You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Technical Analysis

- Thread starter Sean K

- Start date

- Joined

- 23 September 2007

- Posts

- 454

- Reactions

- 1

Re: XAO Analysis

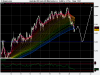

On my 1hr charts (XJO), the MA are starting to cross lower indicating shorts are on the table. Maybe a pullback to sligthly higher levels before executing a speculative short with targets back to the supports levels made on the 12th and 13th.

Personally, I'm waiting for support about 50 points lower to get long.

.

The market seems to be unsure where to go from here, it seems we may have turned a corner - anyone thinking of putting their SHORTS on?

On my 1hr charts (XJO), the MA are starting to cross lower indicating shorts are on the table. Maybe a pullback to sligthly higher levels before executing a speculative short with targets back to the supports levels made on the 12th and 13th.

Personally, I'm waiting for support about 50 points lower to get long.

.

Attachments

Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

Re: XAO Analysis

I'm looking at the weekly chart and I reckon, looking at the standard deviatian channel, we could have a minor correction back to 5,800'ish also, and still be in uptrend, then push on for one more leg up well into the 6,000's in this move.

From my untrained EW eye, that would then look like the completion of 5 waves up... and pretty much set us up for a sideways/up trend to continue.

I'm looking at the weekly chart and I reckon, looking at the standard deviatian channel, we could have a minor correction back to 5,800'ish also, and still be in uptrend, then push on for one more leg up well into the 6,000's in this move.

From my untrained EW eye, that would then look like the completion of 5 waves up... and pretty much set us up for a sideways/up trend to continue.

Attachments

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

Re: XAO Analysis

After last night's mini-rout on Wall St, I can put on my Expurt Hat and confidently predict - "Here cometh the next down leg...."

AJ

After last night's mini-rout on Wall St, I can put on my Expurt Hat and confidently predict - "Here cometh the next down leg...."

AJ

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Re: XAO Analysis

And if you can take any notice of an ol Ex who has lost his spurt it may well Explode down. On Bloomberg "Hedge Funds Facing Peril..." worth a look, too big to post here. 80 Trillion could just implode, the Fed Reserve will be scratching over that.

Anyway, yep we will be down today.

After last night's mini-rout on Wall St, I can put on my Expurt Hat and confidently predict - "Here cometh the next down leg...."

AJ

And if you can take any notice of an ol Ex who has lost his spurt it may well Explode down. On Bloomberg "Hedge Funds Facing Peril..." worth a look, too big to post here. 80 Trillion could just implode, the Fed Reserve will be scratching over that.

Anyway, yep we will be down today.

- Joined

- 28 March 2006

- Posts

- 3,567

- Reactions

- 1,310

Re: XAO Analysis

Looking at around 5800 for the XAO and if wave 5 plays out on the XFJ we could have 4000 on that.

My

Looking at around 5800 for the XAO and if wave 5 plays out on the XFJ we could have 4000 on that.

My

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

Re: XAO Analysis

Have to say, for the first time since I stated I thought we had turned the corner in March and went long (which we did), I am now strongly bearish.

This corresponds with bullishness back into gold.

I think we are seeing a momentum shift in both.

Cheers

Have to say, for the first time since I stated I thought we had turned the corner in March and went long (which we did), I am now strongly bearish.

This corresponds with bullishness back into gold.

I think we are seeing a momentum shift in both.

Cheers

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Re: XAO Analysis

Boy lets face it we are all Bears now. the Bull market is dead. 1 drop and its the end of the dead cat run. :

:

I've been playing short since Friday arvo but thats it. I have flipped and now playing long (mostly ) since this morning.

) since this morning.

Boy lets face it we are all Bears now. the Bull market is dead. 1 drop and its the end of the dead cat run.

I've been playing short since Friday arvo but thats it. I have flipped and now playing long (mostly

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Re: XAO Analysis

Judging by what I'm seeing right now, it's not going to take much to spook this market - some 'get me outa here' selling going on?

Judging by what I'm seeing right now, it's not going to take much to spook this market - some 'get me outa here' selling going on?

Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

Re: XAO Analysis

He he, yeah here we go again.

Hold onto your shirts people... it's a bear trap looming!!!

It's just that the cycle of all the 'stars'... oil, the USD, a hint of higher inflation and the POG have all aligned against the stockmarket together again.

What if oil demand destruction is coming (which I think is) and the POG mini breakout is an over-reaction?

Where's an EW'er when we need one! This is only a wave four retrace... isn't it?

PS: Yeah uncle... that's all it is. Some easily spooked people are spooked!!!

Boy lets face it we are all Bears now. the Bull market is dead. 1 drop and its the end of the dead cat run.:

He he, yeah here we go again.

Hold onto your shirts people... it's a bear trap looming!!!

It's just that the cycle of all the 'stars'... oil, the USD, a hint of higher inflation and the POG have all aligned against the stockmarket together again.

What if oil demand destruction is coming (which I think is) and the POG mini breakout is an over-reaction?

Where's an EW'er when we need one! This is only a wave four retrace... isn't it?

PS: Yeah uncle... that's all it is. Some easily spooked people are spooked!!!

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Re: XAO Analysis

I reckon this is just a mid week spiral down to let the 'players' get some volume.

- some 'get me outa here' selling going on?

I reckon this is just a mid week spiral down to let the 'players' get some volume.

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Re: XAO Analysis

Is the herd spooked yet?? Too early to say? Lot's of trigger fingers though who don't want to get caught out again. It will be an interesting auction this arvo.

Too early to say? Lot's of trigger fingers though who don't want to get caught out again. It will be an interesting auction this arvo.

PS: Yeah uncle... that's all it is. Some easily spooked people are spooked!!!

Is the herd spooked yet??

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

Re: XAO Analysis

Absolutely, my itchy trigger finger is well away from the gun, but that being said, I had a pre-determined stop on SEK hit today.

Only 3 positions left open, bought some GOLD and some SBM (a breakout today, at least a lot of interest, see how it closes). Small parcels and the sidelines look a good place for me at the moment.........

Not many set-ups presenting themselves over the last few days!

On another note, neither the XMJ or the XFJ look strong to me at the moment.....is one ready to carry the load? These two indices have been carrying the XJO lately IMO, with funds sloshing between them, but one remaining robust at any given time.

Sentiment poll released Monday, while still seeing quiet a few bears, had less than previous weeks and on top of that, far more neutrals........

Maybe a consolidation at the 5600 level rather than the 5800 level to be seen......

Lot's of trigger fingers though who don't want to get caught out again.

Absolutely, my itchy trigger finger is well away from the gun, but that being said, I had a pre-determined stop on SEK hit today.

Only 3 positions left open, bought some GOLD and some SBM (a breakout today, at least a lot of interest, see how it closes). Small parcels and the sidelines look a good place for me at the moment.........

Not many set-ups presenting themselves over the last few days!

On another note, neither the XMJ or the XFJ look strong to me at the moment.....is one ready to carry the load? These two indices have been carrying the XJO lately IMO, with funds sloshing between them, but one remaining robust at any given time.

Sentiment poll released Monday, while still seeing quiet a few bears, had less than previous weeks and on top of that, far more neutrals........

Maybe a consolidation at the 5600 level rather than the 5800 level to be seen......

Re: XAO Analysis

On the contrary, it looks to me that the XFJ is just about to break out of an ascending triangle on the daily

On another note, neither the XMJ or the XFJ look strong to me at the moment.....

On the contrary, it looks to me that the XFJ is just about to break out of an ascending triangle on the daily

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

Re: XAO Analysis

Yes, a downward breakout looks much more likely.

Though, a pretty loose ascending triangle, not much even resistance at the top of the triangle.

On the contrary, it looks to me that the XFJ is just about to break out of an ascending triangle on the daily

Yes, a downward breakout looks much more likely.

Though, a pretty loose ascending triangle, not much even resistance at the top of the triangle.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Re: XAO Analysis

Don't fight the guns. You will have you head handed to you on a stick.

I reckon this is just a mid week spiral down to let the 'players' get some volume.

Any particular reason/s for turnaround today.

Don't fight the guns. You will have you head handed to you on a stick.

- Joined

- 5 January 2008

- Posts

- 556

- Reactions

- 0

Re: XAO Analysis

At 3.01pm, the benchmark S&P/ASX200 index was up 0.5%, or 29.4 points, to 5852.8.

After posting earlier losses, BHP Billiton and Rio Tinto helped lead the market up. BHP was recently trading at $48.20, a rise of 2.84%, or $1.33, while Rio was up 1.55%, or $2.32, to $152.37.

http://www.businessday.com.au/shares-bounce-back-20080522-2h0e.html

If BHP and Rio rally then XAO will such is their weighting.

The Australian share market bounced back this afternoon, after falling more than 1% earlier in the day. The early falls came after heavy losses on Wall Street overnight and weaker base metals prices, although record crude oil prices buoyed energy stocks.Any particular reason/s for turnaround today.

At 3.01pm, the benchmark S&P/ASX200 index was up 0.5%, or 29.4 points, to 5852.8.

After posting earlier losses, BHP Billiton and Rio Tinto helped lead the market up. BHP was recently trading at $48.20, a rise of 2.84%, or $1.33, while Rio was up 1.55%, or $2.32, to $152.37.

http://www.businessday.com.au/shares-bounce-back-20080522-2h0e.html

If BHP and Rio rally then XAO will such is their weighting.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Re: XAO Analysis

Business day!! what a load of Rubbish. Why do you guys read that crap.

Its just jurno's trying to put an explanation to something they don't understand after it has happened.

Business day!! what a load of Rubbish. Why do you guys read that crap.

Its just jurno's trying to put an explanation to something they don't understand after it has happened.

Similar threads

- Replies

- 31

- Views

- 4K

- Replies

- 141

- Views

- 34K

- Replies

- 9

- Views

- 5K

- Replies

- 22

- Views

- 15K