- Joined

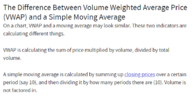

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

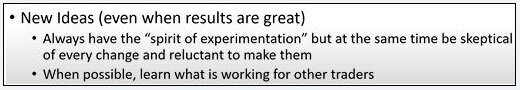

I think that monitoring the number of signals found by these two systems could be a valuable switching mechanism that may work much better than an index filter alone.

Without giving too many secrets away

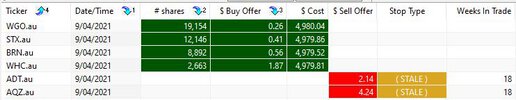

A simple measure (as a rule of thumb) is the ratio of "buy signals" versus "sell signals". It's not the number of signals but the ratio between the two. This is not how I decide to rotate out of one strategy into another but it's a "quick & dirty" explanation.

I'm glad @peter2 & I are on the same page

I posted my "method of strategy rotation" last Monday. (as a switching mechanism)

I think this idea may be a better mechanism than an index filter because the index is so market cap heavy.

In total agreement again

I've found better ways to take advantage of an Index Filter. I've found using an index filter annexed to a buy condition counterproductive for the reason that has already been stated. (The Index is driven by a few companies)

Interesting topics have a habit of drawing in comments from the more experienced

It's great to see topics (about all things trading) being discussed

Peter, thank you for making a great post

Duc & yourself (IMHO) have posted great content today & I've marked both accordingly.

Skate.

I have no data other than gut feel to backup my suggestion.

I have no data other than gut feel to backup my suggestion.