Re: XAO Analysis

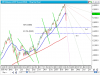

Not a bad method for locating potential areas of support/resistance, but remember in fast moves (especially fear driven panic moves) that these areas may not offer the same kind of effect compared to an orderly bull market trend.

Try using a retracement tool from pivot points (say a key low to a key high), and examine how bearish moves tend to behave in the horizontal divisions. If you study enough patterns, you can work out the probabilities for price levels of support and resistance.

In this case, this is a fast corrective move which trades very differently from other patterns. Try going back to your studies on key market tops and look at the fast corrective moves with the retracement tool for a while and see if you can see a correlation between the patterns and the divisions of the range. (Also, try doing this in weekly and monthly charts too for comparison).

You might find this enlightening to revisit this in conjunction with what you’re doing. Hope this is helpful.

Kind Regards

Magdoran

Hello Kenas,kennas said:Hi Mags, just previous highs and lows. Areas of conjestion. Previous highs should be support.

I'm starting to think however, that in radical moves like this, that these support and resistance lines become less valid.

They've certainly worked for me in the past. Buy support, sell at resistance...Pretty basic stuff, but has worked in a 'stable' market. Not sure how it works in this environment. Although, perhaps this is stable: A constant flow down hill....

Not a bad method for locating potential areas of support/resistance, but remember in fast moves (especially fear driven panic moves) that these areas may not offer the same kind of effect compared to an orderly bull market trend.

Try using a retracement tool from pivot points (say a key low to a key high), and examine how bearish moves tend to behave in the horizontal divisions. If you study enough patterns, you can work out the probabilities for price levels of support and resistance.

In this case, this is a fast corrective move which trades very differently from other patterns. Try going back to your studies on key market tops and look at the fast corrective moves with the retracement tool for a while and see if you can see a correlation between the patterns and the divisions of the range. (Also, try doing this in weekly and monthly charts too for comparison).

You might find this enlightening to revisit this in conjunction with what you’re doing. Hope this is helpful.

Kind Regards

Magdoran