- Joined

- 17 February 2021

- Posts

- 39

- Reactions

- 58

I have nothing concrete to back this up with. I wonder if slight down days in larger caps would see rotation into higher volatility stocks by day traders?Not complaining vs today, but i noticed my systems have a tendency to do well/very well on days where the asx is actually slightly down.has anyone noticed the same and has a possible explanation?

I understand i am highly small caps etc.

On big asx200 falls, the systems follow..

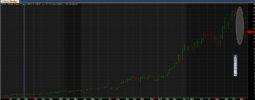

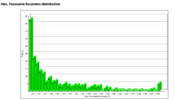

I've found chasing those infrequent big winners tends to introduce more volatility in returns--and I guess this is your point regarding a smoother equity curve. Each to their own, but for me frequent smaller profits is what I want.

I've found chasing those infrequent big winners tends to introduce more volatility in returns--and I guess this is your point regarding a smoother equity curve. Each to their own, but for me frequent smaller profits is what I want.