You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AUD

- Thread starter money tree

- Start date

-

- Tags

- aud australian dollar

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

That late buying support must have been the RBA intervention. Seems they are getting the jitters that AUD will drop below 60c with unwinding of the Yen carry trades.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aKuCBtGS2vHA&refer=home

Anyone know exactly how much the RBA is chucking at the $AUBananaBuck? Is there a link to that up to date info?

http://www.bloomberg.com/apps/news?pid=20601087&sid=aKuCBtGS2vHA&refer=home

Anyone know exactly how much the RBA is chucking at the $AUBananaBuck? Is there a link to that up to date info?

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

Woah!

Big jump in AUD underway right now. Could be result of Bank of Korea slashing rate by 75 basis points?

Big jump in AUD underway right now. Could be result of Bank of Korea slashing rate by 75 basis points?

Kauri

E/W Learner

- Joined

- 3 September 2005

- Posts

- 3,428

- Reactions

- 11

Woah!

Big jump in AUD underway right now. Could be result of Bank of Korea slashing rate by 75 basis points?

G7 maybe will be issuing a joint statement.... possibly addressing the FX volatility, in particular the yen... intervention may be on the way, to help/try to help, stabilise the markets.... so shorts are unloading in case... I thunk

Cheers

.............Kauri

P.S.

news filteringout that the BOJ (or BOJ proxies) were supporting

USD/JPY below 92. USD/JPY jumped on the talk and took the Aussie in tow.

Also stories that the RBA had confirmed that they had bought

AUD on Friday night around 0.6130 with the official word that it was to "add

liquidity in an illiquid market"

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

Crikey. The RBA is dipping into the till again - buying up $BananBuck$ this afternoon to try and support the Lil' Aussie Bleeder.

None of the news items I have read indicates any $ cost figures. Has anyone got a link that shows exactly how much of ordinary Australian's hard-earned taxes has been splurged by the RBA during it's two buying sprees in the last few days?

aj

None of the news items I have read indicates any $ cost figures. Has anyone got a link that shows exactly how much of ordinary Australian's hard-earned taxes has been splurged by the RBA during it's two buying sprees in the last few days?

aj

michael_selway

Coal & Phosphate, thats it!

- Joined

- 20 October 2005

- Posts

- 2,397

- Reactions

- 2

Crikey. The RBA is dipping into the till again - buying up $BananBuck$ this afternoon to try and support the Lil' Aussie Bleeder.

None of the news items I have read indicates any $ cost figures. Has anyone got a link that shows exactly how much of ordinary Australian's hard-earned taxes has been splurged by the RBA during it's two buying sprees in the last few days?

aj

Hm could be interesting days ahead

thx

MS

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

Ooops. Looks like the RBA's weak hand has been called....

$AUBananaBuck$ being pummelled by Crazy Yen again. Back down she goes to 60.7c.

Will the RBA try to up the ante AGAIN, tonight?

How many more chips do the RBA have in this Poker Game To End All Poker Games?

Stay tuned.....

$AUBananaBuck$ being pummelled by Crazy Yen again. Back down she goes to 60.7c.

Will the RBA try to up the ante AGAIN, tonight?

How many more chips do the RBA have in this Poker Game To End All Poker Games?

Stay tuned.....

The RBA tried this last time our dollar tanked, all it did was give support for around 24 hrs max before the selling resumed in earnest. What a cop out by the RBA to try to justify their interference in the market by say they were introducing Liquidity into an Illiquid market. Here is a quote from the RBA own website.

"In terms of global turnover, the AUD/USD is the fourth most traded currency pair and the Australian dollar is the sixth most traded currency. The Australian foreign exchange market is the seventh largest in the world."

http://www.rba.gov.au/PublicationsAndResearch/Bulletin/bu_jan08/aus_fx_derivatives_mrkts.html

They must think we are all dumbed down sheeple, who are incapable of thinking for ourselves....bahhhhhhhhhh

"In terms of global turnover, the AUD/USD is the fourth most traded currency pair and the Australian dollar is the sixth most traded currency. The Australian foreign exchange market is the seventh largest in the world."

http://www.rba.gov.au/PublicationsAndResearch/Bulletin/bu_jan08/aus_fx_derivatives_mrkts.html

They must think we are all dumbed down sheeple, who are incapable of thinking for ourselves....bahhhhhhhhhh

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,892

Good grief! It's 0.607 USD (AU$1.645 reverse) to the AUD. Up until recently this move would indicate a banana republic.

However, exchange movements tend to go much farther than they should as speculators, of the George Soros ilk, move in to take profits.

Once commodities rebound, a small rebound maybe, there should be a sudden recovery.

I'm moving out of my US Dollar Bonds/Treasuries this week and leaving any further exchange rate gains for the next guy.

However, exchange movements tend to go much farther than they should as speculators, of the George Soros ilk, move in to take profits.

Once commodities rebound, a small rebound maybe, there should be a sudden recovery.

I'm moving out of my US Dollar Bonds/Treasuries this week and leaving any further exchange rate gains for the next guy.

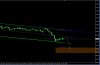

It still looks ready to plunge again with a descending triangle on the hourly with good targets below at 5850 & 5730, but, usually those triangles provide a low risk long opportunity on the smaller TF's (1 min ,5 min), which is a bit harder to do in currency futures atm due to larger spreads from a "thin" market.

At round 6135 we had a support become resistance, and we may see the same happen around the 6035 area...

At round 6135 we had a support become resistance, and we may see the same happen around the 6035 area...

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

Good grief! It's 0.607 USD (AU$1.645 reverse) to the AUD. Up until recently this move would indicate a banana republic.

However, exchange movements tend to go much farther than they should as speculators, of the George Soros ilk, move in to take profits.

Once commodities rebound, a small rebound maybe, there should be a sudden recovery.

I'm moving out of my US Dollar Bonds/Treasuries this week and leaving any further exchange rate gains for the next guy.

At .603 USD now.

The three month exchange charts are pretty grim viewing. Lucky for us the drop in the AUD vs Chinese Yuan (-35%) is "relatively" a lot less than against the USD (-37%) or JPY (-44%)!!

Attachments

- Joined

- 4 September 2008

- Posts

- 117

- Reactions

- 1

Had a discussion yesterday and it came up that if interest rates drop further that the dollar will hit about $0.45USD.

What are everyone’s thoughts on this?

I can’t see a reason for it happening, with Australian interest rates still higher than a lot of others, we are still a relatively good place to invest, and our economy is relatively stable. History also shows that just because interest rates are low doesn’t mean that the dollar has to drop. Is this the case now?

:bier:

blue

What are everyone’s thoughts on this?

I can’t see a reason for it happening, with Australian interest rates still higher than a lot of others, we are still a relatively good place to invest, and our economy is relatively stable. History also shows that just because interest rates are low doesn’t mean that the dollar has to drop. Is this the case now?

:bier:

blue

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

slipppping ....

Now .6011 USD

Will it break .60 today or will RBA play a Joker?

Now .6011 USD

Will it break .60 today or will RBA play a Joker?

arco

action-reaction

- Joined

- 13 February 2006

- Posts

- 304

- Reactions

- 34

.

Due to the daily separation of Tenken/Kijun (Blue/Red) its possible for a north move occur in the near future IMO. - Big range, but within 0-200 pips.

This north move can be traded once a reversal signal is received on the lower timeframes.

rgds - arco

Due to the daily separation of Tenken/Kijun (Blue/Red) its possible for a north move occur in the near future IMO. - Big range, but within 0-200 pips.

This north move can be traded once a reversal signal is received on the lower timeframes.

rgds - arco

Attachments

- Joined

- 6 October 2008

- Posts

- 126

- Reactions

- 0

Had a discussion yesterday and it came up that if interest rates drop further that the dollar will hit about $0.45USD.

What are everyone’s thoughts on this?

I can’t see a reason for it happening, with Australian interest rates still higher than a lot of others, we are still a relatively good place to invest, and our economy is relatively stable. History also shows that just because interest rates are low doesn’t mean that the dollar has to drop. Is this the case now?

:bier:

blue

Interest rate differential is a key driver.

There's lots of carry trade to unwind and I suspect this is the main driver for USD and Yen strength in the current climate.

AUD - USD will continue to suffer as carries unwind. Falling interest rates will drive the currency lower in this climate. Sub 50 is on the cards at some point in the next 6 months but at the rate things are moving it could be sooner rather than later.

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

RBA still playing roulette & poker with the AUD.

I still can't find ANY info on HOW MUCH they are spending to prop the li'l bugger up. Nada on their website - unless it is buried somewhere hard to find?

How can the Australian public have any clue (or confidence) about what is going on unless they tell us the actual monetary figures? Is it $AU2 Billion? $AU4 Billion? Who knows?

How much of the Public Monies kitty is left?

*sigh*

End rant.

aj

I still can't find ANY info on HOW MUCH they are spending to prop the li'l bugger up. Nada on their website - unless it is buried somewhere hard to find?

How can the Australian public have any clue (or confidence) about what is going on unless they tell us the actual monetary figures? Is it $AU2 Billion? $AU4 Billion? Who knows?

How much of the Public Monies kitty is left?

*sigh*

End rant.

aj

- Joined

- 6 October 2008

- Posts

- 126

- Reactions

- 0

Crazy aj. Official reports where saying they were only "providing liquidity because there were no buyers present in the market". WTF? Using taxpayer dollars. This type of action usually ends in traders testing and breaking a central banks' resolve.

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

Crazy aj. Official reports where saying they were only "providing liquidity because there were no buyers present in the market". WTF? Using taxpayer dollars. This type of action usually ends in traders testing and breaking a central banks' resolve.

As far as I am aware, the RBA is NOT a private company and should therefore be FULLY and OPENLY accountable to the public for its actions when it comes to jiggling the public purse. Why can't they make a media announcement after each day they buy up $AUD - ie: something along the lines of "Today the RBA took the decision to make a Forex purchase of $AUDxxx,xxx,xxx,xxx which leaves X amount of $AUD in Cash Reserves for future purchases".

As it stands, while wearing the Official Cloak Of Secrecy it must be great to be one of their Forex "refresh monkeys", plonked in front of his 'puter and hitting the "BUY" button everytime the lil' bleeder hits USD.603! How thrilling it must feel to feed $AUDmillion tokens into the slot each time without having ANY accountability problem.

*sigh*

end rant part deux

Crazy aj. Official reports where saying they were only "providing liquidity because there were no buyers present in the market". WTF? Using taxpayer dollars. This type of action usually ends in traders testing and breaking a central banks' resolve.

What Bull dust is the official statement, I already showed a link from the RBA own website showing that the AUD is the sixth most traded currency in the world. This is just one of those statements they throw out that sounds legit to the average punter on the street. Meanwhile they are engaging in market manipulation with a unlimited checkbook. Didn't work before, and not going to work now. Unless of course they are prepared to create more money out of thin air and drive inflation even higher thus stealing from everyone who has money saved!!

arco

action-reaction

- Joined

- 13 February 2006

- Posts

- 304

- Reactions

- 34

.

Due to the daily separation of Tenken/Kijun (Blue/Red) its possible for a north move occur in the near future IMO. - Big range, but within 0-200 pips.

This north move can be traded once a reversal signal is received on the lower time-frames.

rgds - arco

1 HR time frame Ichimoku signal was given at .6207 for circa 590 pips max so far

GTA - arco

Attachments

Similar threads

- Replies

- 41

- Views

- 3K