Not sure but I've run out of popcorn

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

America a Failed State and a Rogue State to the rest of the World

- Thread starter kahuna1

- Start date

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,690

- Reactions

- 10,288

Me too @HumidNot sure but I've run out of popcorn

Reminds me of a time I was going to end a relationship with a girl and took her to the movies to do so after the final scene. Her granny decided to come along and carked it halfway through and I had to break it to the girl at her gran's funeral and got criticised for it.

Ever since then I don't do any favours in a situation such as a thread like this.

gg

Before text messaging?Me too @Humid

Reminds me of a time I was going to end a relationship with a girl and took her to the movies to do so after the final scene. Her granny decided to come along and carked it halfway through and I had to break it to the girl at her gran's funeral and got criticised for it.

Ever since then I don't do any favours in a situation such as a thread like this.

gg

- Joined

- 18 June 2004

- Posts

- 1,045

- Reactions

- 638

You're hardly one to be calling anyone else bitter!

Seek help ... it is confronting the journey you are upon.

When you get down to zero the only way to go is up, and that tends to be a pretty invigorating experience if you have a fundamentally positive mindset.

Good to hear.

Take care

Back every 10,000 increase in USA numbers .... sadly ...

Will leave it to others to take what they will, or not ... from opinions and other things on this thread and site.

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

That fiat currencies are "paper."

Printed "money" is paper, but money can also be "created" on balance sheets, which can be paper or digital nowadays (did you ever see anyone carry their $750k in cash to the bank so they could buy their house?).

That's why @ducati916's use of M1 and M2 are a bit of a red herring.

Iran's printed money - physical paper - just had 2 zeroes removed from it, so within a nation the government can give and take as it pleases.

The bottom line is if you want a store of "value" it cannot be "paper."

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,690

- Reactions

- 10,288

Thanks @rederobThat fiat currencies are "paper."

Printed "money" is paper, but money can also be "created" on balance sheets, which can be paper or digital nowadays (did you ever see anyone carry their $750k in cash to the bank so they could buy their house?).

That's why @ducati916's use of M1 and M2 are a bit of a red herring.

Iran's printed money - physical paper - just had 2 zeroes removed from it, so within a nation the government can give and take as it pleases.

The bottom line is if you want a store of "value" it cannot be "paper."

gg

- Joined

- 26 March 2014

- Posts

- 20,043

- Reactions

- 12,609

- Joined

- 18 June 2004

- Posts

- 1,045

- Reactions

- 638

Most people recover from the virus, so isn't it obvious that there is an immune response ?

Herpes does not kill you so I am told ... its a virus ... one that keeps on giving, and giving and flaring up ... and the question with any new virus is if it does actually give you immunity, if so ... for how long. Shingles can be caught time and time again ... measles however seems to give life long immunity.

CV19 is new, this question already has some serious questions over even short term immunity let alone longer term. All to be answered.

- Joined

- 18 June 2004

- Posts

- 1,045

- Reactions

- 638

Well the Trump rhetoric has an answer ....

China party media outlet ...

China needs to expand the number of its nuclear warheads to 1,000 in a relatively short time. It needs to have at least 100 Dongfeng-41 strategic missiles. We are a peace-loving nation and have committed to never being the first to use nuclear weapons, but we need a larger nuclear arsenal to curb US strategic ambitions and impulses toward China. Maybe we have to deal with challenges with stronger determination in the near future, which requires the support of the Dongfeng and Julang missiles.

Don't be naïve. Don't assume that nuclear warheads are useless. In fact, they are being used every day as a deterrent to shape the attitudes of US elites toward China. Some Chinese experts say we don't need more nuclear weapons, I think they are as naïve as children.

https://www.globaltimes.cn/content/1187766.shtml

Bravo ... applause ... well done Mr Trump ... I cant wait for the war to distract us.

A mere limited exchange from ... well two regimes neither of which I like .... and well nuclear winter. Bravo again Mr Trump and your idiot team.

China party media outlet ...

China needs to expand the number of its nuclear warheads to 1,000 in a relatively short time. It needs to have at least 100 Dongfeng-41 strategic missiles. We are a peace-loving nation and have committed to never being the first to use nuclear weapons, but we need a larger nuclear arsenal to curb US strategic ambitions and impulses toward China. Maybe we have to deal with challenges with stronger determination in the near future, which requires the support of the Dongfeng and Julang missiles.

Don't be naïve. Don't assume that nuclear warheads are useless. In fact, they are being used every day as a deterrent to shape the attitudes of US elites toward China. Some Chinese experts say we don't need more nuclear weapons, I think they are as naïve as children.

https://www.globaltimes.cn/content/1187766.shtml

Bravo ... applause ... well done Mr Trump ... I cant wait for the war to distract us.

A mere limited exchange from ... well two regimes neither of which I like .... and well nuclear winter. Bravo again Mr Trump and your idiot team.

When you have the US threatening to create a nuclear winter - one would think Nuclear Arms defence is essential for guaranteeing a country's own autonomy.

https://www.ft.com/content/bf3599e4-57f3-11ea-abe5-8e03987b7b20

One can only suggest to the American leaders (assuming they are not all 100% corrupt and/or purposefully evil) to simply go on wikipedia and read about the rest of the world. Read about history and the lessons from history. Just read and learn.

https://www.ft.com/content/bf3599e4-57f3-11ea-abe5-8e03987b7b20

One can only suggest to the American leaders (assuming they are not all 100% corrupt and/or purposefully evil) to simply go on wikipedia and read about the rest of the world. Read about history and the lessons from history. Just read and learn.

the body does cure itself in most cases (fortunately) but tests are showing that quite a high percentage of those that have recovered do not have many antibodies in their system.

This increases the possibility of them catching it again, it also means that a vaccine (if we ever find one) may not work very well.

Some Virus' are quite difficult to whack because they change so often eg: the annual flu shot is not a real success because flu mutates so often.

A couple of years ago the success rate was 10%, no better than a placebo really. It seems to average about a 36-40% success rate for a virus that we a know a lot about.

Of course, the common cold is a virus and we still haven't whacked that one which is why I do my thing with Vit D, 15 years since I have had a cold/flu now.

- Joined

- 13 February 2006

- Posts

- 5,175

- Reactions

- 11,872

1. Fiat currencies have a net value of zero.

2. Sovereign nations cannot go broke because they can create "money" as they see fit.

3. @ducati should have used money in physical circulation to make his point, rather than M1 and M2 constructs, as they just muddy these waters.

4. MMT only begins to unravel when foreign transactions come into play and the "value" of printed money is brought to account.

5. In between the above, sovereign nations can do what they like and suffer the consequences.

For example, our government has just created, on paper, a massive accounting debt. Nobody lent Australia the "money" that will be paying out on JobKeeper, JobSeeker and a myriad of other programs.

6. Coalition governments like to hang their hat on being good "money managers" but finance experts know this is a spurious claim.

7. I don't always agree with @kahuna1's wording but he's one of the smartest posters at this site.

1. If by that you mean an intrinsic value of zero (which I think you do) I would agree. They (fiat currencies) only have value because of the coercive force used in giving them value (government/etc).

2. Slightly inaccurate: Sovereign nations that do not incur debts in other than their own currency. That has been the issue where Sovereign nations have borrowed in US dollars or whatever and cannot obtain/earn that foreign currency to pay outstanding debts.

3. Incorrect. Read the underlined/highlighted section:

The currency component of M1, sometimes called "money stock currency," is defined as currency in circulation outside the U.S. Treasury and Federal Reserve Banks. Data on total currency in circulation are obtained weekly from balance sheets of the Federal Reserve Banks and from the U.S. Treasury. Weekly currency in circulation data are published each week on the Federal Reserve Board's H.4.1 statistical release "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks." Vault cash is reported on the FR 2900 and subtracted from total currency in circulation. For institutions that do not file the FR 2900, vault cash is estimated using data reported on the Call Reports.

M1 details the actual 'cash in pocket' measure.

4. A discussion of MMT is beyond the scope on this thread.

5./6. See above.

7. Opinion.

jog on

duc

- Joined

- 18 June 2004

- Posts

- 1,045

- Reactions

- 638

A discussion of MMT is beyond the scope on this thread.

You just keep postulating your pet theory which is wrong.

Any and all sources politely pointing this out are ignored, even professors, PHD's and market experts.

You apparently are the worlds expert.

Please start a thread on MMT. Discuss your quaint, incorrect and absurd theories to your hearts content.

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

I addressed this at #4.2. Slightly inaccurate: Sovereign nations that do not incur debts in other than their own currency. That has been the issue where Sovereign nations have borrowed in US dollars or whatever and cannot obtain/earn that foreign currency to pay outstanding debts.

Sovereign nations may have an obligation to pay a foreign debt, but they can simply default and carry on as usual, with the debt as an overhang.

You can repeat your mistake as often as you wish, but here's the truth and it's also line-itemed in the table you posted.3. Incorrect. Read the underlined/highlighted section:

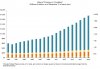

Bottom line is that paper in physical circulation disagrees with M1 by a massive margin. The remaining M1 components are not physical currency but, instead, "accounts."

Bottom line is that paper in physical circulation disagrees with M1 by a massive margin. The remaining M1 components are not physical currency but, instead, "accounts."Keeping the modern banking system afloat is a very complex matter. However, it is impossible to avoid the fact that paper money ultimately has no value. I won't argue further with you on this so will instead make a very simple point that most readers will understand. Some years back had you holidayed in the USA your physical Australian dollar could buy you USD$1.10 yet that very same dollar today (ie the unchanged physical component or "money") gets you about USD$0.64 cents. The only thing that changed in the intervening period was a set of complex accounting arrangements within a global financial system that debased the money in your hands. And if that does not convince you that our paper money has no value, see how you go with only Australian physical currency - aka paper money - on your holiday to Uzbekistan.

Last edited:

- Joined

- 13 February 2006

- Posts

- 5,175

- Reactions

- 11,872

1. I addressed this at #4.

2. Sovereign nations may have an obligation to pay a foreign debt, but they can simply default and carry on as usual, with the debt as an overhang.

3. You can repeat your mistake as often as you wish, but here's the truth and it's also line-itemed in the table you posted.

4. Bottom line is that paper in physical circulation disagrees with M1 by a massive margin. The remaining M1 components are not physical currency but, instead, "accounts."

5. Keeping the modern banking system afloat is a very complex matter. However, it is impossible to avoid the fact that paper money ultimately has no value. I won't argue further with you on this so will instead make a very simple point that most readers will understand. Some years back had you holidayed in the USA your physical Australian dollar could buy you USD$1.10 yet that very same dollar today (ie the unchanged physical component or "money") gets you about USD$0.64 cents. The only thing that changed in the intervening period was a set of complex accounting arrangements within a global financial system that debased the money in your hands. And if that does not convince you that our paper money has no value, see how you go with only Australian physical currency - aka paper money - on your holiday to Uzbekistan.

1. In part. Just inaccurately at your original [2]: because an insolvency or default is not really just a carry on as normal.

2. See above.

3. Two points:

(a) Your chart only goes to 2018. It is 2yrs out of date; and

(b) Read the text.

The currency component of M1, sometimes called "money stock currency," is defined as currency in circulation outside the U.S. Treasury and Federal Reserve Banks. Data on total currency in circulation are obtained weekly from balance sheets of the Federal Reserve Banks and from the U.S. Treasury. Weekly currency in circulation data are published each week on the Federal Reserve Board's H.4.1 statistical release "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks." Vault cash is reported on the FR 2900 and subtracted from total currency in circulation. For institutions that do not file the FR 2900, vault cash is estimated using data reported on the Call Reports.

(i) The 'currency component' in 'circulation' is cash in your pocket; and

(ii) See FRB H.4.1

In 1 week: April 15 to April 22 currency in you pocket increased by $5,971M or essentially $6 Billion dollars.

4. Re. 'accounts'. Accounts are 'money'. Accounts are an expansion of the money supply. Due to the slightly more abstract nature of the original argument, vis-a-vis 'printing', it seemed easier to just provide documentary evidence of 'cash in the pocket'.

5. You are confusing 'no value' with loss of purchasing power over time due to inflation of fiat currencies.

jog on

duc

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

Russia, Pakistan and Argentina are examples of nations carrying on as normal after defaulting on their debts. Many more have in recent decades.1. In part. Just inaccurately at your original [2]: because an insolvency or default is not really just a carry on as normal.

2. See above.

3. Two points:

(a) Your chart only goes to 2018. It is 2yrs out of date; and

(b) Read the text.

The currency component of M1, sometimes called "money stock currency," is defined as currency in circulation outside the U.S. Treasury and Federal Reserve Banks. Data on total currency in circulation are obtained weekly from balance sheets of the Federal Reserve Banks and from the U.S. Treasury. Weekly currency in circulation data are published each week on the Federal Reserve Board's H.4.1 statistical release "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks." Vault cash is reported on the FR 2900 and subtracted from total currency in circulation. For institutions that do not file the FR 2900, vault cash is estimated using data reported on the Call Reports.

(i) The 'currency component' in 'circulation' is cash in your pocket; and

(ii) See FRB H.4.1

View attachment 103315

In 1 week: April 15 to April 22 currency in you pocket increased by $5,971M or essentially $6 Billion dollars.

4. Re. 'accounts'. Accounts are 'money'. Accounts are an expansion of the money supply. Due to the slightly more abstract nature of the original argument, vis-a-vis 'printing', it seemed easier to just provide documentary evidence of 'cash in the pocket'.

5. You are confusing 'no value' with loss of purchasing power over time due to inflation of fiat currencies.

jog on

duc

Yes, their financial systems are impaired to the extent that there is an overhang, but the average person on the street is generally oblivious

Your repeated point about physical money in circulation is patently false. Yes the chart is 2 years old because it's the latest available from the Federal Reserve. Nevertheless, it is crystal clear from the charted information - yours and mine - that M1 is about twice as much as printed paper in circulation. My chart even describes the value of the circulated note, so it is not an "accounting" item, unlike a number of those referenced under M1.

Finally, I realise printed money has purchasing power, as that's its whole purpose. That purchasing power has 2 components: internal and external. Externally, it's reliant on a global financial system that can make it worthless overnight. If it had intrinsic value, that would not be possible.

In the gold thread I provided some charts that clearly showed several of your points were not soundly based, and time and time again you came back with responses that ignored what was presented. You are doing the same here and it's not a good look.

- Joined

- 18 June 2004

- Posts

- 1,045

- Reactions

- 638

A failed state is a political body that has disintegrated to a point where basic conditions and responsibilities of a sovereign government no longer function properly (see also fragile state and state collapse).

And

Rougue State a nation or state regarded as breaking international law and posing a threat to the security of other nations.

Sadly we now have the USA claiming openly CV19 is actually not as bad as it is with near 80,000 deaths, emergency workers wearing garbage bags as PPE .... workers not paid unemployment and now sent back to work. Some states such as Florida processed a mere 5% of claims the first month and a mere 25% by the latest set of numbers.

Questionable reporting of deaths by several states ... Georgia Florida and Texas as one might expect.

On and on it goes.

Fake cures ..... ones that dont work ... other political favorites give massive funding such as the one that has never made a drug or vaccine got 473 million.

USA actively stoking global tensions ... war almost .... de funding and actively acting to destroy global bodies which 200 member nations support and one, USA is trying to destroy, deliberately.

Bailout in the USA went so far 87% to the big business side and already a tax cut for property developers buried in the bills and the Federal goverment insisting on another ... before any aid to the peasants will be allowed.

Strange world and one the experts at Fox News and Sky News I am sure will sort out. USA unemployment numbers shocking and ... well. ... missing over half because they either did not qualify for help or ... if you noticed the participation rate slumped and removed another 5% of people via its massive fall.

I am sure ... this state of affairs will continue with, things not good one the ground and getting worse as time goes on despite the back to work and it being ignored in favor of narratives that suit political agendas.

And

Rougue State a nation or state regarded as breaking international law and posing a threat to the security of other nations.

Sadly we now have the USA claiming openly CV19 is actually not as bad as it is with near 80,000 deaths, emergency workers wearing garbage bags as PPE .... workers not paid unemployment and now sent back to work. Some states such as Florida processed a mere 5% of claims the first month and a mere 25% by the latest set of numbers.

Questionable reporting of deaths by several states ... Georgia Florida and Texas as one might expect.

On and on it goes.

Fake cures ..... ones that dont work ... other political favorites give massive funding such as the one that has never made a drug or vaccine got 473 million.

USA actively stoking global tensions ... war almost .... de funding and actively acting to destroy global bodies which 200 member nations support and one, USA is trying to destroy, deliberately.

Bailout in the USA went so far 87% to the big business side and already a tax cut for property developers buried in the bills and the Federal goverment insisting on another ... before any aid to the peasants will be allowed.

Strange world and one the experts at Fox News and Sky News I am sure will sort out. USA unemployment numbers shocking and ... well. ... missing over half because they either did not qualify for help or ... if you noticed the participation rate slumped and removed another 5% of people via its massive fall.

I am sure ... this state of affairs will continue with, things not good one the ground and getting worse as time goes on despite the back to work and it being ignored in favor of narratives that suit political agendas.

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

This might help regarding the "component" nature of M1:Your repeated point about physical money in circulation is patently false. Yes the chart is 2 years old because it's the latest available from the Federal Reserve. Nevertheless, it is crystal clear from the charted information - yours and mine - that M1 is about twice as much as printed paper in circulation. My chart even describes the value of the circulated note, so it is not an "accounting" item, unlike a number of those referenced under M1.

- Joined

- 13 February 2006

- Posts

- 5,175

- Reactions

- 11,872

1. Russia, Pakistan and Argentina are examples of nations carrying on as normal after defaulting on their debts. Many more have in recent decades.

Yes, their financial systems are impaired to the extent that there is an overhang, but the average person on the street is generally oblivious

2. Your repeated point about physical money in circulation is patently false. Yes the chart is 2 years old because it's the latest available from the Federal Reserve. Nevertheless, it is crystal clear from the charted information - yours and mine - that M1 is about twice as much as printed paper in circulation. My chart even describes the value of the circulated note, so it is not an "accounting" item, unlike a number of those referenced under M1.

3. Finally, I realise printed money has purchasing power, as that's its whole purpose. That purchasing power has 2 components: internal and external. Externally, it's reliant on a global financial system that can make it worthless overnight. If it had intrinsic value, that would not be possible.

4. In the gold thread I provided some charts that clearly showed several of your points were not soundly based, and time and time again you came back with responses that ignored what was presented. You are doing the same here and it's not a good look.

1. At the point leading up to default and a period (immediately) after default, life would have been far from normal. Simply look at Venezuela as a current example.

2. Which is why I qualified it with Table H.4.1.

3. Which was exactly my point.

4. Well go back to the Gold thread and try again.

In any case, you have missed entirely the issue that was being argued:

Mr Kahuna's position was that the US 'was not printing money'. Clearly the US are. The entire M1 question was to demonstrate that there is a 'cash in your pocket' expansion underway at a phenomenal rate, never mind the more esoteric credit expansion in the financial system.

The US is printing hand over fist. It's currency is far from exploding currently (unless you mean higher).

There seems to be confusion between:

(a) Monetary policy expansion; and

(b) Fiscal policy expansion.

jog on

duc

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

For most Venezualans there was no real difference before and after. Their national debt crisis was a long time coming.1. At the point leading up to default and a period (immediately) after default, life would have been far from normal.

On the contrary.In any case, you have missed entirely the issue that was being argued:

The USA cannot just print paper money from thin air and assume it retains the purchasing power to cover foreign debt. If that were true, every government would do it and none would have to worry about debt!

@kahuna1 did not write it as I would but his sense is retained.