greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,491

- Reactions

- 4,587

True enough, but then Bitcoin is not touted as a trading instrument. Instead, you're meant to buy and hold your digital gold in your digital wallet long term since there will only ever be 2.1 quadrillion satoshis so supply is limited. Limited supply must equate to an ever rising price right? Just ignore the price action over the last 12 months as an aberration.

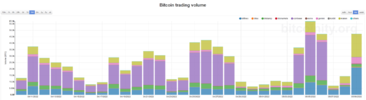

There's no way I'd hold crypto long term, but it's the only 24/7/365 market that I'm aware of; and you can't beat the volatility. Also, as I pointed out above the price action patterns seem more predicable than that of other markets, such as the forex market, which is notoriously difficult to trade.

I'm still trying to understand the crypto space in terms of the technology, but ultimately if you're just trading it, it doesn't matter.