You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Technical Analysis

- Thread starter Sean K

- Start date

Re: XAO Analysis

Wayne,

You just don't understand the fundamentals mate, it's all about oil. I mean sure the market is hitting new lows even though oil is off -30% from its highs. You see its just got to go bit lower and everything will be allright, promise. Afterall, those nasty investment banks use up so much oil for their CLO's CDO's and what not.

You can't plot a MACD divergence unless a pivot point low is in. Clearly we don't have that yet.

...and think about why oil is off. I don't think POO is much of a factor at this point (my opinion).

Wayne,

You just don't understand the fundamentals mate, it's all about oil. I mean sure the market is hitting new lows even though oil is off -30% from its highs. You see its just got to go bit lower and everything will be allright, promise. Afterall, those nasty investment banks use up so much oil for their CLO's CDO's and what not.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,972

- Reactions

- 13,286

Re: XAO Analysis

Wayne,

You just don't understand the fundamentals mate, it's all about oil. I mean sure the market is hitting new lows even though oil is off -30% from its highs. You see its just got to go bit lower and everything will be allright, promise. Afterall, those nasty investment banks use up so much oil for their CLO's CDO's and what not.

- Joined

- 1 May 2007

- Posts

- 2,904

- Reactions

- 52

Re: XAO Analysis

What im worried about is that some ppl will take that post at face value...

Wayne,

You just don't understand the fundamentals mate, it's all about oil. I mean sure the market is hitting new lows even though oil is off -30% from its highs. You see its just got to go bit lower and everything will be allright, promise. Afterall, those nasty investment banks use up so much oil for their CLO's CDO's and what not.

What im worried about is that some ppl will take that post at face value...

Re: XAO Analysis

Was that your rabbit. Oh..Oh...we lost our jobs ...the bank took our house..then the bank went bankrupt...we were hungry..looks like we ate your rabbit...you can have the skin back if that helps.

LOST

One white fluffy bunny rabbit. Goes by the name BUNNY. Very cute and cuddly... Anyone finding Bunny, please call the US FEDs so they can pull it out of a hat...

Was that your rabbit. Oh..Oh...we lost our jobs ...the bank took our house..then the bank went bankrupt...we were hungry..looks like we ate your rabbit...you can have the skin back if that helps.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,478

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,972

- Reactions

- 13,286

- Joined

- 1 May 2007

- Posts

- 2,904

- Reactions

- 52

Re: XAO Analysis

Hey tech/a u see it cracking SPI low tonight? It's held pretty good so far.

Hey tech/a u see it cracking SPI low tonight? It's held pretty good so far.

Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

Re: XAO Analysis

Me too, but I don't think the average invester/trader is quite that silly.

You would have to be a galoot!

...and in the meantime oil has plunged into the low 90's.

What im worried about is that some ppl will take that post at face value...

Me too, but I don't think the average invester/trader is quite that silly.

Beware that it may be just a pothole... (the latest chapter of bank/financials re-organisation) in a market that naturally is looking to see what's around the corner, economy wise.

Agree POO has nothing to do with this pothole, but POO has a lot to do with the short to medium term state of the economy.

Wayne,

Afterall, those nasty investment banks use up so much oil for their CLO's CDO's and what not.

You would have to be a galoot!

...and in the meantime oil has plunged into the low 90's.

Re: XAO Analysis

You would be wouldn't you? Yet that has been your exact argument. However, Whiskers the great revisionist is on the job. If the world doesn't fit your predictions just revise them to fit the outcome. What has he got left? completely wrong on technicals, completely wrong on fundamentals. What was that mantra again?

This needs a bit of revising

Ahh that's better.

Me too, but I don't think the average invester/trader is quite that silly.

You would have to be a galoot!

You would be wouldn't you? Yet that has been your exact argument. However, Whiskers the great revisionist is on the job. If the world doesn't fit your predictions just revise them to fit the outcome. What has he got left? completely wrong on technicals, completely wrong on fundamentals. What was that mantra again?

my main aim is to provoke more discussion re positive events and investment opportunities for the average investor,

This needs a bit of revising

to lose money,my main aim is to provoke more discussion re positive events and investment opportunities for the average investor....

Ahh that's better.

Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

Re: XAO Analysis

Gaud, here we go again... you galoot, dhukka... I posted a nice winning trade the other day.

Since I and at least most other investors/traders choose our time to buy and sell by the short, medium or longer term cycles of the market and our investment/trading strategy, this may well prove to be the best buying swing for some time.

But dhukka haven't you got something better to do with your time than to get around spuriously carrying on a vendetta against anyone who has a different opinion to you.

You do realise that you intimidate some from posting for fear of savage and unscrouplously vendictive harrasment around the forum, don't you. Is that your altera motive!

How about you put up some good fundamental or technical analysis why the current financial reorganisation in the US will have such a significant long lasting impact for Australia and is not another over reaction?

You know put something substantial up to support your 'super'-bear propaganda.

Just as one indicator, I don't see any 'end of the financial world' type buying in gold yet.

Gaud, here we go again... you galoot, dhukka... I posted a nice winning trade the other day.

Since I and at least most other investors/traders choose our time to buy and sell by the short, medium or longer term cycles of the market and our investment/trading strategy, this may well prove to be the best buying swing for some time.

But dhukka haven't you got something better to do with your time than to get around spuriously carrying on a vendetta against anyone who has a different opinion to you.

You do realise that you intimidate some from posting for fear of savage and unscrouplously vendictive harrasment around the forum, don't you. Is that your altera motive!

How about you put up some good fundamental or technical analysis why the current financial reorganisation in the US will have such a significant long lasting impact for Australia and is not another over reaction?

You know put something substantial up to support your 'super'-bear propaganda.

Just as one indicator, I don't see any 'end of the financial world' type buying in gold yet.

Re: XAO Analysis

Once again the straw man arguments arise. End of the world, super-bear eh? The worst day we had in the stockmarket in the last decade was January 22nd of this year and whilst chicken littles were running around screaming the sky is falling, I bought stock and then traded it out a week later for a 20% profit. As repeated ad nauseum, the further this market goes down, the more opportunities arise.

As for putting up supporting arguments. They are all over this forum and unlike yourself I can don't need to revise them.

Gaud, here we go again... you galoot, dhukka... I posted a nice winning trade the other day.

Since I and at least most other investors/traders choose our time to buy and sell by the short, medium or longer term cycles of the market and our investment/trading strategy, this may well prove to be the best buying swing for some time.

But dhukka haven't you got something better to do with your time than to get around spuriously carrying on a vendetta against anyone who has a different opinion to you.

You do realise that you intimidate some from posting for fear of savage and unscrouplously vendictive harrasment around the forum, don't you. Is that your altera motive!

How about you put up some good fundamental or technical analysis why the current financial reorganisation in the US will have such a significant long lasting impact for Australia and is not another over reaction?

You know put something substantial up to support your 'super'-bear propaganda.

Just as one indicator, I don't see any 'end of the financial world' type buying in gold yet.

Once again the straw man arguments arise. End of the world, super-bear eh? The worst day we had in the stockmarket in the last decade was January 22nd of this year and whilst chicken littles were running around screaming the sky is falling, I bought stock and then traded it out a week later for a 20% profit. As repeated ad nauseum, the further this market goes down, the more opportunities arise.

As for putting up supporting arguments. They are all over this forum and unlike yourself I can don't need to revise them.

Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

Re: XAO Analysis

But, you said a few days ago that you don't trade!

Oh, thats it... you want to drive the market down to get some bargains.

Well, shouldn't you be held by the same rules as everyone else and referance the particular ones you rely on in a particular arguement!

Surely it's not too hard to summarize in a sentence or two... cos you know us active investors/traders haven't got the time to stalk around all of the threads... c'mon, there are some newbe's around that surely would gain from a quick precise of your compound wisdom.

Once again the straw man arguments arise. End of the world, super-bear eh? The worst day we had in the stockmarket in the last decade was January 22nd of this year and whilst chicken littles were running around screaming the sky is falling, I bought stock and then traded it out a week later for a 20% profit.

But, you said a few days ago that you don't trade!

As repeated ad nauseum, the further this market goes down, the more opportunities arise.

Oh, thats it... you want to drive the market down to get some bargains.

As for putting up supporting arguments. They are all over this forum and unlike yourself I can don't need to revise them.

Well, shouldn't you be held by the same rules as everyone else and referance the particular ones you rely on in a particular arguement!

Surely it's not too hard to summarize in a sentence or two... cos you know us active investors/traders haven't got the time to stalk around all of the threads... c'mon, there are some newbe's around that surely would gain from a quick precise of your compound wisdom.

Re: XAO Analysis

It wouldn't do you any good whiskers, the rose coloured glasses have been welded firmly to your noggin.

I don't. It was a rare opportunity. If you played a game of cricket in the back yard once, would you call yourself a cricketer? I'm not a trader, and I don't trade.But, you said a few days ago that you don't trade!

What a ridiculous statement. How could anyone hope to drive the market down posting on ASF? Unlike yours, my analysis doesn't rely on hope.Oh, thats it... you want to drive the market down to get some bargains.

Yes I should,Well, shouldn't you be held by the same rules as everyone else and reference the particular ones you rely on in a particular arguement!

Surely it's not too hard to summarize in a sentence or two... cos you know us active investors/traders haven't got the time to stalk around all of the threads... c'mon, there are some newbe's around that surely would gain from a quick precise of your compound wisdom.

It wouldn't do you any good whiskers, the rose coloured glasses have been welded firmly to your noggin.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,478

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,478

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,478

Re: XAO Analysis

I dont think there is any doubt "How" it will react.

Its how it finishes the day which will tell something more about the immediate future.

It is possible that many are starting to realise that this isnt going to go away.

Bank collapses will effect massively wide sections of business.

Personally I think you'll see the following unfold.

(1) Early morning panic sell off. say -180

(2) Systematic "Bargain" hunting say to around -80-100

(3) Late trading fear and sell off - say around -180 ish.

I love this clock and commentary---just watch it for a while and get a grip of the massive consumption WITHOUT production.

http://www.babylontoday.com/national_debt_clock.htm

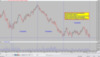

SPI currently

I dont think there is any doubt "How" it will react.

Its how it finishes the day which will tell something more about the immediate future.

It is possible that many are starting to realise that this isnt going to go away.

Bank collapses will effect massively wide sections of business.

Personally I think you'll see the following unfold.

(1) Early morning panic sell off. say -180

(2) Systematic "Bargain" hunting say to around -80-100

(3) Late trading fear and sell off - say around -180 ish.

I love this clock and commentary---just watch it for a while and get a grip of the massive consumption WITHOUT production.

http://www.babylontoday.com/national_debt_clock.htm

SPI currently

Attachments

Similar threads

- Replies

- 31

- Views

- 4K

- Replies

- 141

- Views

- 34K

- Replies

- 9

- Views

- 5K

- Replies

- 22

- Views

- 15K