- Joined

- 6 January 2009

- Posts

- 2,300

- Reactions

- 1,130

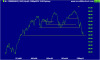

Re: XAO Analysis

Why so?

Cheers

Best thing for this rally would be for the US to start the week down. IMO.

Why so?

Cheers