You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BPT - Beach Energy

- Thread starter Bonk

- Start date

Kauri

E/W Learner

- Joined

- 3 September 2005

- Posts

- 3,428

- Reactions

- 11

Kauri

E/W Learner

- Joined

- 3 September 2005

- Posts

- 3,428

- Reactions

- 11

Doesn't seem like a very good anouncment? I would think the share price will fall back now? Am i Reading it right?

Clowboy,

Looks like it, I've got out at $1.50, left a fair chunk of todays action on the table but can't win them all... starting to look like a classic blow-off...

.Cheers

........Kauri

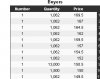

Attachments

- Joined

- 1 April 2006

- Posts

- 509

- Reactions

- 0

Sorry - don't have time to do this research myself but seems the Baskar Mantra project is having a number of troubles - what percentage of BPTs future revenues does this represent?

thanks to anyone who can help...

thanks to anyone who can help...

- Joined

- 29 June 2007

- Posts

- 15

- Reactions

- 0

Attached is the link to BPT's March 07 report, If my math is correct, which shows that oil revenue from Gippsland basin ( Basker Manta ) represent about 24% of total BPT's during that Qtr.

SP has down 12% , market may be overreacting? given that BManta will be back in operational within "a number of weeks" not months.

Fri 6/7 another ann after market closed . "WARRAGON-1 SPUDS IN SW QUEENSLAND" estimate mean recoverable oil 1.33MMBO + 0.56MMBO .

Would like to see other member's comment.

http://www.beachpetroleum.com.au/fi...ses/2007/048-07QuarterlyReporttoMarch2007.pdf

SP has down 12% , market may be overreacting? given that BManta will be back in operational within "a number of weeks" not months.

Fri 6/7 another ann after market closed . "WARRAGON-1 SPUDS IN SW QUEENSLAND" estimate mean recoverable oil 1.33MMBO + 0.56MMBO .

Would like to see other member's comment.

http://www.beachpetroleum.com.au/fi...ses/2007/048-07QuarterlyReporttoMarch2007.pdf

Okay here is the deal for Basker.

Oil sales for the whole of Beach for the quarter = 2590 KBOE = 2,590,000 Barrels of oil.

Basker

Average BOPD for 1/4 = 8752

8752 * 365/4 = 798620 Barrels of oil for quarter.

798620/ 2590000

=31% of sales from Basker.

I am not entrely convinced fall in current Sp is due to Basker problems but rather Alinta gas deal collapsing. I got stopped out at 1.40 but once we find a bottom again I will jump back in. I think BEach management are doing a good job and it seems with all of the interest in green energy everyone overlooks the fact Beach own 21% of Petratherm Energy and has the option to buy another 15% into the company.

Oil sales for the whole of Beach for the quarter = 2590 KBOE = 2,590,000 Barrels of oil.

Basker

Average BOPD for 1/4 = 8752

8752 * 365/4 = 798620 Barrels of oil for quarter.

798620/ 2590000

=31% of sales from Basker.

I am not entrely convinced fall in current Sp is due to Basker problems but rather Alinta gas deal collapsing. I got stopped out at 1.40 but once we find a bottom again I will jump back in. I think BEach management are doing a good job and it seems with all of the interest in green energy everyone overlooks the fact Beach own 21% of Petratherm Energy and has the option to buy another 15% into the company.

- Joined

- 22 July 2006

- Posts

- 852

- Reactions

- 1

..........with all of the interest in green energy everyone overlooks the fact Beach own 21% of Petratherm Energy and has the option to buy another 15% into the company.

Rage

Beach have an equity interest in the Paralana Joint Venture, not the Company itself.

Just thought I would make the distinction for you, because it is only that one project that Beach will have equity in, provided they meet the farm in expenditure requirements.

Minotaur Exploration Ltd is actually the biggest holder in the entity, with 34% of the issued capital.

Cheers

Reece

- Joined

- 1 April 2006

- Posts

- 509

- Reactions

- 0

thanks for your comments above - as we suspected it looks like the market may have overdone things - news out today seems to have given them a lift - will this continue to test 1.50 mark again? or too early to say? PoO up and good news on other projects continues...

Others thoughts?

Others thoughts?

BASKER MANTA COMPLETES INSPECTION OF STATUS OF SINGLE POINT MOORING (SPM)

The BMG JV provides the following summary of activities and plans following the incident last Thursday when the BMG shuttle tanker, the Basker Spirit, drifted from its SPM in Bass Strait.

Inspection of the SPM component on the surface and subsurface using a Remotely Operated Vehicle (ROV) has confirmed the site of the mooring failure. A pin in one of the chain shackles has become dislodged, allowing the upper mooring elements to detach from the three point mooring at the nodal point. The mooring system itself is in good condition, with no reason to question its integrity. The hose that transfers oil from the Crystal Ocean FPSO to the Basker Spirit has been damaged as it took the load of the Basker Spirit when the shackle decoupled from the nodal point. The BMG JV has spare hoses in stock.

To restore the full mooring system and allow full production to recommence will require a specialized construction vessel to be mobilized. The need for lifting capacity and saturation diving capability requires such a vessel. The BMG JV is sourcing such a vessel now and expects to have one (of three possible vessels) in the field in the latter part of August, subject to negotiations with the vessel owners.

In the meantime, the BMG JV plans to continue production, with the Basker Spirit moored in Westernport Bay or other acceptable ports, with the Crystal Ocean transferring crude oil to the Basker Spirit in a shuttle operation. It is expected that production of about 3,000 bopd [so thats about one third of normal production] can be maintained with this operation. Production will increase to the field capacity when the SPM integrity is re-established and the Basker Spirit resumes its mooring location in the field.

- Joined

- 19 September 2004

- Posts

- 205

- Reactions

- 5

Seems to be good up side with this stock and short term target is $1.60.

Was travelling nicely until this recent market correction.

Was travelling nicely until this recent market correction.

Seems to be good up side with this stock and short term target is $1.60.

Was travelling nicely until this recent market correction.

Indeed I am surprised BPT is not much higher yet. This might help.

"Beach Petroleum Ltd has continued to break quarterly and annual production and sales

revenue records and has also booked a big increase in petroleum reserves in the period

ended 30 June 2007.

Sales revenue in the June quarter rose 18 per cent to a record $A93.03 million, up from

$A78.6 million in the March 2007 quarter"

- Joined

- 31 March 2006

- Posts

- 5

- Reactions

- 0

Anyone knows how to calculate for every 1000 barrel of oil, how much does it add to its e.p.s. Thanks

- Joined

- 25 September 2004

- Posts

- 431

- Reactions

- 0

Doesn't Beach have interest in geothermal energy?

http://news.ninemsn.com.au/article.aspx?id=92248

It sounds pretty good except the cost of infrastructure.

http://news.ninemsn.com.au/article.aspx?id=92248

It sounds pretty good except the cost of infrastructure.

Im back in this now at $1.22....bought at 30c a couple of years ago and sold completely out at $1.40 mid last year. I didnt like the reaction of the market to the takeover last year or the way the bonus shares were issued at an above market price, or the huge increase the directors took in pay ....but confidence seems to have returned and the bedding process is hopefully over now.....so as a price of oil bet it looks good to me  ..but take your own gambling advice. ;-)..Good luck to all.

..but take your own gambling advice. ;-)..Good luck to all.

This article in SMH may have helped...

Beach is starting to look underpriced

Reg Nelson gets to preside over the release of what should be a bumper result for Beach Petroleum on Wednesday. Thanks to a full year from the Delhi acquisition, the market will be looking for something near the $90 million mark ahead of a charge to $200 million in following years.

That's why analyst Stuart Baker at Morgan Stanley slapped a $2-a-share price target on the stock early last month when Beach was looking nice and strong at $1.43 a share. That Beach has drifted back to $1.145 on Friday - it hit 99c on Black Thursday - reflects the lack of rebound for the stock since the subprime sell-off, plus some disappointment that the BMG oil project in Bass Strait needs remedial work to get to original forecast production levels.

Wednesday's profit report could be the catalyst for the rerating that Baker and others think is now due to Beach, now ranked number four in our listed oil and gas stocks behind Woodside, Santos and Oil Search. Now that Beach has arrived as a sizeable and profitable producer for the long term (20 years-plus), Nelson has cranked up its exploration portfolio.

Four high-impact wells are now slotted to be drilled in the next 15 months. The big Fermat 1 gas target offshore from Portland in Victoria (1200 petajoules in the second quarter of 2008) has been locked in for a while. The new additions (1 in New Zealand's Taranaki Basin and two in the Bass Basin) each have the potential to yield net oil reserves to Beach of more than 20 million barrels of oil.

Beach is starting to look underpriced

Reg Nelson gets to preside over the release of what should be a bumper result for Beach Petroleum on Wednesday. Thanks to a full year from the Delhi acquisition, the market will be looking for something near the $90 million mark ahead of a charge to $200 million in following years.

That's why analyst Stuart Baker at Morgan Stanley slapped a $2-a-share price target on the stock early last month when Beach was looking nice and strong at $1.43 a share. That Beach has drifted back to $1.145 on Friday - it hit 99c on Black Thursday - reflects the lack of rebound for the stock since the subprime sell-off, plus some disappointment that the BMG oil project in Bass Strait needs remedial work to get to original forecast production levels.

Wednesday's profit report could be the catalyst for the rerating that Baker and others think is now due to Beach, now ranked number four in our listed oil and gas stocks behind Woodside, Santos and Oil Search. Now that Beach has arrived as a sizeable and profitable producer for the long term (20 years-plus), Nelson has cranked up its exploration portfolio.

Four high-impact wells are now slotted to be drilled in the next 15 months. The big Fermat 1 gas target offshore from Portland in Victoria (1200 petajoules in the second quarter of 2008) has been locked in for a while. The new additions (1 in New Zealand's Taranaki Basin and two in the Bass Basin) each have the potential to yield net oil reserves to Beach of more than 20 million barrels of oil.

This article in SMH may have helped...

Beach is starting to look underpriced

Reg Nelson gets to preside over the release of what should be a bumper result for Beach Petroleum on Wednesday. Thanks to a full year from the Delhi acquisition, the market will be looking for something near the $90 million mark ahead of a charge to $200 million in following years.

That's why analyst Stuart Baker at Morgan Stanley slapped a $2-a-share price target on the stock early last month when Beach was looking nice and strong at $1.43 a share. That Beach has drifted back to $1.145 on Friday - it hit 99c on Black Thursday - reflects the lack of rebound for the stock since the subprime sell-off, plus some disappointment that the BMG oil project in Bass Strait needs remedial work to get to original forecast production levels.

Wednesday's profit report could be the catalyst for the rerating that Baker and others think is now due to Beach, now ranked number four in our listed oil and gas stocks behind Woodside, Santos and Oil Search. Now that Beach has arrived as a sizeable and profitable producer for the long term (20 years-plus), Nelson has cranked up its exploration portfolio.

Four high-impact wells are now slotted to be drilled in the next 15 months. The big Fermat 1 gas target offshore from Portland in Victoria (1200 petajoules in the second quarter of 2008) has been locked in for a while. The new additions (1 in New Zealand's Taranaki Basin and two in the Bass Basin) each have the potential to yield net oil reserves to Beach of more than 20 million barrels of oil.

Yes... the last two weeks have been insane. I'd been doing a lot of comparisons between similar producing companies. I'm very happy though - it gave me a chance to get in a $1.16

Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

Very nice jump in price today. I can't understand how a stock like BPT is still in the low $1. Does anyone know why it went up over 10% today?

Certainly a good trading stock, unfortunately I sold out friday, pre-empting the reversal crossover on the oscilator.

Insane decision as you should always wait for the confirmation, not second guess things.

A slap across the face with a wet fish and learn......................again