- Joined

- 23 September 2007

- Posts

- 454

- Reactions

- 1

Re: XAO Analysis

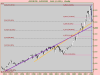

hehe.. sorry, the bulls are back in town if it broke 5700... but when 5850 is broken, i'd say the heard of bulls are back

Also, I read in some text that the stronger the support line, in this case 5500-5550, the more explosive the break will be when it does go lower.

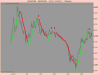

Yikes... could this be the beginning of what some here have been expecting as the 4700's as the ultimate low? I say... BRING IT ON AND GET IT OVER AND DONE WITH, so we can go back to 'NORMAL' (whatever that is)

And you mean if it broke 5700, a good sign the bulls are coming back?

hehe.. sorry, the bulls are back in town if it broke 5700... but when 5850 is broken, i'd say the heard of bulls are back

However, its estimated 75% break in line with the previous trend

Also, I read in some text that the stronger the support line, in this case 5500-5550, the more explosive the break will be when it does go lower.

Yikes... could this be the beginning of what some here have been expecting as the 4700's as the ultimate low? I say... BRING IT ON AND GET IT OVER AND DONE WITH, so we can go back to 'NORMAL' (whatever that is)