- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

But it started so well

I've had another question - "the strategy started well but now it's losing money, is there something wrong with the strategy?"

The answer I gave was along these lines

A good strategy takes time to develop. Those new to trading are very concerned about finding a strategy that works quickly while at the same time quickly dismissing a good strategy that refuses to display early gains. At times, a strategy with a few simple trading rules has often become the foundation of a good strategy & the "Platinum Strategy" is no different.

Short term results

The measure of a strategy is not how it performs (either in the short or long term) but rather the consistency of returns. Shooting for the moon is not what a trader should be looking to achieve but rather build profits over time. Just by "not losing money" can be considered a good strategy. Capital preservation is the "game in town" when it comes to trading.

"The Platinum Strategy"

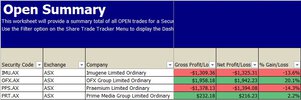

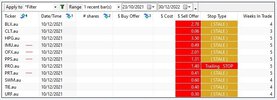

It's been tough trading recently. The "Backtest results" below on the left side are over an "11 month period" compared to the returns on the right are the results of one month.

Monthly returns

Skate.