DrBourse

If you don't Ask, You don't Get.

- Joined

- 14 January 2010

- Posts

- 893

- Reactions

- 2,124

Another example of Information meant to Confuse Beginners - Hope you can follow the sequence below....

This post might also shine some creedence on my words in post Nr 100(above)....

The 1st snapshot below is self explanatory - Note the "USD$61 Outperform Target Price (= abt AUD$90.00)"....

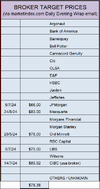

The next Snapshot is a list of Target Prices from a variety of Brokers showing an Average Target Price of $78.38....

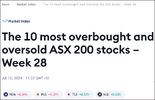

And Finally from the MarketIndex 15/7/24 @ 11.33am....

So which TP would you think is ok to use for your Research & Analysis....

14/7/24 USD$61 = abt $90AUD....

As at 15/7/24 $78.38 as an average from MarketIndex Morning & Evening Reports....

OR....

Then on 15/7/24 @ 11.33am MarketIndex suggest that NEM is suddenly OVERBOUGHT @ $70.00.....

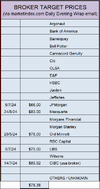

And to add insult to injury,this morning 16/7/24 MarketIndex quote NEM in their Brokers Consensus List as shown below....

So which is it MarketIndex, Overbought @ $70.00 - OR - STRONG BUY @ A 12 Mth TP OF $78.66....

And all that above data & information came from MarketIndex on 14/7/24 & 15/7/24....

Pretty neat Eh!

One last comment from me, IMO an Intrinsic Value is a pretty precise thing if it is calculated correctly, BUT, on the other hand a Brokers Target Price is a Mythical Guesstimate based on each individual "Brokers In House Rules", as I have documented in numerous past posts in the 3 "DrB Help for Beginners Forums (General, FA & TA)"....

I've had the NEM IV @ $74.65 since early 2024....

Dr.B

This post might also shine some creedence on my words in post Nr 100(above)....

The 1st snapshot below is self explanatory - Note the "USD$61 Outperform Target Price (= abt AUD$90.00)"....

The next Snapshot is a list of Target Prices from a variety of Brokers showing an Average Target Price of $78.38....

And Finally from the MarketIndex 15/7/24 @ 11.33am....

So which TP would you think is ok to use for your Research & Analysis....

14/7/24 USD$61 = abt $90AUD....

As at 15/7/24 $78.38 as an average from MarketIndex Morning & Evening Reports....

OR....

Then on 15/7/24 @ 11.33am MarketIndex suggest that NEM is suddenly OVERBOUGHT @ $70.00.....

And to add insult to injury,this morning 16/7/24 MarketIndex quote NEM in their Brokers Consensus List as shown below....

So which is it MarketIndex, Overbought @ $70.00 - OR - STRONG BUY @ A 12 Mth TP OF $78.66....

And all that above data & information came from MarketIndex on 14/7/24 & 15/7/24....

Pretty neat Eh!

One last comment from me, IMO an Intrinsic Value is a pretty precise thing if it is calculated correctly, BUT, on the other hand a Brokers Target Price is a Mythical Guesstimate based on each individual "Brokers In House Rules", as I have documented in numerous past posts in the 3 "DrB Help for Beginners Forums (General, FA & TA)"....

I've had the NEM IV @ $74.65 since early 2024....

Dr.B

Last edited: