chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

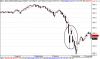

Re: XAO Analysis

Get a daily chart of the xao. Scroll to 1987. There is a long bar. I'm not going to tell you which other two bars you should be looking at, but it should be very very obvious. Perhaps I should have said 4 bars. :

:

Tech. Are you basing your trades on my SPI comments? :

:

Hi Chops_a_must, would you mind point out what you mean by your last comment.

Get a daily chart of the xao. Scroll to 1987. There is a long bar. I'm not going to tell you which other two bars you should be looking at, but it should be very very obvious. Perhaps I should have said 4 bars.

Tech. Are you basing your trades on my SPI comments?