- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

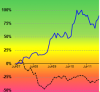

It's a good thing I like trading reversals because there's going to be plenty of them when the market sentiment turns bullish.

Many of the bullish 1st CAM-UP (green) and CAM-blue bars are also Morales & Karcher "pocket pivot" buy signals. I use them as a method to get into the trend before the obvious BO-HR.

Lets talk about strategy design & what a strategy hopes to achieve

@peter2 has made some great comments lately "thinking out loud" giving us an insight into his current line of thinking. A lot of forum members trade breakout strategies & I have noticed some are buying in this downtrend "which is hard for me to get my head around". It goes to prove as traders we are all different.

Lets talk about breakouts strategies

Most would have noticed that the most robust breakout strategies work poorly when markets are declining or selling off sharply. I know of no mechanical trend trading strategy that enters a declining market with low risk as breakouts tend to fail at a consistent rate. (shorting is not in the mix)

"Pocket Pivots" versus a breakout strategy.

Another quote from the book "Trade Like an O'Neil Disciple: How We Made Over 18,000% in the Stock Market" talks about using "Pocket Pivots" (in the pocket trading) versus entering using a breakout strategy in shallow, sideways or tanking markets. Breakouts to a new high have a high failure rate because the breakout fails to carry through in these types of trading conditions. (as they lead to false breakout signals)

A few more paragraphs

"The premise of the pocket pivot is simple, buying the bottom of a constructive base could offer optimal, low-risk entry points to begin taking a position, particularly if the stock is a proven market leader. The pocket pivot can give an investor a head start where standard breakouts are more often “fake outs” the pocket pivot buy point technique can get an investor into a stock at a lower-risk price point and thereby make it more possible for the investor to sit through a pullback if the all-too-obvious new- high breakout buy point fails initially and the stock retrenches, corrects, or sells off"

"When standard new high base breakouts that are not working in the shallow and sideways moving markets many initial buys at standard, new-high buy points can quickly turn into 7% to 8% losers within a few days. If investors had bought the breakout to new highs, the sharp pullback might cause them to be shaken out of their position. However, buying on the pocket pivot would give investors buying the stock a head start putting them in a better position to weather any pullback"

Summary

I'm with Peter on this one - I'll be returning to the markets "only" when the sentiment turns bullish.

Skate.