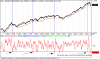

Re: XAO Analysis

BHP and RIO are basically the same business just that BHP is larger and is cheaper interms of PE's. So if there is interest in RIO shares logically there will also be interest in BHP shares, especially if BHP are trading at a lower PE that RIO.

Exactly! If the bid is more likely to fail, BHP’s share price might rise given that the share price of the bidder seems to fall in most takeover bids. (Similar to the share price action for another example close to our hearts; ZFX’s takeover bid for Allegiance.)

How much of the rally we're seeing is due to BHP/RIO? If their share prices fall back on their large gains (e.g. maybe b/c BHP announces a higher bid), will the fall on the XAO spook investors and create panic selling?

BHP and RIO are basically the same business just that BHP is larger and is cheaper interms of PE's. So if there is interest in RIO shares logically there will also be interest in BHP shares, especially if BHP are trading at a lower PE that RIO.