- Joined

- 29 January 2006

- Posts

- 7,231

- Reactions

- 4,491

MS and YT

You are not looking at the picture from the best angle.

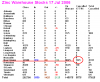

It is true that the rate of decline of total LME inventory is decreasing, but it is still decreasing.

The causes are several fold. Most important is the re-warranting of "cleaned" stock back into New Orleans. That is, damaged stock from Katrina is being made good for sale, so we have had a lot of metal coming and going from New Orleans and muddying the gross data. My estimate is that we are very close to the end of this re-warranting cycle and the LME zinc data hereonin is likely to be much more reliable.

Note that New Orleans accounts for over 70% of LME's warehouse zinc stock and over 80% of cancelled warrants (ie the zinc ready to leave the warehouse).

Buying of base metals this time of year is always cyclically weak - don't lose sight of this very, very important fundamental driver of price.

The good news is that inventory drawdowns are relatively well balanced across the globe at present, so while New Orleans is the key to market direction, we need to open our eyes to wider market action as it occurs.

Lowest low of inventory in past 5 years: 16 May 2005 - LME nickel ends the day at $7.33lb. LME nickel inventories slipped to stand at 4,926 tons.

You are not looking at the picture from the best angle.

It is true that the rate of decline of total LME inventory is decreasing, but it is still decreasing.

The causes are several fold. Most important is the re-warranting of "cleaned" stock back into New Orleans. That is, damaged stock from Katrina is being made good for sale, so we have had a lot of metal coming and going from New Orleans and muddying the gross data. My estimate is that we are very close to the end of this re-warranting cycle and the LME zinc data hereonin is likely to be much more reliable.

Note that New Orleans accounts for over 70% of LME's warehouse zinc stock and over 80% of cancelled warrants (ie the zinc ready to leave the warehouse).

Buying of base metals this time of year is always cyclically weak - don't lose sight of this very, very important fundamental driver of price.

The good news is that inventory drawdowns are relatively well balanced across the globe at present, so while New Orleans is the key to market direction, we need to open our eyes to wider market action as it occurs.

Lowest low of inventory in past 5 years: 16 May 2005 - LME nickel ends the day at $7.33lb. LME nickel inventories slipped to stand at 4,926 tons.