DrBourse

If you don't Ask, you don't Get.

- Joined

- 14 January 2010

- Posts

- 891

- Reactions

- 2,112

I am reposting this from the SVW Forum for the benefit of any beginners that missed the original post dated 4/5/23..

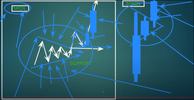

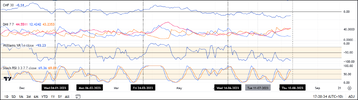

4/5/23 11am – SVW looks interesting……

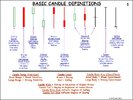

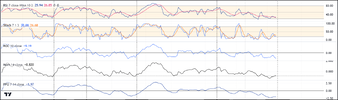

Note the Entry Signals, Blue Triangles & the Thin Blue Vertical Lines, then note the Candle Colours & the CCI Indicator movements…..

Same with the Exit Signals, Red Triangles & the Red Dotted Vertical Lines, then note the Candle Colours & the CCI Indicator movements…..

The Triangle code is Blue B, P or K = Buy, ….. Red S, P or K = Sell….

The Blue B = Buy, the Blue P = Piercing Candle Formation Signal, the Blue K = Kicking Candle Formation,

The Red S = Sell, the Red P = Piercing Candle Formation Signal, the Red K = Kicking Candle Formation…..

Explanation Snapshots of those above Blue & Red codes is below….

Been 3 reasonable trades since early Feb 23, could there be another one starting today…. Or should we wait for tomorrows TA B4 a decision is made…. Your Call.....

This mornings Chart is below…..

Again it’s a bit slow t’day, tomorrow will probably be the same, so I have to do something, may as well bore everyone to tears with some Educational ‘bits n pieces’….

REMEMBER THAT THIS TYPE OF TA WORKS FOR ME, IT MAY NOT SUIT YOUR NEEDS, SO DYOR….

Cheers...

DrB.

4/5/23 11am – SVW looks interesting……

Note the Entry Signals, Blue Triangles & the Thin Blue Vertical Lines, then note the Candle Colours & the CCI Indicator movements…..

Same with the Exit Signals, Red Triangles & the Red Dotted Vertical Lines, then note the Candle Colours & the CCI Indicator movements…..

The Triangle code is Blue B, P or K = Buy, ….. Red S, P or K = Sell….

The Blue B = Buy, the Blue P = Piercing Candle Formation Signal, the Blue K = Kicking Candle Formation,

The Red S = Sell, the Red P = Piercing Candle Formation Signal, the Red K = Kicking Candle Formation…..

Explanation Snapshots of those above Blue & Red codes is below….

Been 3 reasonable trades since early Feb 23, could there be another one starting today…. Or should we wait for tomorrows TA B4 a decision is made…. Your Call.....

This mornings Chart is below…..

Again it’s a bit slow t’day, tomorrow will probably be the same, so I have to do something, may as well bore everyone to tears with some Educational ‘bits n pieces’….

REMEMBER THAT THIS TYPE OF TA WORKS FOR ME, IT MAY NOT SUIT YOUR NEEDS, SO DYOR….

Cheers...

DrB.