You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AEV - Avenira Limited

- Thread starter yogi-in-oz

- Start date

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

Re: MAK - Minemakers

It varies from situation to situation.

Generally the company will take an average of the last X trading days and then offer at a discount to that.

Im not 100% sure but i think i heard somewhere that the maximum discount is 5%, although im thinking that is for Share Purchase Plans not capital raisings.

So in other words, im fairly certain it is set by the co at a discount to the recent average price.

I would suggest they wouldnt go back too far for this average though as it would bring the price down

EDIT - anyone out there feel free to correct me if im wrong

It varies from situation to situation.

Generally the company will take an average of the last X trading days and then offer at a discount to that.

Im not 100% sure but i think i heard somewhere that the maximum discount is 5%, although im thinking that is for Share Purchase Plans not capital raisings.

So in other words, im fairly certain it is set by the co at a discount to the recent average price.

I would suggest they wouldnt go back too far for this average though as it would bring the price down

EDIT - anyone out there feel free to correct me if im wrong

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

This looks to be a capital raising to institutions. Not sure if the public will have a go at this.

IMO this is a very smart move by management. They actually don't look to need the money in the short term. They only completed a capital raising late last year... This is perhaps to fast track Wonarah, but they could have done the raising in a few months after the JORC was revised.

What this is IMO is an opportunity to strike while the irons hot and get some significant cash while the market is interested in their now No 1 project. Rock Phos is flying, Agri is flying, The MC is flying, Instituations have probably started buying, debt is getting more expensive, investors are taking fewer and fewer risks....this was the time to ask for a few mil to take Wonarah through BFS perhaps?

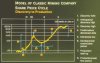

Short term, depending on the terms, this could spell a time for consolidation for MAK. When you look at the 'normal' chart cycle of a company taking a project to development, this is the lull. We may be working into No 4 right now, but too early to tell and speculative of course..

This looks to be a capital raising to institutions. Not sure if the public will have a go at this.

IMO this is a very smart move by management. They actually don't look to need the money in the short term. They only completed a capital raising late last year... This is perhaps to fast track Wonarah, but they could have done the raising in a few months after the JORC was revised.

What this is IMO is an opportunity to strike while the irons hot and get some significant cash while the market is interested in their now No 1 project. Rock Phos is flying, Agri is flying, The MC is flying, Instituations have probably started buying, debt is getting more expensive, investors are taking fewer and fewer risks....this was the time to ask for a few mil to take Wonarah through BFS perhaps?

Short term, depending on the terms, this could spell a time for consolidation for MAK. When you look at the 'normal' chart cycle of a company taking a project to development, this is the lull. We may be working into No 4 right now, but too early to tell and speculative of course..

Attachments

Re: MAK - Minemakers

Gosh I'm not sure if my last post was removed, or I didn't post it correctly.

What it said was

Word out on the street is that the raising is $1.50. Brokers and clients would already be privy to this information. I guess we'll know by Monday (at least it is not going to take 9 days like MON to raise money it seems). Agree with Kennas, great time to raise money with the run in share price - less dilution for you all!

Still don't hold but I'm hoping for a little weakness with cap raising. Time will tell.

Gosh I'm not sure if my last post was removed, or I didn't post it correctly.

What it said was

Word out on the street is that the raising is $1.50. Brokers and clients would already be privy to this information. I guess we'll know by Monday (at least it is not going to take 9 days like MON to raise money it seems). Agree with Kennas, great time to raise money with the run in share price - less dilution for you all!

Still don't hold but I'm hoping for a little weakness with cap raising. Time will tell.

Re: MAK - Minemakers

If MAK is attractive to institutional investors then it would be safer for our investment. Imagine if there will be good result on the phosphate drilling, the price won't just stop at $2. At least we have RIO drilled there with good result. With the RIO drill result before, the project would be feasible. Hopefully there will be more upside from the current drilling.

If MAK is attractive to institutional investors then it would be safer for our investment. Imagine if there will be good result on the phosphate drilling, the price won't just stop at $2. At least we have RIO drilled there with good result. With the RIO drill result before, the project would be feasible. Hopefully there will be more upside from the current drilling.

- Joined

- 21 July 2007

- Posts

- 125

- Reactions

- 0

Re: MAK - Minemakers

Hammered today....along with the whole materials index...hope she holds $1.50...and the new shares haven't even been issued yet

Hammered today....along with the whole materials index...hope she holds $1.50...and the new shares haven't even been issued yet

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

Yes, would be nice if $1.50 is a floor based on the placement, but I've seen plenty of companies trade under a placement level. Some dramatically. This has probably been due to general market conditions I think however. US market's having agreat night so maybe some recovery tomorrow.

As suspected this ia a placement to institutional holders at what looks like a pretty good price to me and will be primarily for Wonarah feasability.

I thought they might try to raise more so they'll definately need another raising to take it through BFS.

On another note IPL having a go at Dyno Noble won't be good for any short term takeover or buy in from IPL of MAK. I has hoping some of the recent action was someone like IPL wich would have created a great deal of more interest. Not to say it definately hasn't but it seems they are preoccupied with Dyno...

Yes, would be nice if $1.50 is a floor based on the placement, but I've seen plenty of companies trade under a placement level. Some dramatically. This has probably been due to general market conditions I think however. US market's having agreat night so maybe some recovery tomorrow.

As suspected this ia a placement to institutional holders at what looks like a pretty good price to me and will be primarily for Wonarah feasability.

Minemakers’ Managing Director, Andrew Drummond, said:

“The Board of Directors is pleased with the share placement for several

reasons, including:

• the presence of quality institutional shareholders at a significant level on

the Minemakers share register for the first time.

• the raising of adequate funds to secure Minemakers’ capacity to complete

several key tasks, especially that of taking the Wonarah Rock Phosphate

project through to the end of feasibility.”

I thought they might try to raise more so they'll definately need another raising to take it through BFS.

On another note IPL having a go at Dyno Noble won't be good for any short term takeover or buy in from IPL of MAK. I has hoping some of the recent action was someone like IPL wich would have created a great deal of more interest. Not to say it definately hasn't but it seems they are preoccupied with Dyno...

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

This has to be good for the long term outlook of MAK.

In the Australian today.

Dwindiling supplies by 2040, should support the prices you'd imagine, indicating that the economics of Wonarah, economical at $100 a ton, should underpin the company for many years.

This has to be good for the long term outlook of MAK.

In the Australian today.

Warning of world phosphate shortage

Matthew Warren, Environment writer | March 12, 2008

THE exponential growth in global food production has not only sent the price of fertilisers skyrocketing, but could lead to a world shortage of phosphate within decades.

Beyond a temporary market spike driven by richer developing countries and increased supply of biofuels, researchers are warning that the world could face dwindling supplies of phosphate by 2040 unless steps are taken to use it more efficiently and recover it from human waste.

But unlike oil, which can be managed by substituting other sources of energy, there is no substitute for the critical role of phosphate in plant development and production.

Mineral phosphorous fertilisers come from mined phosphate rock found in places such as Christmas Island, Nauru and Morocco, which is the world's biggest exporter of the resource.

"Quite simply, without phosphorus we cannot produce food," says Dana Cordell of the Institute of Sustainable Futures, based in Sydney.

Growth in demand for food in China and India, coupled with increased switching of food crops to biofuels in the US, have increased the demand for fertilisers, raising the world price fourfold in the past year.

Despite the development of phosphate mining at Mount Isa to replace declining supplies from Nauru and Christmas Island, Australia still imports about 75 per cent of its fertiliser.

Ms Cordell is researching the scale of the looming shortage and methods to improve the efficiency of phosphate use.

"There is no global organisation looking at global trends in phosphorus and how we're going to ensure we'll have phosphorus production into the future," she said.

"It's just left to the market, which is looking at a different timeline to what we need."

She is working with researchers in Sweden to use human urine as a source of phosphate by redesigning toilets. It would be siphoned off and stored in tanks for supply to farmers.

Dwindiling supplies by 2040, should support the prices you'd imagine, indicating that the economics of Wonarah, economical at $100 a ton, should underpin the company for many years.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

I can't see any reason for the fall accept profit takers worried about losing gains.

This is a long term story IMO. From what we've seen Wonarah will underpin this company for some time. The basic figures have all been crunched, we just need to wait for the feasability studies for confirmation, and while Rock Phos holds well above $200 and the outlook very solid, where's to fault with MC still undemanding for such potential profits.

Next news? Maybe metalurgical studies on Moina, or aeromagnetics on Franklin.

I can't see any reason for the fall accept profit takers worried about losing gains.

This is a long term story IMO. From what we've seen Wonarah will underpin this company for some time. The basic figures have all been crunched, we just need to wait for the feasability studies for confirmation, and while Rock Phos holds well above $200 and the outlook very solid, where's to fault with MC still undemanding for such potential profits.

Next news? Maybe metalurgical studies on Moina, or aeromagnetics on Franklin.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

Next news is Wonarah drilling approvals.....

Would be nice if the sp stabilises with this news and consolidates a bit.

Next news is Wonarah drilling approvals.....

I'm interested in the comments about traditional owners. Conscious of the problems RWD have run into, which will be one of the risks here. Hopefully the local owners will negotiate reasonably once the final negotiations for mining are undertaken.WONARAH DRILLING APPROVALS SECURED

DRILLING TO BEGIN ON SCHEDULE

14 March 2008

Minemakers Limited has now received all requisite approvals for its planned reverse circulation (“RC”) and diamond drilling programmes at the Wonarah Rock Phosphate project.

The Company thanks the Traditional Owners and their representatives, the Central Lands Council, and also the Northern Territory Department of Primary Industry, Fisheries and Mines for their prompt co-operation and enthusiasm.

The drilling will provide the cornerstone data for the economic and development studies. The RC drilling will mobilise in the first week of April and is aimed at allowing a new JORC compliant resource estimate and to test the potential of the Arrawurra Prospect to be a preferred deposit for fast track development. Diamond drilling will begin in mid April and it will:

• Provide material for the metallurgical testwork programmes.

• Provide geotechnical data for pit design, mining method and costs.

• Provide hydrological information.

• Allow testing of the lower phosphorite unit for which resources have not previously been estimated.

The Company is currently in the logistics phase for the programme and will shortly begin line clearing for drill access.

Would be nice if the sp stabilises with this news and consolidates a bit.

- Joined

- 3 December 2006

- Posts

- 170

- Reactions

- 0

Re: MAK - Minemakers

That is good news kennas, noticed that this morning ansd thanks for posting it.

The technical selloff this week was a shame, so as you said, I am hoping for a stabilising now, and possibly a return to the placement level would be nice.

A rocky week it's been, as I've stuck in there.

That is good news kennas, noticed that this morning ansd thanks for posting it.

The technical selloff this week was a shame, so as you said, I am hoping for a stabilising now, and possibly a return to the placement level would be nice.

A rocky week it's been, as I've stuck in there.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

Personally I'm well free carried so I feel less pain when the sp goes down, but it's still money!

I'm not sure what will drive me to top up from here. I suppose technically when it starts making higher highs and lows.

Hi Willo, the other aspect that I'm interested in is the priority drilling of the Arrawurra Prospect. The prospect is economical how it is with half the current RP price but if they come back with some great grades down there then it should be excellent news for the immediate prosperity of the overall project.That is good news kennas, noticed that this morning ansd thanks for posting it.

The technical selloff this week was a shame, so as you said, I am hoping for a stabilising now, and possibly a return to the placement level would be nice.

A rocky week it's been, as I've stuck in there.

Personally I'm well free carried so I feel less pain when the sp goes down, but it's still money!

I'm not sure what will drive me to top up from here. I suppose technically when it starts making higher highs and lows.

- Joined

- 27 January 2008

- Posts

- 40

- Reactions

- 0

Re: MAK - Minemakers

I've never known the Territory black fellas to let any mining get in the way of reaping some royalties...and before all you do gooders get on my back about the black fellas comment, it is not considered by them as a derogitory remark, I know because I live and work with them every day.

Next news is Wonarah drilling approvals.....

I'm interested in the comments about traditional owners. Conscious of the problems RWD have run into, which will be one of the risks here. Hopefully the local owners will negotiate reasonably once the final negotiations for mining are undertaken.

Would be nice if the sp stabilises with this news and consolidates a bit.

I've never known the Territory black fellas to let any mining get in the way of reaping some royalties...and before all you do gooders get on my back about the black fellas comment, it is not considered by them as a derogitory remark, I know because I live and work with them every day.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

Except for Jabiluka perhaps. I can't work out why Ranger was approved and not the second mine. Perhaps when they realise the royalties will stop?I've never known the Territory black fellas to let any mining get in the way of reaping some royalties...and before all you do gooders get on my back about the black fellas comment, it is not considered by them as a derogitory remark, I know because I live and work with them every day.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

I'm not sure why this is price sensitive as the price of RP can be found in other places.

However, awesome for MAK. Problem is that it will get to a point where it's uneconomical for farmers to use....and we will have a price correction. Or, we just wont be able to afford bread!

Wonarah economical at $100 a ton...

MAK up about 30%.

I'm not sure why this is price sensitive as the price of RP can be found in other places.

However, awesome for MAK. Problem is that it will get to a point where it's uneconomical for farmers to use....and we will have a price correction. Or, we just wont be able to afford bread!

ASX ANNOUNCEMENT

FURTHER STRONG INCREASES IN ROCK PHOSPHATE PRICES MINEMAKERS’ WORK PROGRAMMES ARE ON SCHEDULE

17 March 2008

The rock phosphate benchmark Moroccan export price has reportedly increased to US$350-400 per tonne FOB. This is a leap from the $200 per tonne December 2007 price and is a multiple of the $50 per tonne of earlier in 2007.

Wonarah economical at $100 a ton...

MAK up about 30%.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,297

- Reactions

- 11,568

Re: MAK - Minemakers

Some healthy consolidation going on now IMO, well needed. Went too hard too fast and attracted too many short term traders. Wonarah drill to commence at the start of April should maintain interest. Let's just hope there's a quick turn around in assays and they are along the lines of historic results, or better.

With Rock Phos at over $300tn, and Wonarah opex around $100tn, profit $200tn and likely to produce between 2-3 Mt a year = $400-500m profit. Current MC $150m.... Obviously, BIG assumption RP will stay high, and opex low.

Obviously, BIG assumption RP will stay high, and opex low.

I'm disappointed we haven't had news from the fe targets at Franklin after the aeromagnetics. Makes me assume they are poor. Also, the metalurgical test work from Moina is well overdue I think. I was expecting both these results in early March. I think they were due this quarter, so they've got a few days left I suppose.

Technically, I'm looking for a higher low now for some more confidence. Hopefully $1.25 was the bottom, but who knows in this crazy bear environment.

Some healthy consolidation going on now IMO, well needed. Went too hard too fast and attracted too many short term traders. Wonarah drill to commence at the start of April should maintain interest. Let's just hope there's a quick turn around in assays and they are along the lines of historic results, or better.

With Rock Phos at over $300tn, and Wonarah opex around $100tn, profit $200tn and likely to produce between 2-3 Mt a year = $400-500m profit. Current MC $150m....

I'm disappointed we haven't had news from the fe targets at Franklin after the aeromagnetics. Makes me assume they are poor. Also, the metalurgical test work from Moina is well overdue I think. I was expecting both these results in early March. I think they were due this quarter, so they've got a few days left I suppose.

Technically, I'm looking for a higher low now for some more confidence. Hopefully $1.25 was the bottom, but who knows in this crazy bear environment.

Re: MAK - Minemakers

The price rises of rock phosphate have to be worrying farmers. We received a quote by text a couple of weeks ago of $1200 tonne ex Newcastle. Now we thought that was rediculous. That was before the rise above $200/tonne will flow through.

Just my opinion, but I do not think IPL will be able to pass on the same margins as usual. Farmers just can not afford to pay even more than current prices! As I have said before, we would not buy at $1200, let alone higher, which will come.

Some correction is needed. Demand will drop that is for certain.

Still think MAK is a good investment, although I haven't jumped aboard just yet.

Heard Andrew Drummond on ABC Country Hour (radio) last Wednesday chatting about the windfall gain Wonorah would be for NT government as well as people. Jobs, education, services etc.... He was very positive.

The price rises of rock phosphate have to be worrying farmers. We received a quote by text a couple of weeks ago of $1200 tonne ex Newcastle. Now we thought that was rediculous. That was before the rise above $200/tonne will flow through.

Just my opinion, but I do not think IPL will be able to pass on the same margins as usual. Farmers just can not afford to pay even more than current prices! As I have said before, we would not buy at $1200, let alone higher, which will come.

Some correction is needed. Demand will drop that is for certain.

Still think MAK is a good investment, although I haven't jumped aboard just yet.

Heard Andrew Drummond on ABC Country Hour (radio) last Wednesday chatting about the windfall gain Wonorah would be for NT government as well as people. Jobs, education, services etc.... He was very positive.