nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

A-REIT Sector: Weekending Friday 03 March 2017

The chart for the A-REIT Sector pretty much says it all. No body is interested in pushing the share prices up but there is plenty of interest in soaking up the shares being dumped. Hence forth I will refer to the current euphoria in the broader market as the "Trump Effect". It appears one of the perceived side effects of the Trump Effect is that a possible policy change to US taxation laws, where interest will no longer be a deductable expense, will impact on the big funds that are over leveraged. These funds may have to unload or sell down their portfolios to reduce their borrowing costs, which likely include REIT's. This may explain, in some part, why the A-REIT Sector with low price/earnings ratio's is lagging the rest of the market.

Volatility continues, some up, some down and spreads are generally still very tight. Good Luck .

.

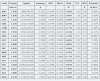

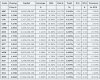

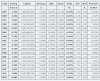

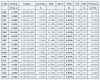

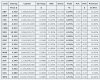

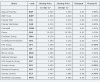

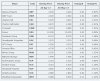

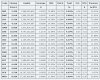

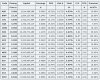

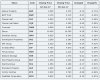

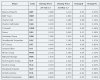

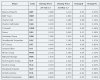

The A-REIT Table for closing prices for Weekending 03 March 2017 follows:

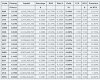

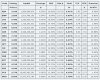

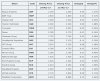

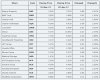

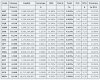

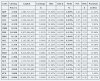

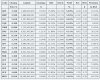

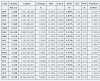

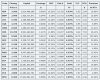

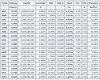

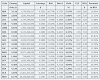

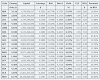

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 20 January 2017, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 20 January 2017. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. The share codes listed in both Tables no longer hyper-link to the last page of the corresponding ASF thread for that share.

5. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck .

.

The chart for the A-REIT Sector pretty much says it all. No body is interested in pushing the share prices up but there is plenty of interest in soaking up the shares being dumped. Hence forth I will refer to the current euphoria in the broader market as the "Trump Effect". It appears one of the perceived side effects of the Trump Effect is that a possible policy change to US taxation laws, where interest will no longer be a deductable expense, will impact on the big funds that are over leveraged. These funds may have to unload or sell down their portfolios to reduce their borrowing costs, which likely include REIT's. This may explain, in some part, why the A-REIT Sector with low price/earnings ratio's is lagging the rest of the market.

Volatility continues, some up, some down and spreads are generally still very tight. Good Luck

The A-REIT Table for closing prices for Weekending 03 March 2017 follows:

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 20 January 2017, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 20 January 2017. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. The share codes listed in both Tables no longer hyper-link to the last page of the corresponding ASF thread for that share.

5. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck