- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

If you've read my ASX portfolio threads then you'll be familiar with how I use a market filter in a long only portfolio. The filter guides my trade management and helps me manage the total portfolio heat. When the market filter is downgraded it's time to tighten the exit stops and reduce the number of open positions. My outlook was biased. It's not an easy thing to create and maintain a balanced outlook on the market. There are too many psychological biases to overcome. I'm interested in your thoughts on what we may use.

I'm posting about one of my filters (the "GTFO" Filter)

@peter2 has raised some very good points about exit/stops & their relationship to a Market Filter. I've exited all my positions (28th February signals) & now I'm in (100% cash) sitting on my hands these last few weeks. The last few weeks have highlighted the importance of an "exit strategy" & why the timing of an exit is so critical. I thought it would be appropriate to make a post about the added protection I have built into all my strategies, the "GTFO" filter.

The key element

Capital preservation is the key to the longevity of a trader.

Let's talk about my "GTFO" filter (a filter I haven't discussed before)

I've posted on many occasions that I'm a wimpy trader & when a position falters I'm off it quick smart. The "GTFO" filter decided that I had to sit out the last quarter of 2018 going into 100% cash. A few weeks ago the "GTFO" filter resulted in a mass exit of all my open positions whereas normally there would only be a few sells at any one time. This decline was sharp & quick & I've given back some open profits in doing so. I'm currently in 100% cash sitting on the sideline. Giving back open profits always hurts but it's the way I trade.

It's worth remember

Open profits & loses = "Belong to the Market"

Closed Profits & loses = "Belong to you"

How does the "GTFO" Filter work?

The GTFO filter has one job & that job is to protect my capital when trading goes pear shape quickly. The GTFO filter has only activated a "mass exit" twice since 2015, once in (2018) & again a few weeks ago. The GTFO filter has saved my bacon twice, the lesson I'd learnt from the (2008 & 2011) trading period.

"GTFO" is a crude acronym

The acronym stands for "Get The Fu#k Out" & exit the position quickly "with no questions asked". My "StaleStop" exit strategy is a recent addition to my "GTFO" filter. The StaleStop exit limits my Drawdowns where the "GTFO" filter protects against a pending disaster. If the "GTFO" filter gets it wrong no harm done "it's better to be safe than sorry". If the pending doom didn't eventuate, I have the option to re-enter that position again.

What does a "GTFO" filter look like

It's a pattern of two filters agreeing by sitting on top of each other & when this occurs it's time to exit. It should be noted the "GTFO" filter works equally well in all time frames.

What does the "Coloured Ribbons" at the bottom of the chart mean?

Green = Index Filter on

Red = Index Filter off

Yellow = Caution

Yellow sitting on top of Red = "EXIT IMMEDIATELY"

Let me show you the "GTFO" pattern

This is the chart of the All Ordinaries to show the "GTFO" filter in action & how accurate it is.

Now let me show you the same pattern on an actual position (recently sold)

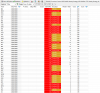

28th February 2020 the "GTFO" filter activated & every open position (in all my strategies) had a sell signal. The volume of open positions took 4/5 hours to complete the sell orders for Monday's pre-auction whereas normally it takes 10 minutes a week to enter the buys & sells in total. (FYI - all the sells settled at the opening auction price)

Charts

The next few charts are actual positions executed in the last few weeks because of the "GTFO" filter activating.

FYI

When the "Yellow & Red Ribbon overlap" in a currently held position the "GTFO" filter signals a sell. If the exit is a "yellow arrow" its either (a) StaleStop exit or (b) a "GTFO" exit. The "Magenta arrow" is a Trailing Stop Exit. The "Colours" on the charts identifies conditions important to me while making the chart easier for me to read (I'm a visual guy that's why colour coding helps)

The GTFO Filter

In the next post I'll upload a few more charts to display the "GTFO" filter in action over the past few weeks.

Skate.