- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,230

so far so good, GB

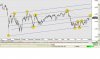

soon as the cash closed, in fact, soon as the 10 min post cash auction was complete the cfd went positive and neever looked back.......the pre-cash spx cfd also went pos well prior to the news annoc, implying by action, that the news was well written into price........buyers engaged albeit on lower volumes......there's a bunch on technical ideas in the xjo that call for more upside......keeping a close eye on money flows

View attachment 48391

Your target looks safe Joules.

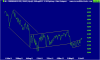

My chart is slightly different. Can't post it at the moment, but thinking 4330 looks about right as a short to medium term high.