tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,464

- Reactions

- 6,570

Just a minor hesitation on W4, up to 4300 and then down to 3400 is my

and................., a longer period to make some much better gains...........going short -Agreed, I guess I just had some newbie panic

Here's my updated EW analysis. I see the XAO climbing to about 4100 before dropping to ~3500. After waves a, b and c, I think the XAO might be at ~3800. This is assuming that wave 4 is approximately equal to wave 2 and wave 5 is approximately equal to wave 1.

If this is the case, then it looks like there's a small period to make some good gains

Isn't shorting banned? Also, I don't have any shares to short haha, this will be my first entry into the markets.

ha ha, you don't need shares to short, you borrow them.

But yes, it is banned.

Huh? Can you explain?

Are we still talking about shares or have we moved onto options/futures?

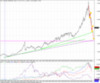

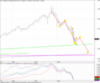

In August 2007 and January of this year I posted some charts on the long term action of the xao since 1980.

I'd like to update them and seek comment.

Both charts are line charts and the second is a semilog chart.

In the first chart it is reasonable to expect the xao to come down to either the old trendline from 1982 which would place the xao at 3000 or the newer trendline from 1992 which would place it at 3500

The second is a semilog and shows some interesting support and resistance lines, a 3500 seems more like a bottom , although 2350 is a distinct possibility.

The first chart by the way shows an obvious wave 3 in ew analysis, so a recovery and further falls to trendlines or support and resistance would not be out of the question.

We are in interesting charting times.

gg

hi guys,

Plenty of discussion on EW lately... would be mistaken to think this thread is more of an EW thread than an XAO one...

What happened to the more traditional TA's like S/R, Trends, Divergence, etc...? are they no good during volatile market conditions like this?

hi guys,

Plenty of discussion on EW lately... would be mistaken to think this thread is more of an EW thread than an XAO one...

What happened to the more traditional TA's like S/R, Trends, Divergence, etc...? are they no good during volatile market conditions like this?

Wow, what a cue for me to make an entry again.

DOW Morning Star still in tact supporting notion the bottom is in for the US. The other two I mentioned probably weren't strictly morning stars.

The XAO hourly chart is looking like it will make 4000 at least.

The USDX recovery started off with a morning star as did the Spot Gold run end with an Evening Star.

The USD/JPY has a good Morning Star bottom which supports the notion that the USDX is on the way down again.

The AUD/USD has a good Morning Star supporting that notion.

The bottom line... commodities probably bottomed too with big funds just about done with their liquidating assets to meet cash commitments, so all the signs suggesting some cash may come back into our market and keep the XAO going.

Lots of trades are indicating a wave 4 up move occuring now.

If interested I am running some commentary over on Reef on a few current trades.Using Elliot and VSA. Warts and all.

And now for some good old fashioned support and resist lvls....

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.