- Joined

- 12 June 2009

- Posts

- 26

- Reactions

- 0

things are getting interesting

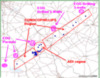

This little map shows various operators and where they are active.

Firstly, the conoco phillips acreages extend from mcmullen/liveoak county line to mid dewitt county and perhps a little further.. in there are operators like TCEI/Hilcorp (with ADI in partnership) and Murphy, Weber, and a few other smaller operators.. Pioneer also has acreages in the belt

Conoco just put in a permit last week for the Plomero ranch on the western fringe or the bookend with petrohawks acreages in mcmullen and lasalle

The far eastern well. Hooks did flow pretty good, they tested it a few months back.. its all sugarkane to there (chalks and eagleford) and our jvp and pioneer have talked about the chalks and eagleford being active in karnes/ live oak and dewitt..

south of the conoco acreages is the pioneer acreages, they are drilling a eagelford well right now in live oak just a mile or so south of the conoco plomero ranch well.

EOG is a newcomer, in the last 3 months they have been drilling like all stink.. they have yet to really let their shareholders know of what the heck they are doing in the counties, as they are still very active in leasing right now as we speak.. i hear as many as 40 landmen are involved for them atm

in karnes they drilled 5 eagleford wells and have opened up one at least.. in gonzales they have the same 3 rigs going full tilt on 3 eagleford wells there right now today.. they have permits in place for 3 wells just north of the ADI kowalik well in karnes county and in atascosa north of the conoco phillips plomero another cluster, and also a cluster in mc mullen further east

sheepishly in lasalle, el paso is quietly at work on an eagleford well. been keeping a close watch on it as it about to be fraced.. the well is locked down with security and no one is prepared to talk about it atm..

petrohawk as we all know in the east have been making huge noises about their discovery and their progress is very much advanced..

what i am hearing is that many operators are all designing varied frac designs, and some are utilising very advanced frac methods (ala conoco and the cobra frac)

in the adi acreages a rig sits over kowalik atm, and the weston well is being prepared for a frac, kennedy is also being prepared

Ihere is a the massive well in kenedy township is also completed, and rumor is that the well was an eagleford well.. i hear another near by it is also on the go and possibly eagleford also..

the conocophillips bordovsky well just east of ADI's acreages is also ready for production, and has been flaring massive flares a few night back on dual flare towers. the flares were seen from runge, kenedy and karnes city

each day i see more and more evidence that the rock adi sit on is producing north south east and west in the eagleford and chalks..

looking forward to the very near future (only days away imho) when adi announce what well is fraccing first and where things are at..

all imho and dyor

EOG is really getting after it in the trend. One more new area of activity for them is north of Hawkville Field in LaSalle County. EOG has permitted the #1 and #2H Hoff Ranch wells (42-283-32224 & 42-283-32225)