nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

$20 here it come you don't have to wait for too long ...

Coles catching up

Actualy if you compare the 1st Quarter 2012 Retails Sales Results for Wesfarmers with that of Woolworths (year on year with 2011) you will see that Wesfarmers had growth of $602 million versus Woolworths growth of $661 million. If Coles was catching up the growth of Woolworths would be less not greater.

Like all good stories it eventually comes to an end and WOW cant command the premium like it used to in its young day.

If you compare the financial statistics of both companies (in this instance from WebIress as at close of business Thursday 27/10/11) you would note the following:

Share Price: wes $32.66, wow $24.08

Earnings per share: wes $1.667, wow $1.736

Price to Earnings: wes 19.6, wow 13.87

Divs per Share: wes $1.50, wow $1.22

Yield: wes 4.59%, wow 5.07%

Of the two companies, Woolworths has the higher Earnings per Share and the higher yield (Also Woolworths is fully franked, I admit I don't know if Wesfarmers is fully or partialy franked).

If any of the shares is trading at a premium I suspect it is actualy Wesfarmers.

Plus WOW earning is also mask by its Pokies earning, if the new Pokie laws come in effect WOW got a perfect storm hit it from all directions....

Both companies own Hotels, hotels have poker machines. Both companies will be impacted by the changes to poker machine law if and when it gets passed through parliament. Knowing the "addicts", they will find ways to get arround the restrictions if they become law.

Still think this stock deserve a premium, not in my book..

As pointed out above wow is not trading at a premium when compared to wes. If anything the close on friday 28/10/11 of $23.83 makes the yield and price earnings even more favourable. The biggest competion for return with the share price is actualy the proposed notes issue. The margin of 3.25% added to the bank bill rate of 4.75% gives a yield of 8% (no franking credits though).

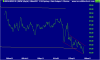

IMO wow is currently over sold. Currently at a level below the GFC nadir of March 2009 and still increasing turnover, Earnings per share and Dividends per share, year on year. Woolworths is a more attractive long term investment (for those that like long term investments) than Wesfarmers.

Has Wesfarmers paid back the loan they took to buy coles yet? How long do you think it will be before "Masters" starts to eat into the "Bunnings" turnover and margins?