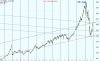

Re: XAO Analysis

What he means is, would you explain the analysis behind your opinion that we are going to move to 5000 'freely'.

Don't suppose you'd be prepared to detail that for us would you?

What he means is, would you explain the analysis behind your opinion that we are going to move to 5000 'freely'.