- Joined

- 8 June 2008

- Posts

- 13,660

- Reactions

- 20,340

yes, we will carry on disagreeing and fair enoughThis made me laugh!

Look, we could discuss our beliefs until we are blue in the face, or dead. However, I would much rather agree to disagree and accept each other are going to do things the way they believe is right. I think @MovingAverage said this earlier, but everyone doing different things is what creates trading opportunites in the market. If we all did the same thing, the same way, our systems wouldn't work.

I appreciate you putting that up, even if you think it has no value.

Just one question from me.

Did you purposely design the systems to have approx. less than 50% exposure, or is that simply a bi-product of what I call 'curve-fitting' your system to more recent market data?

Exposure

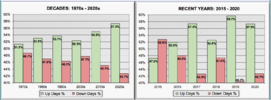

I noticed that too:

probably the effect of filters, SP and volume check etc on the earlier periods: in my 2019 onward BT, they are in the 50% to 80% range

If I can, I want high exposure..let the soldiers fight

So overall not disappointed by what i found out, and data should be ok now.

You will notice some flat behaviors for some system on some longuer periods, others where it is more a smooth constant gain etc;

My conclusion is that these systems as they are now must not be that bad to get these results on a huge period outside design optimisation range;

And as you noted, low exposure for decent returns gives great risk factored return