- Joined

- 13 February 2006

- Posts

- 5,020

- Reactions

- 11,321

So another early start, week 2 of covering for a colleague:

Oil News (prior to headline)

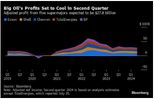

The Q2 quarterly earnings season has continued this week with most of oil majors reporting their performance results, with TotalEnergies and BP providing no clear direction for where oil firms are headed.

- Total’s net income underperformed market expectations of $4.95 billion and came in at $4.7 billion, with the French major dragged down by a 36% year-on-year decrease in refining and chemicals revenue.

- BP, for a long time the least mouth-watering of the oil giants, posted a $2.8 billion Q2 net profit and beat analyst expectations by some 200 million, despite a hefty $1.5 billion impairment from shutting parts of the Gelsenkirchen refinery in Germany next year.

- Weaker downstream performance will be the main drag for US majors, too, with Chevron and ExxonMobil both publishing their results this Friday (August 2), with oil majors collectively expected to see a 6-7% drop in net profits quarter-over-quarter.

Market Movers

- US shale producers Vital Energy (NYSE:VTLE) and Northern Oil and Gas (NYSE:NOG) agreed to jointly purchase the Permian assets of PE-owned Point Energy Partners for $1.1 billion, with Vital taking 80% and Northern buying the remaining 20%.

- Chinese refining giant Sinochem (SHA:600500) is reportedly in talks with Brazilian independent producer Prio to sell a minority stake in the giant Peregrino offshore field, having paid $3 billion for a 40% stake in 2011.

- Italy’s oil major ENI (BIT:ENI) signed a temporary exclusivity agreement with global investment firm KKR to sell a 20% to 25% stake in its biofuel and mobility unit Enilive for up to $13.5 billion.

Tuesday, July 30, 2024

For the first time since the post-OPEC+ meeting selloff, ICE Brent futures dipped below $80 per barrel, driven lower by disappointing global demand as Chinese imports in July are set to hit the lowest level in two years. The decline might be somewhat overdone considering the geopolitical risk upside, with Israel-Lebanon flaring up over the weekend and Venezuela’s highly contested election lifting the risk of operations in the Latin American nation.

With No Mandate for Change, OPEC+ Meets Again. Oil ministers of OPEC+ will hold an online joint ministerial monitoring committee meeting (JMMC) on August 1, reviewing the effects of decisions taken two months ago, but the market expects no changes, only internal discussions.

Labour Government Hikes UK Windfall Tax. The new Labour government confirmed this week that it would raise the windfall profit tax rate by 3% to 38% and increase overall taxation to a punitive 78%, whilst extending the measure (called Energy Profits Levy) by another year to 31 March 2030.

Uranium Prices Soar to 16-Year Highs. Long-term uranium prices have hit 16-year highs, trading as high as $79 per pound lately, as demand for the radioactive fuel is soaring on the back of new power generation buildouts that are expected to double global consumption by 2050.

King Coal Defies Calls for Global Decline. The International Energy Agency believes that global consumption of coal will remain stable in 2024, rising marginally to 8.74 billion tonnes, postponing its forecast for peak coal to 2025 when it sees a slight downslide, citing declining Chinese appetite for coal.

Saudi Influence Extends into LME Warehousing. Attesting to the increasing clout of Saudi Arabia in the mining industry, the London Metal Exchange (LME) has approved the Red Sea port of Jeddah as a warehouse delivery point for copper and zinc traded on the exchange.

Iran Seizes Another Oil Tanker for Smuggling. Iranian authorities have seized the Togo-flagged oil tanker Pearl G for allegedly carrying 700,000 barrels of smuggled crude, with tracking data indicating the vessel has spent the past months sailing between the UAE’s Sharjah and the Iraqi coast.

French Major Gave Up on South Africa. France’s energy major TotalEnergies (NYSE:TTE) has relinquished its stake in Blocks 11B and 12B offshore South Africa, despite having discovered two giant gas fields, citing a challenging environment to monetize the Luiperd and Brulpadda finds.

US Resumes SPR Purchases as WTI Drops. The US Energy Department purchased 4.65 million barrels of crude for the Bayou Choctaw site of the Strategic Petroleum Reserve at an average price of $76.92 per barrel, with ExxonMobil (NYSE:XOM) offering the most and being awarded 3.9 million barrels.

Iraq Boosts Oil Export Capacity. Being the worst overproducers of OPEC+ in recent years, Iraq has nevertheless continued its build-out of crude infrastructure, adding two pumping units next to the Zubair oil field and adding 300,000 b/d of export capacity to around 3.5 million b/d.

Texas Oil Regulator Opens Probe into Earthquakes. Following last week’s powerful earthquakes across the Permian, with the largest measuring 5.1 on the Richter scale, the Railroad Commission of Texas has opened an investigation into disposal wells in the Camp Springs production area.

White House Has No Plans for Venezuela Tightening. Protests have erupted across Venezuela after Nicolas Maduro won a third six-year term in a highly contested vote, although the Biden administration said it is not looking into the retroactive cancellation of existing sanction waivers.

Glencore Mulls Coal Demerger, Announcement Soon. Mining giant Glencore (LON:GLEN) has kept its 2024 production guidance unchanged to reflect the purchase of Teck’s coking coal business, but it said it would disclose its decision on a potential coal demerger at its H1 financial results presentation next week.

US Natgas Prices Continue Their Downfall. US natural gas Henry Hub futures dipped below $2 per mmBtu this week, the lowest since early May, losing more than 55% of their value in less than a month on the back of soaring gas production and August promising to see milder weather compared to July.

Mr FFF

Before I get into $MSFT, the story of $CRWD is an interesting one in that it’s likely going to be a terrific buy soon. I know your plebeian emotions belies in justice and that Crowdstrike will be punished for their crimes; but none of that is going to hammer is corruptible Pax Americana, the death of an Empire edition.

They are as deep state as they come and they’ll be settling their suits soon and hire McKinsey to tighten up the ship and live happily ever after.

On the issue of $MSFT and it tanking in the after hours, the numbers aren’t bad at all.

Azure and other cloud services revenue growth of +29%, +30% constant currency vs +30-31% CC prior guidance

Intelligent Cloud segment revs of $28.5 bln vs $28.4-28.7 bln prior guidance.

More Personal Computing segment revs of $15.9 bln vs $15.2-15.6 bln prior guidance.

The other important number was out of $AMD and it hit and the stock is +4%. We have $ARM, $LRCX and $META coming tomorrow.

The initial reaction to Microsoft is tankage in $AMZN and $META but I suspect it’ll moderate. On the whole, the market is once again sickly and spread thin across defensive sectors and banks. We are in a rut and in order to extricate ourselves we’ll need some speed.

I finished the session down 19bps but made it all back in the after hours due to my gigantic 17% $SQQQ positions crossed against a leveraged portfolio at 151% equity. I cobbled together various defensive stocks and war time stocks just in case the Middle East heats up with the escalatory action in Lebanon.

Ran out of 'chart' space.

jog on

duc

*I'll be back later with some gold stuff!

Oil News (prior to headline)

The Q2 quarterly earnings season has continued this week with most of oil majors reporting their performance results, with TotalEnergies and BP providing no clear direction for where oil firms are headed.

- Total’s net income underperformed market expectations of $4.95 billion and came in at $4.7 billion, with the French major dragged down by a 36% year-on-year decrease in refining and chemicals revenue.

- BP, for a long time the least mouth-watering of the oil giants, posted a $2.8 billion Q2 net profit and beat analyst expectations by some 200 million, despite a hefty $1.5 billion impairment from shutting parts of the Gelsenkirchen refinery in Germany next year.

- Weaker downstream performance will be the main drag for US majors, too, with Chevron and ExxonMobil both publishing their results this Friday (August 2), with oil majors collectively expected to see a 6-7% drop in net profits quarter-over-quarter.

Market Movers

- US shale producers Vital Energy (NYSE:VTLE) and Northern Oil and Gas (NYSE:NOG) agreed to jointly purchase the Permian assets of PE-owned Point Energy Partners for $1.1 billion, with Vital taking 80% and Northern buying the remaining 20%.

- Chinese refining giant Sinochem (SHA:600500) is reportedly in talks with Brazilian independent producer Prio to sell a minority stake in the giant Peregrino offshore field, having paid $3 billion for a 40% stake in 2011.

- Italy’s oil major ENI (BIT:ENI) signed a temporary exclusivity agreement with global investment firm KKR to sell a 20% to 25% stake in its biofuel and mobility unit Enilive for up to $13.5 billion.

Tuesday, July 30, 2024

For the first time since the post-OPEC+ meeting selloff, ICE Brent futures dipped below $80 per barrel, driven lower by disappointing global demand as Chinese imports in July are set to hit the lowest level in two years. The decline might be somewhat overdone considering the geopolitical risk upside, with Israel-Lebanon flaring up over the weekend and Venezuela’s highly contested election lifting the risk of operations in the Latin American nation.

With No Mandate for Change, OPEC+ Meets Again. Oil ministers of OPEC+ will hold an online joint ministerial monitoring committee meeting (JMMC) on August 1, reviewing the effects of decisions taken two months ago, but the market expects no changes, only internal discussions.

Labour Government Hikes UK Windfall Tax. The new Labour government confirmed this week that it would raise the windfall profit tax rate by 3% to 38% and increase overall taxation to a punitive 78%, whilst extending the measure (called Energy Profits Levy) by another year to 31 March 2030.

Uranium Prices Soar to 16-Year Highs. Long-term uranium prices have hit 16-year highs, trading as high as $79 per pound lately, as demand for the radioactive fuel is soaring on the back of new power generation buildouts that are expected to double global consumption by 2050.

King Coal Defies Calls for Global Decline. The International Energy Agency believes that global consumption of coal will remain stable in 2024, rising marginally to 8.74 billion tonnes, postponing its forecast for peak coal to 2025 when it sees a slight downslide, citing declining Chinese appetite for coal.

Saudi Influence Extends into LME Warehousing. Attesting to the increasing clout of Saudi Arabia in the mining industry, the London Metal Exchange (LME) has approved the Red Sea port of Jeddah as a warehouse delivery point for copper and zinc traded on the exchange.

Iran Seizes Another Oil Tanker for Smuggling. Iranian authorities have seized the Togo-flagged oil tanker Pearl G for allegedly carrying 700,000 barrels of smuggled crude, with tracking data indicating the vessel has spent the past months sailing between the UAE’s Sharjah and the Iraqi coast.

French Major Gave Up on South Africa. France’s energy major TotalEnergies (NYSE:TTE) has relinquished its stake in Blocks 11B and 12B offshore South Africa, despite having discovered two giant gas fields, citing a challenging environment to monetize the Luiperd and Brulpadda finds.

US Resumes SPR Purchases as WTI Drops. The US Energy Department purchased 4.65 million barrels of crude for the Bayou Choctaw site of the Strategic Petroleum Reserve at an average price of $76.92 per barrel, with ExxonMobil (NYSE:XOM) offering the most and being awarded 3.9 million barrels.

Iraq Boosts Oil Export Capacity. Being the worst overproducers of OPEC+ in recent years, Iraq has nevertheless continued its build-out of crude infrastructure, adding two pumping units next to the Zubair oil field and adding 300,000 b/d of export capacity to around 3.5 million b/d.

Texas Oil Regulator Opens Probe into Earthquakes. Following last week’s powerful earthquakes across the Permian, with the largest measuring 5.1 on the Richter scale, the Railroad Commission of Texas has opened an investigation into disposal wells in the Camp Springs production area.

White House Has No Plans for Venezuela Tightening. Protests have erupted across Venezuela after Nicolas Maduro won a third six-year term in a highly contested vote, although the Biden administration said it is not looking into the retroactive cancellation of existing sanction waivers.

Glencore Mulls Coal Demerger, Announcement Soon. Mining giant Glencore (LON:GLEN) has kept its 2024 production guidance unchanged to reflect the purchase of Teck’s coking coal business, but it said it would disclose its decision on a potential coal demerger at its H1 financial results presentation next week.

US Natgas Prices Continue Their Downfall. US natural gas Henry Hub futures dipped below $2 per mmBtu this week, the lowest since early May, losing more than 55% of their value in less than a month on the back of soaring gas production and August promising to see milder weather compared to July.

Mr FFF

EARNINGS SEASON IS HERE

Dr. Fly Tue Jul 30, 2024 4:32pm EST 2 CommentsBefore I get into $MSFT, the story of $CRWD is an interesting one in that it’s likely going to be a terrific buy soon. I know your plebeian emotions belies in justice and that Crowdstrike will be punished for their crimes; but none of that is going to hammer is corruptible Pax Americana, the death of an Empire edition.

They are as deep state as they come and they’ll be settling their suits soon and hire McKinsey to tighten up the ship and live happily ever after.

On the issue of $MSFT and it tanking in the after hours, the numbers aren’t bad at all.

Azure and other cloud services revenue growth of +29%, +30% constant currency vs +30-31% CC prior guidance

Intelligent Cloud segment revs of $28.5 bln vs $28.4-28.7 bln prior guidance.

More Personal Computing segment revs of $15.9 bln vs $15.2-15.6 bln prior guidance.

The other important number was out of $AMD and it hit and the stock is +4%. We have $ARM, $LRCX and $META coming tomorrow.

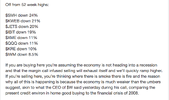

The initial reaction to Microsoft is tankage in $AMZN and $META but I suspect it’ll moderate. On the whole, the market is once again sickly and spread thin across defensive sectors and banks. We are in a rut and in order to extricate ourselves we’ll need some speed.

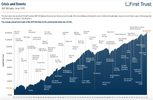

I finished the session down 19bps but made it all back in the after hours due to my gigantic 17% $SQQQ positions crossed against a leveraged portfolio at 151% equity. I cobbled together various defensive stocks and war time stocks just in case the Middle East heats up with the escalatory action in Lebanon.

Ran out of 'chart' space.

jog on

duc

*I'll be back later with some gold stuff!