- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

From my 5 seconds of investigation, Commsec has live SPI prices on the banner that scrolls across the front of their homepage.

Otherwise SFE has 20 minute delayed SPI prices. There's plenty of other third party websites that give delayed SPI prices too.

That's the one, I haven't crossed referenced it with live data yet, but I had suspicions it was live SPI data.

To confirm, that table is only visible when logged into Commsec? They use to (2-3 weeks ago) have a ticker scroll across on their front page that amongst some world indices included the SPI.

XUJ a 1.6% hit today..down 85ish.....anyone got a clue on that ?

Ex-div on APA and DUE.

Same with the REITs.

Ex-div on APA and DUE.

Same with the REITs.

thanks, skc

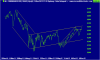

xjo about to print a daily outside down bar.....we dont see a lot of these, topical news aside...

santa mistaken the chimney for a dunny

Upturn or downturn?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.