Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

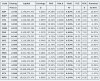

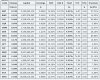

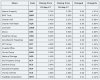

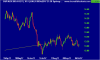

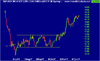

My mistake on the ticker, Westfield of course is WFD. Price action on SCG and VCX, both doing well.I think that the Westfield Group take over initiated two things in the A-REIT Sector.

The first was the recognition by indexes that the Retail shares in the sector are oversold and represent excellent value for potential acquisitions, mergers and takeovers. This review, on the back of the over hype of Amazon commencing in Australia, has encouraged a spurt of buying (most evident in Scentre Group and Vicinity).

The second thing is a flow on effect from the first, in that shorters would have had to scramble to close out their shorts to lock in their profits driving even more buying.

I suspect that there could be some profit taking by those punters that bought into the sector on the lows but once they have been cleared out, the potential for quick returns by way of dividends could prop up the share prices up to close to month end when they go ex-div. I'm not holding any WFD but am holding a boat load of SCG and VCX.

My mistake on the ticker, Westfield of course is WFD. Price action on SCG and VCX, both doing well.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.