DrBourse

If you don't Ask, You don't Get.

- Joined

- 14 January 2010

- Posts

- 893

- Reactions

- 2,124

As a follow up to the above Intrinsic Vales Post above, here is some more Info.

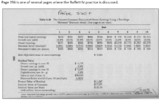

The following is Referenced from "The Warren Buffett Way" pages 35, 36, 37 & 90.

Simplistically, a company's "Intrinsic Value" could be found by estimating the earnings of the company and multiplying those by an appropriate capitalization factor. This factor, or multiplier, is influenced by the company's stability of earnings, assets, dividend policy, and financial health.

Using an Intrinsic Value approach is limited by the analyst's imprecise calculations for a co's economic future.

The concern is that an analyst's projections could be easily negated by a host of potential future factors.

Sales volume, pricing, and expenses are difficult to forecast, thus making the application of a multiplier that much more complex.

The suggestion is that a Margin of Safety could be established and that it could be used to select stocks.

The idea of Intrinsic Value is an elusive concept. It is distinct from the market's quotation price.

Originally, Intrinsic Value was thought to be the same as a company's Book Value, or the sum of it's real assets minus obligations.

However, analysts came to know that the value of a company was not only its Net Real Assets but, additionally, the value of the earnings these assets produced.

The idea is that it is not essential to determine a company's exact Intrinsic Value but, instead accept an appropriate measure or range of value.

A greater amount of a company's Intrinsic Value is the sum of measurable, quantitative factors.

A lesser amount is attributed to Quality of Management, Nature of the Business, and optimistic Growth Projections.

Fixed Assets are measurable, dividends are measurable, current earnings as well as historical earnings are measurable. Each of these factors can be demonstrated by figures and become a source of logic referrerenced by actual experience.

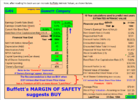

The overall objective of this Intrinsic Valuation Calculator is to identify stocks with a current price that is less than two-thirds of it's Projected Intrinsic Value Range.

This Intrinsic Valuation Calculator relates "Owners Earnings" to the "Current Price".

Owners Earnings is stated as:- a company's net income, plus depreciation, depletion and amortization, less the amount of capital expenditure and any additional working capital that might be needed.

Owners Earnings does not provide a precise calculation as it often requires rough estimates.

This "Estimated Intrinsic/Balance Sheet Share Price Value" is what Buffets Valuer calculates the Share Price should be (based on the PAST current Balance Sheet Figures).

So Buffet is suggesting that provided there are no Abnormal Events this is what this Company's Forward share price is valued at.

If there are Company related abnormal events they can usually be accounted for within this Valuer.

That is, I can adjust any of the "Rates or Actuals" to help reflect abnormal events.

ie:- for a Profit Warning/Downgrade we simply adjust the Growth Rate. etc..

Extra info on Intrinsic Values and how to calculate it can be found in the 1st Edition of "The Warren Buffett Way" as shown in the following attachments.

The following is Referenced from "The Warren Buffett Way" pages 35, 36, 37 & 90.

Simplistically, a company's "Intrinsic Value" could be found by estimating the earnings of the company and multiplying those by an appropriate capitalization factor. This factor, or multiplier, is influenced by the company's stability of earnings, assets, dividend policy, and financial health.

Using an Intrinsic Value approach is limited by the analyst's imprecise calculations for a co's economic future.

The concern is that an analyst's projections could be easily negated by a host of potential future factors.

Sales volume, pricing, and expenses are difficult to forecast, thus making the application of a multiplier that much more complex.

The suggestion is that a Margin of Safety could be established and that it could be used to select stocks.

The idea of Intrinsic Value is an elusive concept. It is distinct from the market's quotation price.

Originally, Intrinsic Value was thought to be the same as a company's Book Value, or the sum of it's real assets minus obligations.

However, analysts came to know that the value of a company was not only its Net Real Assets but, additionally, the value of the earnings these assets produced.

The idea is that it is not essential to determine a company's exact Intrinsic Value but, instead accept an appropriate measure or range of value.

A greater amount of a company's Intrinsic Value is the sum of measurable, quantitative factors.

A lesser amount is attributed to Quality of Management, Nature of the Business, and optimistic Growth Projections.

Fixed Assets are measurable, dividends are measurable, current earnings as well as historical earnings are measurable. Each of these factors can be demonstrated by figures and become a source of logic referrerenced by actual experience.

The overall objective of this Intrinsic Valuation Calculator is to identify stocks with a current price that is less than two-thirds of it's Projected Intrinsic Value Range.

This Intrinsic Valuation Calculator relates "Owners Earnings" to the "Current Price".

Owners Earnings is stated as:- a company's net income, plus depreciation, depletion and amortization, less the amount of capital expenditure and any additional working capital that might be needed.

Owners Earnings does not provide a precise calculation as it often requires rough estimates.

This "Estimated Intrinsic/Balance Sheet Share Price Value" is what Buffets Valuer calculates the Share Price should be (based on the PAST current Balance Sheet Figures).

So Buffet is suggesting that provided there are no Abnormal Events this is what this Company's Forward share price is valued at.

If there are Company related abnormal events they can usually be accounted for within this Valuer.

That is, I can adjust any of the "Rates or Actuals" to help reflect abnormal events.

ie:- for a Profit Warning/Downgrade we simply adjust the Growth Rate. etc..

Extra info on Intrinsic Values and how to calculate it can be found in the 1st Edition of "The Warren Buffett Way" as shown in the following attachments.