explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Re: XAO Analysis

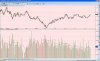

Todays action looking like a reverse hammer. 4050 looks a bit like a resistance area too, March/paril 05 and start of this year.

just

Broadway I remember looking at that to see what Divergence he was talking about. As Divergence after a rally (I guess he was talking about daily) would be bearish.

I couldn't make any sense of it because 1 I couldn't see divergence and 2 it would be bearish

Anyway we did get a false break. Which is keep with the H & S calls on this forum, think they are running at about a 20% hit rate!! good work there

For the bears I reckon you haven't got an edge this week shorting but maybe the coin I flipped was stuffed.

Todays action looking like a reverse hammer. 4050 looks a bit like a resistance area too, March/paril 05 and start of this year.

just