You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Technical Analysis

- Thread starter Sean K

- Start date

Re: XAO Analysis

Be nice if you're right, looking forward to seeing the "evidence"

tech/a said:Ever thought that this "May" not be the top?

I think there is evidence that it may not be yet.

I havent the time to post up the "evidence" today but will do so over the weekend.

While not yet conclusive it is compelling--well I think so.

Against the tide of opinion.

--6415-6435--

Yeh yeh I know I'm a nutter.

Be nice if you're right, looking forward to seeing the "evidence"

- Joined

- 15 March 2007

- Posts

- 28

- Reactions

- 0

Re: XAO Analysis

Sorry for the late post but it has took a day for me to get registered.

The yanks were up .5 % & the xao goes up 1.8%. What goes here? The xao seems to go down slow and back up quick. So much for up on the stairs and down on the elevator. Seems like the other way round at the moment.

Are we that much better than the rest of the world?

theasxgorilla who is the aussie plunge protection team?

Waynel nice bear skin.

Regards.

Rogue Trading

Sorry for the late post but it has took a day for me to get registered.

The yanks were up .5 % & the xao goes up 1.8%. What goes here? The xao seems to go down slow and back up quick. So much for up on the stairs and down on the elevator. Seems like the other way round at the moment.

Are we that much better than the rest of the world?

theasxgorilla who is the aussie plunge protection team?

Waynel nice bear skin.

Regards.

Rogue Trading

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,988

- Reactions

- 13,309

Re: XAO Analysis

Haha! I love the nick, good one.Rogue Trading said:Sorry for the late post but it has took a day for me to get registered.

The yanks were up .5 % & the xao goes up 1.8%. What goes here? The xao seems to go down slow and back up quick. So much for up on the stairs and down on the elevator. Seems like the other way round at the moment.

Are we that much better than the rest of the world?

theasxgorilla who is the aussie plunge protection team?

Waynel nice bear skin.

Regards.

Rogue Trading

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,407

- Reactions

- 11,804

Re: XAO Analysis

Might be a bit of short term support estab at 5800, which will be tested Monday. Our Wednesday is going to be crucial next week. Expectations of poor housing data out of the US on their Tuesday morning is going to push the market significantly one way or the other. General view seems to be bad karma from what I've read. Batten down the hatches on Wednesday morning! Or get some shorts in Tuesday afternoon maybe......Maybe.

Might be a bit of short term support estab at 5800, which will be tested Monday. Our Wednesday is going to be crucial next week. Expectations of poor housing data out of the US on their Tuesday morning is going to push the market significantly one way or the other. General view seems to be bad karma from what I've read. Batten down the hatches on Wednesday morning! Or get some shorts in Tuesday afternoon maybe......Maybe.

http://www.reuters.com/article/ousiv/idUSN1623976920070316?pageNumber=1Reuters said:Housing may feed stocks' angst in a Fed week

Fri Mar 16, 2007 5:37PM EDT

By Cal Mankowski

NEW YORK (Reuters) - The anxiety level on Wall Street may escalate next week with several indicators due on the housing sector and a Federal Reserve meeting that most agree will end with no change in short-term interest rates.

The week begins with nationwide demonstrations by war protesters marking the fourth anniversary of the Iraq war. One of those protests is planned for outside the New York Stock Exchange before the opening bell.

A key piece of data will be February housing starts, due Tuesday morning one hour before the start of regular trading.

In January, the Commerce Department said that housing starts fell 14.3 percent to an annual rate of 1.408 million units.

In a Reuters poll of economists, the consensus is that the February number will rebound a bit to 1.450 million units.

The data includes building permits, which are expected to fall to an annual rate of 1.550 million units from January's pace of about 1.57 million units.

Money manager Sean Clark, who considers housing to be a "major risk for the economy," noted that the expected increase in housing starts represents a small bounce from a weak January number. continued...

theasxgorilla

Problem solved... next bubble.

- Joined

- 7 December 2006

- Posts

- 2,343

- Reactions

- 1

Re: XAO Analysis

Someone to blame when the correction we had to have doesn't go as deep as it ought to and tech/a's Elliott Wave count manifests in the form of a new all-time-high.

Rogue Trading said:theasxgorilla who is the aussie plunge protection team?

Someone to blame when the correction we had to have doesn't go as deep as it ought to and tech/a's Elliott Wave count manifests in the form of a new all-time-high.

- Joined

- 13 February 2006

- Posts

- 5,288

- Reactions

- 12,192

Re: XAO Analysis

It may have more to do with the inability, or greater difficulty of shorting the market for the non-institutional trader on the ASX than US bourses.

Also and this is merely an observation on my part, I trade/invest in the US and tend to monitor the US closely, so a bias as well but; the US as a trading community is far more bearish than the ASX guy's [this forum] who are still generally bulls looking to resume the trend up.

jog on

d998

Rogue Trading said:Sorry for the late post but it has took a day for me to get registered.

The yanks were up .5 % & the xao goes up 1.8%. What goes here? The xao seems to go down slow and back up quick. So much for up on the stairs and down on the elevator. Seems like the other way round at the moment.

Are we that much better than the rest of the world?

theasxgorilla who is the aussie plunge protection team?

Waynel nice bear skin.

Regards.

Rogue Trading

It may have more to do with the inability, or greater difficulty of shorting the market for the non-institutional trader on the ASX than US bourses.

Also and this is merely an observation on my part, I trade/invest in the US and tend to monitor the US closely, so a bias as well but; the US as a trading community is far more bearish than the ASX guy's [this forum] who are still generally bulls looking to resume the trend up.

jog on

d998

- Joined

- 13 February 2006

- Posts

- 5,288

- Reactions

- 12,192

Re: XAO Analysis

Duc,

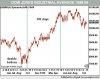

Bullmarket resumed after the period shown on the left chart in 1998-1999, so the bullmarket will resume soon for us??

ducati916 said:For the charties who love this stuff, check out these two;

jog on

d998

Duc,

Bullmarket resumed after the period shown on the left chart in 1998-1999, so the bullmarket will resume soon for us??

- Joined

- 13 February 2006

- Posts

- 5,288

- Reactions

- 12,192

Re: XAO Analysis

That's the point, the bullmarket died at that point.

The index went marginally higher until March 2000 and goodnight.

New highs should not of their own accord define the market, unless there is broad participation. This participation in a purely *technical* sense is missing again in the US

More importantly the sectors that led the market higher, are dying and may very well lead the market lower.

jog on

d998

nizar said:Duc,

Bullmarket resumed after the period shown on the left chart in 1998-1999, so the bullmarket will resume soon for us??

That's the point, the bullmarket died at that point.

The index went marginally higher until March 2000 and goodnight.

New highs should not of their own accord define the market, unless there is broad participation. This participation in a purely *technical* sense is missing again in the US

More importantly the sectors that led the market higher, are dying and may very well lead the market lower.

jog on

d998

Re: XAO Analysis

Am I the only person who sees Bernanke as the boogey man? Must come from living overseas and seeing his every waking breathing moment last year live on cable 24 hours a day thru winter. I started seeing him as the US dollar's greatest ever weapon of mass destruction after watching his alleged and torturous market-crippling struggle against inflation from May-September last year. Everytime he uttered the word "inflation" the market would panic & dive. (It didn't help that it was one of the coldest iciest winters an Australian overseas could ever wish not to experience, to add the the unpleasant memory of it - cold, dark and depressed.)

Hence, Bernanke's mouth scares the hell out of me ... He is criticised by some as being too Keynesian in his economic philosophy (Keynes is post WWI !)

The Fed meets next week (Tues Wed) and unless I have it all wrong, they want him to drop rates in order to help the US housing market: ie - if house prices in the US manage to regain 10% of their value, apparently the fallout from the subprimes will be contained.

If house prices fall 10% as expected, the fallout will cause all sorts of illnesses everywhere.

If Bernanke pulls out his "hawkish" inflation myopia this week, investors will probably start running helter skelter .... inflation data/indicators were a little higher than expected Friday.

Then we'll have US inflation/Fed rates-control panic plus the sub-prime fallout. And I am not even a bear.

http://www.businessweek.com/investing/insights/blog/archives/bernanke.jpg

young bernanke

kennas said:Might be a bit of short term support estab at 5800, which will be tested Monday. Our Wednesday is going to be crucial next week. Expectations of poor housing data out of the US on their Tuesday morning is going to push the market significantly one way or the other. General view seems to be bad karma from what I've read. Batten down the hatches on Wednesday morning! Or get some shorts in Tuesday afternoon maybe......Maybe.

http://www.reuters.com/article/ousiv/idUSN1623976920070316?pageNumber=1

Am I the only person who sees Bernanke as the boogey man? Must come from living overseas and seeing his every waking breathing moment last year live on cable 24 hours a day thru winter. I started seeing him as the US dollar's greatest ever weapon of mass destruction after watching his alleged and torturous market-crippling struggle against inflation from May-September last year. Everytime he uttered the word "inflation" the market would panic & dive. (It didn't help that it was one of the coldest iciest winters an Australian overseas could ever wish not to experience, to add the the unpleasant memory of it - cold, dark and depressed.)

Hence, Bernanke's mouth scares the hell out of me ... He is criticised by some as being too Keynesian in his economic philosophy (Keynes is post WWI !)

The Fed meets next week (Tues Wed) and unless I have it all wrong, they want him to drop rates in order to help the US housing market: ie - if house prices in the US manage to regain 10% of their value, apparently the fallout from the subprimes will be contained.

If house prices fall 10% as expected, the fallout will cause all sorts of illnesses everywhere.

If Bernanke pulls out his "hawkish" inflation myopia this week, investors will probably start running helter skelter .... inflation data/indicators were a little higher than expected Friday.

Then we'll have US inflation/Fed rates-control panic plus the sub-prime fallout. And I am not even a bear.

http://www.businessweek.com/investing/insights/blog/archives/bernanke.jpg

young bernanke

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Re: XAO Analysis

To all those who are citing the old equation

US Slowdown = Reduced consumption of Chinese Exports = Reduced Chinese Demand for Commodities = Reduced Commodity Prices

Have a read of this http://www.aireview.com.au/index.php?act=view&catid=9&id=5102

Also see that figure for reserves? $1.1 TRILLION US!

All those who have been or are in China will agree that the Govt is going nuts getting China ready for the 2008 Olympics, PRIDE is a very big thing over there so "The New China" must be ready for the world to see no matter what the cost!

We have at least 1 year left minimum in this Commodity Boom - Minimum!

To all those who are citing the old equation

US Slowdown = Reduced consumption of Chinese Exports = Reduced Chinese Demand for Commodities = Reduced Commodity Prices

Have a read of this http://www.aireview.com.au/index.php?act=view&catid=9&id=5102

Also see that figure for reserves? $1.1 TRILLION US!

All those who have been or are in China will agree that the Govt is going nuts getting China ready for the 2008 Olympics, PRIDE is a very big thing over there so "The New China" must be ready for the world to see no matter what the cost!

We have at least 1 year left minimum in this Commodity Boom - Minimum!

Re: XAO Analysis

It will stop when the media stops placing the US at the centre of the universe. It seems very hard to convince the old boys that the US does not rule and that our collective future prosperity has not been designated to the bad consumer tastes of millions of polyester clad SUV driving mall-crawling lard butts.

YOUNG_TRADER said:To all those who are citing the old equation

US Slowdown = Reduced consumption of Chinese Exports = Reduced Chinese Demand for Commodities = Reduced Commodity Prices

It will stop when the media stops placing the US at the centre of the universe. It seems very hard to convince the old boys that the US does not rule and that our collective future prosperity has not been designated to the bad consumer tastes of millions of polyester clad SUV driving mall-crawling lard butts.

Re: XAO Analysis

Marginally higher??

It almost touched 12000 at the peak, or about 15% higher than the 10300 dispayed on your chart.

But your point is valid.

The weakness signalled the beginning of the end.

ducati916 said:That's the point, the bullmarket died at that point.

The index went marginally higher until March 2000 and goodnight.

Marginally higher??

It almost touched 12000 at the peak, or about 15% higher than the 10300 dispayed on your chart.

But your point is valid.

The weakness signalled the beginning of the end.

theasxgorilla

Problem solved... next bubble.

- Joined

- 7 December 2006

- Posts

- 2,343

- Reactions

- 1

Re: XAO Analysis

Media is a powerful tool, is it not? I'm sure Mr Murdoch would like us to all continue to believe that the US is the lynch-pin of our well-being and prosperity. When I consider the alternatives...Russia, China...I still think that US/UK national security values are better aligned with Australia.

Atomic5 said:It will stop when the media stops placing the US at the centre of the universe. It seems very hard to convince the old boys that the US does not rule and that our collective future prosperity has not been designated to the bad consumer tastes of millions of polyester clad SUV driving mall-crawling lard butts.

Media is a powerful tool, is it not? I'm sure Mr Murdoch would like us to all continue to believe that the US is the lynch-pin of our well-being and prosperity. When I consider the alternatives...Russia, China...I still think that US/UK national security values are better aligned with Australia.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,988

- Reactions

- 13,309

Re: XAO Analysis

USD chart

This is the dilemma for BB, lower interest rates and bye-bye to a USD already in trouble. This will increase INflationary pressures in the US making interest rates negative in real term (already close to that) and destroy the incentive to save at all. This temporary prop would make things far worse later.Atomic5 said:The Fed meets next week (Tues Wed) and unless I have it all wrong, they want him to drop rates in order to help the US housing market: ie - if house prices in the US manage to regain 10% of their value, apparently the fallout from the subprimes will be contained.

USD chart

Re: XAO Analysis

Yes, I agree. But during 'panics' the market demand and supply balance in the resources market is often sited, and in that area there are very different circumstances for each country:

The UK has a % (?) of companies who have mining $ interests in Africa, Australia, even Canada, etc - resources for export.

The USA's ambition with regard to resources appears to also be self-sufficiency, and 'on-shore' in the sense that if they dig up Uranium in eg: Colorado, it's to power their own stations. If they dig up oil it's to oil their own plants and cars etc and to rid themselves of a dependency on hostile 3rd world suppliers.

With Australia, the population's needs are small compared to the resources available, so the idea is to export the excess to China and others at a premium.

In this scenario, in simple terms, the US is not the centre of the universe for Australia, given that the US is supposeldy only 25% of the Asian export market, and should be able to survive any US crash quite well.

theasxgorilla said:When I consider the alternatives...Russia, China...I still think that US/UK national security values are better aligned with Australia.

Yes, I agree. But during 'panics' the market demand and supply balance in the resources market is often sited, and in that area there are very different circumstances for each country:

The UK has a % (?) of companies who have mining $ interests in Africa, Australia, even Canada, etc - resources for export.

The USA's ambition with regard to resources appears to also be self-sufficiency, and 'on-shore' in the sense that if they dig up Uranium in eg: Colorado, it's to power their own stations. If they dig up oil it's to oil their own plants and cars etc and to rid themselves of a dependency on hostile 3rd world suppliers.

With Australia, the population's needs are small compared to the resources available, so the idea is to export the excess to China and others at a premium.

In this scenario, in simple terms, the US is not the centre of the universe for Australia, given that the US is supposeldy only 25% of the Asian export market, and should be able to survive any US crash quite well.

- Joined

- 7 February 2006

- Posts

- 299

- Reactions

- 0

Re: XAO Analysis

One half of the "Reduced demand for commodities" equation (above) is probable, the other half (below) is fact.

The US may/may not go into reccession, China actively trying to cool things down. If the cycles line up..... not god for commodity based Oz

~~~~~~~~

BEIJING (AP) -- China's central bank said Saturday it will raise key interest rates by more than a quarter percentage point in a move to cool torrid economic growth -- the fourth increase in a year.

The 0.27 percentage point hike in one-year deposit and lending benchmark rates will go into effect Sunday, the People's Bank of China said.

That would raise lending rates to 6.39 percent and deposit rates to 2.79 percent, the bank said in a statement on its Web site.

The new rates will "promote the good, fast development of the national economy" by guiding an increase in credit and investment, preserving price stability and steady operation of the financial system, the statement said.

The rate hike is the latest in a series of measures China's leaders have taken to slow an economy they fear is running at an unsustainable pace. Four years of double-digit economic growth, largely driven by investment and exports, have left the financial system flush with cash.

In recent months Chinese leaders have been sounding the alarm about excessive lending, worried that it would push growth too fast and thereby accelerate recently rising inflation or touch off a debt crisis if imprudently made loans go bad.

Low deposit rates have also encouraged a rush by ordinary Chinese into the country's buoyant stock markets, exposing them to greater risks as a two-year bull market begins to flag.

Premier Wen Jiabao, at a news conference Friday, ticked off a list of economic problems, citing excessive investment, credit and liquidity and swelling foreign exchange reserves.

"My mind is full of concerns," he told reporters.

US Slowdown = Reduced consumption of Chinese Exports = Reduced Chinese Demand for Commodities = Reduced Commodity Prices

One half of the "Reduced demand for commodities" equation (above) is probable, the other half (below) is fact.

The US may/may not go into reccession, China actively trying to cool things down. If the cycles line up..... not god for commodity based Oz

~~~~~~~~

BEIJING (AP) -- China's central bank said Saturday it will raise key interest rates by more than a quarter percentage point in a move to cool torrid economic growth -- the fourth increase in a year.

The 0.27 percentage point hike in one-year deposit and lending benchmark rates will go into effect Sunday, the People's Bank of China said.

That would raise lending rates to 6.39 percent and deposit rates to 2.79 percent, the bank said in a statement on its Web site.

The new rates will "promote the good, fast development of the national economy" by guiding an increase in credit and investment, preserving price stability and steady operation of the financial system, the statement said.

The rate hike is the latest in a series of measures China's leaders have taken to slow an economy they fear is running at an unsustainable pace. Four years of double-digit economic growth, largely driven by investment and exports, have left the financial system flush with cash.

In recent months Chinese leaders have been sounding the alarm about excessive lending, worried that it would push growth too fast and thereby accelerate recently rising inflation or touch off a debt crisis if imprudently made loans go bad.

Low deposit rates have also encouraged a rush by ordinary Chinese into the country's buoyant stock markets, exposing them to greater risks as a two-year bull market begins to flag.

Premier Wen Jiabao, at a news conference Friday, ticked off a list of economic problems, citing excessive investment, credit and liquidity and swelling foreign exchange reserves.

"My mind is full of concerns," he told reporters.

theasxgorilla

Problem solved... next bubble.

- Joined

- 7 December 2006

- Posts

- 2,343

- Reactions

- 1

Re: XAO Analysis

I lean this way myself, but I don't have any hard facts to substantiate. My money remains in the Aust market in any case, so my bets are placed I hope you (we) are right!

I hope you (we) are right!

Atomic5 said:With Australia, the population's needs are small compared to the resources available, so the idea is to export the excess to China and others at a premium.

In this scenario, in simple terms, the US is not the centre of the universe for Australia, given that the US is supposeldy only 25% of the Asian export market, and should be able to survive any US crash quite well.

I lean this way myself, but I don't have any hard facts to substantiate. My money remains in the Aust market in any case, so my bets are placed

Re: XAO Analysis

As we speak various opinions are doing the internet rounds: here's an article circulating under different titles for the same article eg: 'Asia, Europe Wont Survive US Meldown', to 'Why Catch Cold if the US Sneezes'.

I like the Golman Sachs London opinion:

"O'Neill says the world economy can "decouple" from the U.S. "The evidence is pretty strongly in our favor."

[

http://www.chinapost.com.tw/editorial/detail.asp?ID=104914&GRP=i

Europe, Asia can't stand U.S. slowdown

2007/3/18

By Michael R. Sesit Bloomberg

As the US$13.3 trillion U.S. economy slows, will the rest of the world pick up the slack?

It's a question that has bedeviled economists. The debate over whether global growth can weather a steep U.S. slowdown has all the earmarks of a number-crunching exercise, and it is already having an effect on stock prices in Asia and Europe.

The U.S. economy is slowing. Gross domestic product expanded at an annual rate of 2.2 percent in the fourth quarter compared with 5.6 percent in the first three months of 2006. [ .... ]

"We see some downside risks to our own U.S. forecast, which is below consensus," says Jim O'Neill, Goldman Sachs's global head of economic research in London. He notes the recent increase in stock-market volatility, widening credit spreads and the potential unraveling of the yen-carry trade.

O'Neill says the world economy can "decouple" from the U.S. "The evidence is pretty strongly in our favor."

[ .... ]

The 13-country euro area, Japan, the U.K. and the four so- called BRIC countries -- Brazil, Russia, India and China -- all reported stronger growth in the fourth quarter than the U.S., he says. "It appears that the U.S. has indeed stopped being the 'engine' of world growth."

The ability of other countries to emerge from the U.S. economy's long shadow may reflect more wishful thinking than logic. No doubt, it will eventually happen, especially as some of the bigger emerging countries mature. Right now, the world still needs the U.S. consumer.

The global economy is too dependent on exports to the U.S., whose trade deficit was US$765.3 billion in 2006, while Asia and Europe lack sufficient domestic demand to offset reduced U.S. spending on overseas goods, says Stephen Roach, chief economist at Morgan Stanley in New York.

[ .... ]

The U.S. accounts for 24 percent of Japan's total exports, 84 percent of Canada's, 86 percent of Mexico's and about 40 percent of China's, he says.

Just as China is dependent on the U.S., other countries rely on Asia's second-largest economy. So a U.S. slowdown that hurts China will reverberate in Japan, Taiwan, South Korea and commodity producers such as Russia, Australia, New Zealand, Canada and Brazil.

The earnings of European companies' U.S. units plunged 64 percent in 2001, according to Quinlan. Those declines in the biggest and most-profitable market for many German, U.K., French and Dutch enterprises resulted in reduced orders, lower profit, slower job growth and weak business confidence. After expanding 3.9 percent in 2000, euro-area growth shrank to 1.9 percent in 2001, 0.9 percent in 2002 and 0.8 percent in 2003.

"As the U.S. economy decelerates and as the dollar continues its slide, Europe will sink or swim with the U.S. in 2007," Quinlan says. Affiliates of European Union companies generate 42 percent of their non-EU earnings in the U.S., he says.

If the naysayers are wrong about decoupling and Goldman Sachs is right, the world may even help the U.S. economy through its slowdown, O'Neill says.

"If the U.S. has a massive housing correction, what better time to do it than when the rest of the world can help pick up the slack."

"Happy Slowdown" is his motto.

The U.S. will be hoping O'Neill is right.

As we speak various opinions are doing the internet rounds: here's an article circulating under different titles for the same article eg: 'Asia, Europe Wont Survive US Meldown', to 'Why Catch Cold if the US Sneezes'.

I like the Golman Sachs London opinion:

"O'Neill says the world economy can "decouple" from the U.S. "The evidence is pretty strongly in our favor."

[

http://www.chinapost.com.tw/editorial/detail.asp?ID=104914&GRP=i

Europe, Asia can't stand U.S. slowdown

2007/3/18

By Michael R. Sesit Bloomberg

As the US$13.3 trillion U.S. economy slows, will the rest of the world pick up the slack?

It's a question that has bedeviled economists. The debate over whether global growth can weather a steep U.S. slowdown has all the earmarks of a number-crunching exercise, and it is already having an effect on stock prices in Asia and Europe.

The U.S. economy is slowing. Gross domestic product expanded at an annual rate of 2.2 percent in the fourth quarter compared with 5.6 percent in the first three months of 2006. [ .... ]

"We see some downside risks to our own U.S. forecast, which is below consensus," says Jim O'Neill, Goldman Sachs's global head of economic research in London. He notes the recent increase in stock-market volatility, widening credit spreads and the potential unraveling of the yen-carry trade.

O'Neill says the world economy can "decouple" from the U.S. "The evidence is pretty strongly in our favor."

[ .... ]

The 13-country euro area, Japan, the U.K. and the four so- called BRIC countries -- Brazil, Russia, India and China -- all reported stronger growth in the fourth quarter than the U.S., he says. "It appears that the U.S. has indeed stopped being the 'engine' of world growth."

The ability of other countries to emerge from the U.S. economy's long shadow may reflect more wishful thinking than logic. No doubt, it will eventually happen, especially as some of the bigger emerging countries mature. Right now, the world still needs the U.S. consumer.

The global economy is too dependent on exports to the U.S., whose trade deficit was US$765.3 billion in 2006, while Asia and Europe lack sufficient domestic demand to offset reduced U.S. spending on overseas goods, says Stephen Roach, chief economist at Morgan Stanley in New York.

[ .... ]

The U.S. accounts for 24 percent of Japan's total exports, 84 percent of Canada's, 86 percent of Mexico's and about 40 percent of China's, he says.

Just as China is dependent on the U.S., other countries rely on Asia's second-largest economy. So a U.S. slowdown that hurts China will reverberate in Japan, Taiwan, South Korea and commodity producers such as Russia, Australia, New Zealand, Canada and Brazil.

The earnings of European companies' U.S. units plunged 64 percent in 2001, according to Quinlan. Those declines in the biggest and most-profitable market for many German, U.K., French and Dutch enterprises resulted in reduced orders, lower profit, slower job growth and weak business confidence. After expanding 3.9 percent in 2000, euro-area growth shrank to 1.9 percent in 2001, 0.9 percent in 2002 and 0.8 percent in 2003.

"As the U.S. economy decelerates and as the dollar continues its slide, Europe will sink or swim with the U.S. in 2007," Quinlan says. Affiliates of European Union companies generate 42 percent of their non-EU earnings in the U.S., he says.

If the naysayers are wrong about decoupling and Goldman Sachs is right, the world may even help the U.S. economy through its slowdown, O'Neill says.

"If the U.S. has a massive housing correction, what better time to do it than when the rest of the world can help pick up the slack."

"Happy Slowdown" is his motto.

The U.S. will be hoping O'Neill is right.

Similar threads

- Replies

- 31

- Views

- 4K

- Replies

- 141

- Views

- 34K

- Replies

- 9

- Views

- 5K

- Replies

- 22

- Views

- 15K