That's just it some are just 'holding' till it hits a million. Considering that will crimp supply, it has to put a floor down.Since the price of Bitcoin is basically unchanged since the same time last year, the hodlers thinking $100k Bitcoin was just over the horizon will now indeed need to reassess whether to return to their low paying service sector jobs. Depends on how much tax free government assistance they continue to receive to remain unemployed. Is Bitcoin in a bear cycle? Many chartists would argue this has been the case since November last year. But then a work colleague recently reiterated the maximalist mantra, buy, hold, never sell and you will be a millionaire eventually, LOL.

View attachment 138707

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin price discussion and analysis

- Thread starter greggles

- Start date

Listened to Bitcoin evangelist Robert Breedlove make a similar assertion in an interview. The "dematerialized asset" that is Bitcoin only has limited circulation due to all the "hodlers" who, supposedly, will never sell their Bitcoin. The underlying assumption being this will not only set a floor price at some level, but eventually lead to amazing gains as in the past. A Lamborghini in the garage is only a question of patience but of course means selling at some stage. This may actually eventuate if many will not sell no matter the price movement, but I suggest that floor price is somewhere deep in the basement and after the smart money has fully existed the casino.That's just it some are just 'holding' till it hits a million. Considering that will crimp supply, it has to put a floor down.

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Week in Review: Record High Inflation, Russia-Ukraine Conflict, Biden’s Executive Order and More

CoinDesk’s Tech Managing Editor Christie Harkin and Markets Managing Editor Brad Keoun join host Christine Lee on “All About Bitcoin” to review this week’s top stories and look into the major news events that could move the bitcoin markets next week.

- Joined

- 6 December 2021

- Posts

- 111

- Reactions

- 147

the bit coin boat has left the port, next one is due after current passengers have emptied thier wallets on the drinks package

That crypto ship has already sailed but the next port of call is the bottom of the ocean. But yes, while the unsinkable Cryptotanic is taking on water on its way to the bottom, might as well open up the crypto wallet and spend up big while you still can. But then you should never sell those block chain ledger entries because they are dematerialized digital gold.the bit coin boat has left the port, next one is due after current passengers have emptied thier wallets on the drinks package

- Joined

- 9 July 2006

- Posts

- 6,002

- Reactions

- 1,652

When holding dematerialized crypto casino chips does not bail you out of a difficult position...

An example of how an "unconfiscatable" crypto asset (totally erroneous assertion) can easily be rendered useless such that holding good old fashioned fiat is not only preferable but necessary.

Cashless and flightless, Russian tourists stuck in Thailand

"Many have cash and those with UnionPay credit cards, which are issued by a Chinese financial services company, can still use them, but payment by cryptocurrency is not allowed"...An example of how an "unconfiscatable" crypto asset (totally erroneous assertion) can easily be rendered useless such that holding good old fashioned fiat is not only preferable but necessary.

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Top 5 cryptocurrencies to watch this week: BTC, DOT, SAND, RUNE, ZEC

BTC’s technical setup suggests a potential breakout to the upside and charts suggest DOT, SAND, RUNE and ZEC would be the first to benefit from any bullish price action.

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Another method of payment is the increasing use of gold backed debit cards. Most just keep the gold on their cards though they are useful if a Fiat card is refused. I have a Tally gold backed debit card that is backed by gold held.When holding dematerialized crypto casino chips does not bail you out of a difficult position...

Cashless and flightless, Russian tourists stuck in Thailand

"Many have cash and those with UnionPay credit cards, which are issued by a Chinese financial services company, can still use them, but payment by cryptocurrency is not allowed"...

An example of how an "unconfiscatable" crypto asset (totally erroneous assertion) can easily be rendered useless such that holding good old fashioned fiat is not only preferable but necessary.

-----

How to Get a Gold-Backed Debit Card

Learn how to obtain a gold-backed debit card with our step-by-step guide. Discover the benefits of gold-backed currency, understand the application process and find reputable providers.

nomadcapitalist.com

nomadcapitalist.com

-----

Many oligarchs are thought to hold multiple cards to get round the need to exchange Fiat currencies. There are also cards that are backed by other commodities.

The Tally gold backed debit card looks interesting although custodial and transactional costs are not disclosed on their site. I prefer to transact with a local precious metals dealer where the buy/sell prices are updated daily and I can easily convert gold to fiat although it's not immediate.Gold-backed debit cards aren’t a necessity for most investors, but if you’d like to make your precious metal assets more liquid, they can be a useful tool.

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

I'm not sure if you are referring to the UK or the USA Tally cards. They are quite different companies. I use the UK Tally card.The Tally gold backed debit card looks interesting although custodial and transactional costs are not disclosed on their site. I prefer to transact with a local precious metals dealer where the buy/sell prices are updated daily and I can easily convert gold to fiat although it's not immediate.

Home - A

tally is a digital currency representing physical gold that protects your savings from devaluation. You can save, spend and send tally just like pounds using the app and TallyMoney Debit Mastercard.

The card appears costly at 1% per year though I send money abroad via Tally with no charges or fees of any kind. An increasing number of companies have no problems with transfers as the amount of trading has been increasing sharply in the last 18 months.

Money Transfer Company Reviews | MoneyTransfers.com

You can tell it could be expensive if paying from dollars to euros though paying in gold is the best method. It takes awhile to understand and many people fail to spend a few hours understanding all the information before using it - quite vital as it is only too easy to screw up. It is so easy to accidentally pay in Fiat when several more patient clicks and its covered in gold. Also the above article does miss out the more complicated transactions - probably only meant for those paying in shops in various countries: On the other hand it is a money transfer article.

* I am a shareholder in Tally Limited.

Last edited:

- Joined

- 20 December 2021

- Posts

- 218

- Reactions

- 500

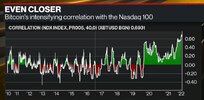

Bitcoin trading at 3-week highs after the technology sector led gains on Wall Street overnight reiterates a point made on this thread a few weeks ago that it is essentially a high-beta risk asset which can potentially act as a leveraged bet on tech.

If BTC can now manage its first weekly close above $44,000 this year, it might allow for a strong move higher. However, all trading carries risk, and if we see rising yields weigh on tech shares, it won’t be surprising to see an intensified decline in the crypto markets.

If BTC can now manage its first weekly close above $44,000 this year, it might allow for a strong move higher. However, all trading carries risk, and if we see rising yields weigh on tech shares, it won’t be surprising to see an intensified decline in the crypto markets.

- Joined

- 28 May 2020

- Posts

- 6,618

- Reactions

- 12,690

Thanks for that Noirua, one of my sons has been interested in Tally, and I have only just started following it.I'm not sure if you are referring to the UK or the USA Tally cards. They are quite different companies. I use the UK Tally card.

Home - A

tally is a digital currency representing physical gold that protects your savings from devaluation. You can save, spend and send tally just like pounds using the app and TallyMoney Debit Mastercard.www.tallymoney.com

The card appears costly at 1% per year though I send money abroad via Tally with no charges or fees of any kind. An increasing number of companies have no problems with transfers as the amount of trading has been increasing sharply in the last 18 months.

Money Transfer Company Reviews | MoneyTransfers.com

moneytransfers.com

You can tell it could be expensive if paying from dollars to euros though paying in gold is the best method. It takes awhile to understand and many people fail to spend a few hours understanding all the information before using it - quite vital as it is only too easy to screw up. It is so easy to accidentally pay in Fiat when several more patient clicks and its covered in gold. Also the above article does miss out the more complicated transactions - probably only meant for those paying in shops in various countries: On the other hand it is a money transfer article.

* I am a shareholder in Tally Limited.

Have they relisted on the LSE yet?

According to the website, they were listed as LION on the LSE, but I can no longer find that code.

Appreciate your comments.

Mick

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Thanks for that Noirua, one of my sons has been interested in Tally, and I have only just started following it.

Have they relisted on the LSE yet?

According to the website, they were listed as LION on the LSE, but I can no longer find that code.

Appreciate your comments.

Mick

Investors-stage

INVESTORS Tally Central Ltd Tally Central Ltd (incorporated in Guernsey with Company Number 53026) is the central monetary authority and innovator behind the independent non-fiat non-crypto monetary system and physical-gold digital currency, tally®. Previously quoted as Lionsgold (LSE:LION) on...

It is part of the Company’s corporate strategy to Standard List on the Main Market of the London Stock Exchange (“IPO”), albeit the final share price and listing date is not yet known.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,950

- Reactions

- 13,241

So what you effectively have with Tally is a - 1% interest rate, however you have a currency that cannot be debased by Gumin action (just market flucs)... a sort of "antibond", if you will... (Loosest possible definition of bonds there but just thinking aloud)

Interesting

Interesting

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Https://youtu.be/8Re4SIfMFBc

"Most People Have No Idea What's Coming.." Max Keiser | Bitcoin Will EAT EVERY Other Asset

51,777 views Mar 16, 2022

"Most People Have No Idea What's Coming.." Max Keiser | Bitcoin Will EAT EVERY Other Asset

51,777 views Mar 16, 2022

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

In the news, Bitcoin pumper and crybaby keynote speaker at the Bitcoin 2022 conference, Peter Thiel, blames "sociopathic grandpa" Warren Buffett and other members of a “finance gerontocracy” for holding back Bitcoin from reaching $100K! So the 30% decline in BTC over the last 12 months can largely be attributed to these old world order grandpas casting doubt on the future of the modern tulip bulb and daring to challenge the new orthodoxy of self-promoting crypto elites like Theil. Self-evident truth (with no supporting evidence required) or sensational attention seeking nonsense from a shill? I am going with the latter.

https://www.forbes.com/sites/abrambrown/2022/04/07/peter-thiel-crypto-bitcoin-blockchain-miami/?sh=34cc603e46e7

https://www.bloomberg.com/news/arti...imon-buffett-and-fink-as-finance-gerontocracy

Last edited:

Let's see how BTC responds to rising interest rates and inflation rather than rubbing the BTC chartist crystal ball. So far, it's not looking very promising for the price of digital fiat from here.

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,510

Similar threads

- Article

- Replies

- 2

- Views

- 1K

- Replies

- 10

- Views

- 4K