- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

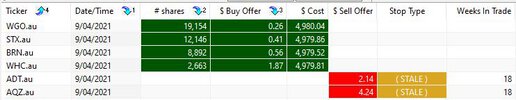

I think that monitoring the number of signals found by these two systems could be a valuable switching mechanism that may work much better than an index filter alone.

Without giving too many secrets away

A simple measure (as a rule of thumb) is the ratio of "buy signals" versus "sell signals". It's not the number of signals but the ratio between the two. This is not how I decide to rotate out of one strategy into another but it's a "quick & dirty" explanation.

I think this idea may be a better mechanism than an index filter because the index is so market cap heavy.

Interesting topics have a habit of drawing in comments from the more experienced

It's great to see topics (about all things trading) being discussed

I thought Warr87 put it welll the other day - we don't always have to shoot the lights out to beat broader market or super fund returns. Peter2 large cap thread has a similar theme. Will be interested to see how both hold up long term as potentially this is another form of diversification for future capital and profits - move to more conservative slower growing and hopefully low DD strategy.

Guess that's what the Bee investment strategy is too in a way.....

All of those things can be done easily in Realtest and probably can be done in AB.

It's pretty easy to test different allocation amounts, withdrawals etc.

I think Marsten is going to start a youTube channel to show what Realtest can do.

Here's a YouTube video of a recent Amibroker Canada user group meeting.

Sharing trading ideas is how I strive to be a better trader.

To calculate the dip

Take the Average True Range (ATR) of the last 5-days & subtract it from today’s low, this is known as the ‘stretch’. Then the signals are "ranked" using the Rate of Change (ROC) over the last 5-days. Any positions opened during the day will be exited ‘market on close’.

1. Changing nature of markets

Having an "edge" might be an accepted "catchphrase" when trading is going gangbusters. When trading is performing badly, we readily accept that our strategy has lost its "edge" & we set about improving it.

2. How?

By fiddling with a perfectly good strategy "without" knowing what the "edge" is or what having an "edge" really means. Luck, randomness, market timing, could be all tributers to my trading performance.

3. Perseverance

One thing I do know that I possess in spades is "perseverance" - maybe that's my edge.

Skate.

Twisting it up

The backtest results displayed on Nick Radge's website use the Russell-1000 Universe. The backtest results I'll post will be traded against the "All Ordinaries". The same basic setting, with a few minor filters, added.

Interesting topics have a habit of drawing in comments from the more experienced

Backtest Results

This calendar year (2021) versus the last financial year (1st July 2020 to 30th June 2021). The results aren't too shabby, the basic idea is effective & I'm sure spending more time on the strategy the results could be improved.

@Skate,

How do you physically trade 40 positions on your weekly system?

Do you sit there and enter in 40 positions, surely theres an easier way?

I know Nick Radge has a custom built API, is this something you use as well?

I've been inspired by @Skate's generous contributions regarding some details of his ASX weekly hybrid system. I've been particularly intrigued by the number of open positions in his portfolios (40 - 53). That's a big number to manage and is normally too many for an active trader to manage effectively.

Another observation: I''ll always find plenty of opportunities to consider buying and I'll have a hard time selecting one or two. Now, with so many positions to fill I have been adding them all. Buy them all and cull the losers later. It's quite liberating.

The reason I'm managing a 40 pos portfolio in this thread is to monitor the portfolio heat and see if I can consistently apply an active management style to a portfolio with a large number of positions. It appears from skate's comments that there are approx 6 buy/sells each week once a portfolio is established (more getting a portfolio started). Every one of us can handle that.

Using the ideas of others

Over time I've used the meaning of the words in posts to create indicators & trading systems. I try out every new idea to determine if there is an "edge" to improve my overall trading results.

Given the above, and your reference to Nick Radge's ADX etc, I must confess I was surprised that you discounted in no uncertain terms, the possibilities of using the VWAP as an "indicator" a few posts back?

@barney, I’m at a loss to “your reference” of the acronym (VWAP) - I take that to mean the “Value Weighted Average Price” a reference often made by Nick to signify “the opening price of the markets”. You may be referencing something entirely different. - so would you kindly expand on which one of my posts you are referring to.

Skate,

A filter which I often check on a Stock that has had ultra high intra-day Volume. Definitely not a red flag, but might be worth considering when sitting on large gains?? (pps) I wonder if some kind of back test could be done to see the historic relationship between large moves relative to VWAP and where a Stock Closes in relation to said daily moves etc etc?? Mr. @Skate?

Yeah it won't tell you when to Buy or Sell of course, but it definitely gives perspective knowing at what level the bulk of the money changed hands over a given day (and more importantly, days) Bit hard with ONE today because of the huge one day spike. It closed at 37.5 with a VWAP of around 34.5 so at least today, that is positive price action. Hopefully Mr. Skate might have done a little research on it's usefulness

@barney the issues you raised, frankly, I never think about (or want to). The issue @MovingAverage raised, those of trading by emotions - I've covered many times before in this thread.

I keep my trading style simple & consistent

I get in - I get out & everything in between is out of my control. My energy is spent researching new trading ideas & sharpening the signals of the strategies that I already trade. When you get a series of trades under your belt (experience) you tend to roll with the punches rather than reacting to them.

Stock that has "ultra-high intra-day Volume" is not a measure I can use trading a weekly system. Ultra-high volume could be coded as an indicator of some value depending on the direction of the price movement.

Just to clarify re VWAP; Rather just the price level at which the majority of Trading is/has been done at any given moment

Basically like a Moving Average of Price, but with Volume determining the "important"/most traded levels - there might find a way to utilize it to your advantage

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?