- Joined

- 11 September 2008

- Posts

- 844

- Reactions

- 0

Re: XAO Analysis

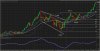

Surfziggy you may be right there. I guess one question is whether the US$ has been oversold and it due for a correction. I also note that gold is really starting to look streched (please note I'm a trend follower and don't like to pick tops here, but it is looking streched nonetheless). I wonder what reaction the US$ would have if the gold price starts to lower.

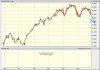

On another note, yet another fade out in the Australian markets after what was another bullish day in the US. The US finished well of their lows on a negative news day. Sooner or later either the US market has to drop or Aus has to play catch up.

Surfziggy you may be right there. I guess one question is whether the US$ has been oversold and it due for a correction. I also note that gold is really starting to look streched (please note I'm a trend follower and don't like to pick tops here, but it is looking streched nonetheless). I wonder what reaction the US$ would have if the gold price starts to lower.

On another note, yet another fade out in the Australian markets after what was another bullish day in the US. The US finished well of their lows on a negative news day. Sooner or later either the US market has to drop or Aus has to play catch up.