- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

Arrgh! Don't remind me about 2011.

Apologies as I'm not posting results of a backtest. I'm happy sharing my real time performance for that time because I learned something very important.

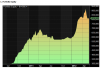

I established my SMSF in June 07 and decided to manage it myself. As a complete newbie I handled the GFC like a champ. My market filter kept me safely out of the market and when the market recovered I pounced on the opportunities. I was into my fourth year of managing my SMSF and was feeling really good about my performance.

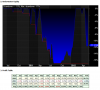

View attachment 101083 Then, 2011 started. This was the year of my max DD -17%.

I struggled to beat the market. I didn't stand aside like I did during the GFC but traded through it. What a dummy. From champ to chump. The DD happened in slow motion and I didn't see it happening.

View attachment 101084

@peter2, thanks for the raw post. I would say we have both learnt lessons from 2011 even though yours carried a financial burden. It appears luck was on my side as my trading career didn’t start until July 2015.

My comment to the systematic traders and wannabe systematic traders is that you don't know how you're going to handle yourself in a larger draw down situation until you've traded through one and come out the other side.

Backtest draw downs are meaningless. They're just numbers. It's vital that you stick to your proven systems when you experience a draw down like we're all going through currently. The current fall in the market is putting us to the test. It's a good opportunity to see if we've got what it takes to be profitable traders.

On the money

Your last post sums the current situation up perfectly, well done. The rapid decline of the last few weeks has caught everyone by surprise. Weekly systematic traders would have felt the burn that was unavoidable. My posts today reinforces why a trading plan is critical to our survival while reinforcing why a trading plan trumps a trading strategy.

Skate.