nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

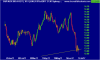

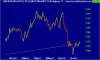

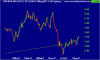

A-REIT Sector: Weekending Friday 16 June 2017

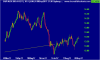

Another 4 day week for the All-Ords. The rest of the world is still going nuts politically but key issues appear to be: Donald Trump is being investigated as to whether the sacking of the head of the FBI was an attempt to interfere with the law; The British PM is still trying to put together a coalition to form government; Malcolm made fun of Donald at the winter ball but Donald can't remember who Malcolm is, and: The A-REIT Sector clawed back 4.29% for the week. This must be the run-up toward dividends. Good luck.

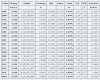

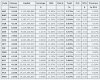

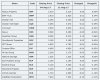

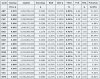

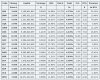

The A-REIT Table for closing prices for Weekending Friday 16 June 2017 follows:

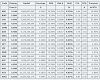

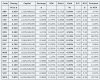

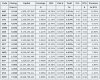

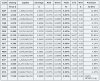

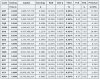

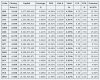

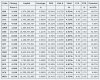

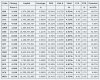

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 17 March 2017, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 17 March 2017. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck .

.

Another 4 day week for the All-Ords. The rest of the world is still going nuts politically but key issues appear to be: Donald Trump is being investigated as to whether the sacking of the head of the FBI was an attempt to interfere with the law; The British PM is still trying to put together a coalition to form government; Malcolm made fun of Donald at the winter ball but Donald can't remember who Malcolm is, and: The A-REIT Sector clawed back 4.29% for the week. This must be the run-up toward dividends. Good luck.

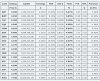

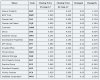

The A-REIT Table for closing prices for Weekending Friday 16 June 2017 follows:

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 17 March 2017, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 17 March 2017. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck