. It was a real test of my patience to keep trading that system for 2.5 years and make little progress.

If I run backtests now over that period ( Jan 2015 to Aug 2017) the real performance you see above is inline with the backtest

It is seriously tough trading through a lot of consecutive losers and for me that messes with my head so is something I'm very sensitive to. My backtests over 4000 historic trades have this particular system sitting at max consecutive winners of around 36 and max consecutive losers at around 20. The current figures on the live version of the system (which is shown in the graphs above) has consecutive winners at 10 and consecutive losers at 9, but that is after around 351 live trades, which is clearly far less than the 4000 trades executed in my backtests.

What to believe

Everybody talks about technical or fundamental analysis as they know it intimately & feed it to others with the best of intentions (most of the time). Like all skills, if you are trading for financial freedom you better make yourself comfortable as it takes an extraordinary length of time to be good at it. My point is, "there are different trading methods" that work & all you need to do is to find something that suits your lifestyle, schedule, & most of all is your personality. Your personality will ultimately decide if you can stick to a plan even when the going gets tough.

Looking for perfection

For those looking for the perfect strategy, there isn’t one, so in the meantime, why re-invent the wheel – pick an idea that’s been backtested, proven to work & modify the idea to suit the job you want it to achieve.

Below are some of your posts

Take what you will from them but I suggest you read them carefully to understand nothing is set in concrete.

Skate.

Three trading periods

I'm guessing the trade results below are from the same strategy. Looking at those distinct periods, I believe something changed & I'm not suggesting you fiddled with your strategy but rather it was that the "market that changed" over that short period of time.

View attachment 134289

Skate.

Please don't confuse my comments on you backtest results as not agreeing market conditions have changed. I'm simply saying that your original post asked people to pick 1 of your 3 strategies. And I'm suggesting I wouldn't pick any based on your sim results of a few hundred trades--not that using recent data is wrong.

What have those prior posts of mine got to do with the comment I made in relation to backtest period and number of trades taken?

Nope--I have made two very significant changes to my system that are responsible for this change in performance. The first is the universe of stocks from which buy set-up are looked for and the second is a profit exit. Yes an even on non-recent data these changes drive a significant change.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.