skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

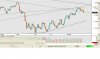

This is one of the more interesting reporting season I've experienced. Share prices just don't move coherently, even for big caps.

BLD reported crap numbers but was a slight beat - today's range was first down 3% and went almost 1% up.

AMC reported yesterday which was ever so slightly disappointing. It fell 2% before fighting back to be in the green, but today it is sold off over 4% at one stage. Same thing happened to BXB, and looks like happening to AIO as well.

MND up 8% yesterday, down 5% today. ARI up 13% yesterday, down 8% today. QBE went for a 8% range in 3 days.

Suncorp went for large payout with a headline profit that's short of consensus - it first went down 1% but now printing new highs +3.5%. Judging by the track record, it should fall a few % tomorrow.

This all suggest to me that we are at some sort of cross-road. Analysts are adjusting their models and different camps are having pretty different views of the macro future and so are moving stocks accordingly - causing all sorts of funny ripples. But the overall tone still appear to be buy the dips.

BLD reported crap numbers but was a slight beat - today's range was first down 3% and went almost 1% up.

AMC reported yesterday which was ever so slightly disappointing. It fell 2% before fighting back to be in the green, but today it is sold off over 4% at one stage. Same thing happened to BXB, and looks like happening to AIO as well.

MND up 8% yesterday, down 5% today. ARI up 13% yesterday, down 8% today. QBE went for a 8% range in 3 days.

Suncorp went for large payout with a headline profit that's short of consensus - it first went down 1% but now printing new highs +3.5%. Judging by the track record, it should fall a few % tomorrow.

This all suggest to me that we are at some sort of cross-road. Analysts are adjusting their models and different camps are having pretty different views of the macro future and so are moving stocks accordingly - causing all sorts of funny ripples. But the overall tone still appear to be buy the dips.

or even

or even