- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

BlackRock expected to offer crypto trading as Three Arrows exec says long Bitcoin, ETH in 2022

Long BTC, ETH in 2022 says Zhu Su as BlackRock reportedly prepares crypto trading.

It appears that BTC is not responding well to the threats of war in The Ukraine.

Bitcoin and Ethereum rally continues on Russia and Black Rock approval

Bitcoin continued its recovery on Friday morning following months of a downward trend in the crypto market and a colossal sell-off in January. The world’s...www.proactiveinvestors.co.uk

So, I have some environmentally friendly hay that the Clydesdales may be interested in.So is bitcoin etc a risk on, or a risk off asset?

Because it sure as hell behaves like a risk on asset in my book.

In other unrelated news, I've just traded in my work truck for a rickshaw and two Clydesdales

Give it a month or two and that might even be a good deal, and the girls could make pretty lead ropes out of the bale stringSo, I have some environmentally friendly hay that the Clydesdales may be interested in.

Completely Organic, all bales are gender non binary whose preferred pronoun is they, no slave labour was used in their production, and bale string is rainbow coloured.

Only 0.1 bitcoins each.

Plus transport.

Mick

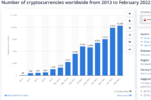

Since Bitcoin has no intrinsic value it only becomes risk off when trading at $0 per satoshi and finally recognized as the unregulated financial con job it was from the beginning. Otherwise it continues to rank among the highest risk "assets" just behind the other 10,000+ sh$t coins requiring ever more fiat currency to flow into the crypto casino to enrich promoters, whales and pump and dump merchants at the expense of hodlers.So is bitcoin etc a risk on, or a risk off asset?

I will be selling the first HNFT at a competitive auction online from next Monday.So, I have some environmentally friendly hay that the Clydesdales may be interested in.

Completely Organic, all bales are gender non binary whose preferred pronoun is they, no slave labour was used in their production, and bale string is rainbow coloured.

Only 0.1 bitcoins each.

Plus transport.

Mick

I think Byron Boy already has plenty of dopes of their own.I will be selling the first HNFT at a competitive auction online from next Monday.

The first Hay Non-Fungible Token will be available from our sister hotel in Byron Bay from Monday 28th February.

BYO Dope.

Eliminate transport costs for your fodder.

gg

Some lift by BTC. Thoughts that some oligarchs' are moving cash from banks not under freezing conditions into Bitcoin. Appears the case in Cyprus where many keep large sums. Bitcoin the greatest haven. |

|

Related: European Commission to remove Russian banks from SWIFT cross-border network“Russia cannot use crypto to replace the hundreds of billions of dollars that could be potentially blocked or frozen.”

While I have never spent any time in Lugano Prison, one of Lugano's main claims to fame, this sweet Swiss more than a hamlet, is not without it's made men and colourful characters.?BREAKING: Swiss city of Lugano will accept #Bitcoin as payment for taxes.

Since the price of Bitcoin is basically unchanged since the same time last year, the hodlers thinking $100k Bitcoin was just over the horizon will now indeed need to reassess whether to return to their low paying service sector jobs. Depends on how much tax free government assistance they continue to receive to remain unemployed. Is Bitcoin in a bear cycle? Many chartists would argue this has been the case since November last year. But then a work colleague recently reiterated the maximalist mantra, buy, hold, never sell and you will be a millionaire eventually, LOL.Looks like another fear/bear cycle, as everyone talks about how to cope going back to a real job.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.