- Joined

- 20 July 2021

- Posts

- 11,893

- Reactions

- 16,560

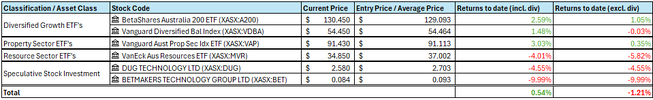

if only i could gloat on how many times , i got the perfect entry ( a depressingly small number , considering)I am conscious I could of timed my entry into DUG better.

however time ( and fuzzy hindsight ) often dulls over those embarrassments

i resorted to calculating a 'good enough ' price strategy .. if the selection slices through and goes another 20% lower ( and it has happened a few times ) i clamp my jaw and consider a second buy ( even the same day ) , lower

all part of the learning curve ( as is holding the resolve too long and missing out on the stock completely )