I am not going to tell you what this chart is.

But I want some opinions.

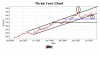

It looks like this year it has been over bought and over sold. For 3 years it wiggled its way up in a trading range and never appeared to go outside the train tracks.

It was over bought and over sold. Where to from here. Has the trend been broken? Or will the upward 3 year trend stay intact as long as it does drop below the blue line, that being the $7.50 mark.

But I want some opinions.

It looks like this year it has been over bought and over sold. For 3 years it wiggled its way up in a trading range and never appeared to go outside the train tracks.

It was over bought and over sold. Where to from here. Has the trend been broken? Or will the upward 3 year trend stay intact as long as it does drop below the blue line, that being the $7.50 mark.