- Joined

- 1 June 2008

- Posts

- 159

- Reactions

- 0

http://www.foxbusiness.com/story/ma...hillips-scales-drilling-discloses-texas-buys/

"We're going to be a player in unconventional resources in a big way in the future," said Gallogly, speaking at ConocoPhillips' analyst meeting in New York.

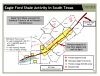

ConocoPhillips has acquired a leading position in south Texas' Eagle Ford shale, buying up 300,000 net acres ahead of the rest of the industry at low cost, Gallogly said. The company also has a position in Louisiana's Haynesville Shale.

What a smart bunch they are over there at ConocoPhillips. That's surely how every company wants to play it, grab a huge acreage "at low cost". Somehow I think they might be finished getting their acreage, and have announced it now so that there's upward price pressure for anyone else trying to follow suit.

Nice to see that the Eagleford is a play that they're actively persuing in 2009, which is only one of 4 they're going after this year in the "unconventional play" sector - and all they're going after is Shale according to that graphic. So they must really think they can score a big hit from their Shale plays.

Would be nice for ADI to be teamed up a bit more directly with ConocoP, but I doubt we'd be considered on that big money stage.

Great bit of commentary yesterday Agent, loved the insight given when you pull it all together.