- Joined

- 12 January 2011

- Posts

- 39

- Reactions

- 0

Make no mistake Woolworths current share price will be a long memory in five years. Its purely a great company and will continue to deliver great earnings.

Make no mistake Woolworths current share price will be a long memory in five years. Its purely a great company and will continue to deliver great earnings.

Make no mistake Woolworths current share price will be a long memory in five years. Its purely a great company and will continue to deliver great earnings.

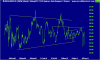

Hi nulla, WOW is firmly on my watch list, top company in my opinion. I think your 3 day rule might work, QBE sort of went the same way. The only thing holding me back as a dividend investor is that the dividend is not quite high enough, only 4.5% FF. I can buy an ETF (with much less risk than a 1 company risk) that pays the same divi of around 4.5%. Having said that I really like WOW, if it drops below $25 on Monday then I might buy some as then the divi is nearing 5% FF. This is a good company and todays prices weren't bad, good luck to all holders.I have a "three day" rule. When the report is so-so but there is an apparent over-reaction, wait for the third day and buy in for the bounce. It doesn't always work, sometimes the share keeps falling. However, on average, this rule has served me well in the past. With advances in technology I find these days that you may need to be prepared to jump in after two days. I could be wrong, I often amhowever I jumped in today at $25.25.

Hi nulla, WOW is firmly on my watch list, top company in my opinion. I think your 3 day rule might work, QBE sort of went the same way. The only thing holding me back as a dividend investor is that the dividend is not quite high enough, only 4.5% FF. I can buy an ETF (with much less risk than a 1 company risk) that pays the same divi of around 4.5%. Having said that I really like WOW, if it drops below $25 on Monday then I might buy some as then the divi is nearing 5% FF. This is a good company and todays prices weren't bad, good luck to all holders.

I wouldn't buy WOW at $25, expensive as, it doesn't deserve this premium considering going forward, its cash flow will be impacted by the resurrection of Coles and an all out price war with Bunnings and people like Costco, Aldi snip around the edges

I buy under $20 and not a cent morewhen it get to $20 I may have to re-valuate before I jump in

I think the hardware thing is pretty stupid.

It's like they are chasing Wesfarmers instead of being way ahead of them to begin with.

Not so good for HVN though that they are going to persue white goods as part of it IMO.

Hi nulla, WOW is firmly on my watch list, top company in my opinion. I think your 3 day rule might work, QBE sort of went the same way. The only thing holding me back as a dividend investor is that the dividend is not quite high enough, only 4.5% FF. I can buy an ETF (with much less risk than a 1 company risk) that pays the same divi of around 4.5%. Having said that I really like WOW, if it drops below $25 on Monday then I might buy some as then the divi is nearing 5% FF. This is a good company and todays prices weren't bad, good luck to all holders.

I've just freed up a large chunk of money (see MRE thread) and feel WOW is screaming "buy me" but cant help but notice the dividend is somewhat woefulBill do you have any capital "at risk" ?

My whole darn portfolio is at risk, the only thing that is risk free right now is cash in the bank but unfortunately that won't pay the bills. But I know what you mean, WOW is not a company I would be worried about going broke.Bill do you have any capital "at risk" ?

I have thought that for 10years lol

Each time I think the are over valued, they pull a new business divsion out of the hat like a magic rabbit, and a new stream of profit growth follows.

Not saying this is what will happen with the Hardware, But it just might.

I'm not at all worried about Aldi or Costco or a price war with bunnings,

Disclaimer - I do not hold WOW, Would consider a selling a put if the strike was low enough though.

That's funny.

I averaged in some more today around 25.35. Thinking there will be some excitement about the new hardware thing!

WES did a bit of a fear drop with good volume. Maybe they felt the same as me! Nervous about competition.

If the markets week tomorrow, you't think WOW would be stronger given it's cum dividend and a defensive!

It will be interesting to see if the stores are really appealing to women. They look pretty intimidating on that level to me!

I should have shorted WES and made it a pair! Stupid cow!

Yep picked up some yesterday too.WOW traded today between $25.74 (high) and $25.42 (low). Is your average $25.35? (todays purchase in this range with a lower purchase earlier in the week?)

Yep picked up some yesterday too.

I thought the press has been quite charitable with regard to the big opening!

I'm probably not going to be in it for long but if I am that will be fine.

I felt it might get a bit of a wave up to it's dividend.

I'm not expecting dips unless there is a general tank.

I'd say flat at worst then a little nasty after that if markets are skittish around pay day!

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.